Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

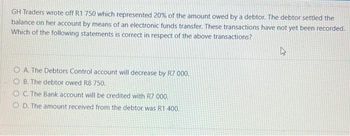

Transcribed Image Text:GH Traders wrote off R1 750 which represented 20% of the amount owed by a debtor. The debtor settled the

balance on her account by means of an electronic funds transfer. These transactions have not yet been recorded.

Which of the following statements is correct in respect of the above transactions?

OA. The Debtors Control account will decrease by R7 000.

OB. The debtor owed R8 750.

OC. The Bank account will be credited with R7 000.

OD. The amount received from the debtor was R1 400.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Similar questions

- Looking for answers. Please include all the calculations for my reference. Thanks in advance.arrow_forwardUse the information provided below to prepare the following for January and February 2023 as per guide lines on theouc4.1 Debtors Collection Schedule INFORMATIONThe following information was provided by Intel Enterprises:1. The bank balance on 31 December 2022 is expected to be R40 000 (unfavourable).2. Credit sales are expected to be as follows:December 2022 January 2023 February 2023R576 000 R540 000 R648 0003. Credit sales usually make up 40% of the total sales. Cash sales make up the balance. Cash customersreceive a 10% discount.4. Credit sales are normally collected as follows:* 30% in the month in which the transaction takes place, and these customers are entitled to a 5% discount.* 65% in the following monthThe rest is usually written off as bad debts.5. Budgeted purchases of inventory are as follows:December 2022 January 2023 February 2023R1 000 000 R800 000 R920 000 6. Fifty percent…arrow_forwardThe following information was taken from the books of Zia Traders on 30 June 2019: 1. The items appearing on the bank reconciliation statement of Zia Traders as at 31 May 2019. Details Amount (R) Balance as per bank statement (unfavourable) 25400 Oustanding deposit 5700 Outstanding cheques: CHQ116 1430 CHQ135 2780 Correction of incorrect cheque(see note 2.5 below) 570 Balance as per bank account ? A comparison of the cashbooks for June, the above bank reconciliation statement and the bank statement for June showed the following: 2.1 Provisional totals in the cashbooks on 30 June: -Cashbook Receipts R 113 200 -Cashbook Payments R 96 000 2.2 The outstanding deposit at the end of May for R5 700 appeared on the bank statement on 5 June 2019. 2.3 Cheque number CHQ135 appeared on the bank statement on 7 June for R3 100. An investigation revealed that the bank statement amount was correct. 2.4…arrow_forward

- 5. On 30" September, 2012, the Cash Book of Kumipreko Enterprise showed a debit balance of GH¢1,560, 000. The Bank Statement of the business at the same date showed a credit balance of GH¢1,130,000. On comparing the Cash Book with the bank statement, the following differences were found; A cheque for GH¢720,000 had been paid into the bank on 30t September but was not credited by the bank until the following day Cheques totalling GH¢1,180,000 had been drawn but not presented to the bank for payment Bank charges of GH¢290,000 was debited against the bank statement but did not appear in the Cash Book Dividend of GH¢960,000 collected and credited by the bank on behalf of Kumipreko Enterprise did not appear in the Cash Book Payments under standing orders for an amount of GH¢500,000 had been made but did not reflect in the Cash Book A cheque for GH¢1,060,000 paid in was dishonoured, and marked Refer to Drawer. This was not captured by the Cash Book. Required: Draw up an adjusted Cash Book…arrow_forwardPlease answer the question correctly. Thank you.arrow_forwardThe Cash account of Lydia reported a balance of RM2, 540 at December 31, 2018. There were outstanding checks totaling $400 and a December 31 deposit in transit of $100. The bank statement, which came from Park Bank, listed the December 31 balance of RM3, 340. Included in the bank balance was a collection of RM510 on account from Bella, a Lydia customer who pays the bank directly. The bank statement also shows a RM30 service charge and RM20 of interest revenue that Lydia earned on its bank balance. Prepare Lydia's bank reconciliation at December 31.arrow_forward

- The following information was taken from the books of Zia Traders on 30 June 2019: The items appearing on the bank reconciliation statement of Zia Traders as at 31 May 2019. Details Amount (R) Balance as per bank statement (unfavourable) 25400 Oustanding deposit 5700 Oustanding cheques: CHQ116 1430 CH135 2780 Correction of incorrect cheque (see note 2.5 below) 570 Balance as per bank account ? A comparison of the cashbooks for June, the above bank reconciliation statement and the bank statement for June showed the following: 2.1 Provisional totals in the cashbooks on 30 June: -Cashbook Receipts R 113 200 -Cashbook Payments R 96 000 2.2 The outstanding deposit at the end of May for R5 700 appeared on the bank statement on 5 June 2019. 2.3 Cheque number CHQ135 appeared on the bank statement on 7 June for R3 100. An investigation revealed that the bank…arrow_forward14 )arrow_forwardPlease! help me with this questionarrow_forward

- You observe the following details about a bank (amounts in million) net interest income: $1,250 net noninterest income: $200 operating expenses: $900 loan loss provisions: $170 gains from trading: $75 Taxes: $150 Total assets: $17,000 Equity: $2,200 What is the bank's ROE? Write your answer expressed as a %, and round to two decimals. For instance, if you think the ROE is 0.0856237, then you write 8.56 belowarrow_forwardWhile performing the monthly bank reconciliation, Avon Company adjusted for a bank service charge of $20. Which of the following correctly shows how the adjustment for the bank service charge affects the financial statements? A. B. C. D. Assets N/A (20) (20) (20) Multiple Choice Option A Option C Option B Option D Balance Sheet Liabilities + N/A (20) N/A N/A Stockholders' Equity N/A N/A (20) (20) Revenue N/A N/A (20) N/A Income Statement Expense = N/A N/A N/A 20 Net Income N/A N/A (20) (20) Statement of Cash Flows (20) OA (20) OA (20) OA (20) OAarrow_forwardRM Inc. had the following bank reconciliation on August 31, 2021: Balance per bank statement, 8/31 Add: Deposits in transit P5,400,000 600,000 6,000,000 1,350,000 P4,650,000 Less: Outstanding checks Balance per books, 8/31 Data per bank for the month of September 2021 follow: Deposits (including P300,000 note collected for RM) Disbursements (including P210,000 NSF check and P15,000 service charge) P13,500,000 10,500,000 All reconciling items on August 31, 2021 cleared the bank in September. Outstanding checks on September 30 totaled P900,000. There deposits in transit amounted to P1,500,000 on September 30. What is the amount of cash disbursements per book in September?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education