FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

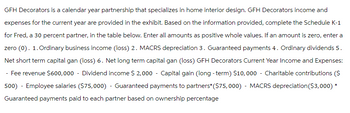

Transcribed Image Text:GFH Decorators is a calendar year partnership that specializes in home interior design. GFH Decorators income and

expenses for the current year are provided in the exhibit. Based on the information provided, complete the Schedule K-1

for Fred, a 30 percent partner, in the table below. Enter all amounts as positive whole values. If an amount is zero, enter a

zero (0). 1. Ordinary business income (loss) 2. MACRS depreciation 3. Guaranteed payments 4. Ordinary dividends 5.

Net short term capital gan (loss) 6. Net long term capital gan (loss) GFH Decorators Current Year Income and Expenses:

-Fee revenue $600,000 - Dividend income $ 2,000 - Capital gain (long-term) $10,000 - Charitable contributions ($

500) - Employee salaries ($75,000) - Guaranteed payments to partners* ($75,000) - MACRS depreciation ($3,000) *

Guaranteed payments paid to each partner based on ownership percentage

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The partnership of Chase and Chloe shares profits and losses in a 70:30 ratio respectively after Chloe receives a $14,000 salary. Prepare a schedule showing how the profit and loss should be divided, assuming the profit or loss for the year is: If an amount is zero, enter "0". For those boxes in which you must enter subtractive or negative numbers use a minus sign. (Example: -300) A. $40,000 Chase Chloe Total Salaries $4 Remaining income allocation Total division of income B. $12,000 Chase Chloe Total Salaries Remaining income allocation Total division of income C. S(10,000) Chase Chloe Total Salaries Remaining income allocation Total division of income %24 %24 %24 %24 %24 %24 %24 %24arrow_forwardLawler and Riello formed a partnership on March 15, 2024. The partners agreed to contribute equal amounts of capital. Lawler contributed her sole proprietorship's assets and liabilities (credit balances in parentheses) as follows: X Data table Lawler's Business Current Market Value its. Select the explanation on the last line of the journal entry table.) Accounts Receivable 10,600 Merchandise Inventory 29,000 Prepaid Expenses 2,800 Credit 26,000 Store Equipment, Net Accounts Payable (25,000) Done More info On March 15, Riello contributed cash in an amount equal to the current market value of Lawler's partnership capital. The partners decided that Lawler will earn 60% of partnership profits because she will manage the business. Riello agreed to accept 40% of the profits. During the period ended December 31, the partnership earned net income of $70,000. Lawler's withdrawals were $36,000, and Riello's withdrawings totaled $26,000. Print Done Requirement 1. Journalize the partners' initial…arrow_forwardi need the answer quicklyarrow_forward

- For Industry H, determine each partner's share of income assuming the partners agree to share income by giving a $67,700 per year salary allowance to Price, a $126,100 per year salary allowance to Waterhouse, a $113,700 per year salary allowance to Coopers, a 15% interest on their initial capital investments, and the remaining balance shared equally. (Enter all allowances as positive values. Enter losses as negative values.) Important! Be sure to click the correct Industry at the top of the dashboard. Net income (loss) Salary allowances Balance of income (loss) Interest allowances Balance of income (loss) Balance allocated equally Balance of income (loss) Shares of each partner Initial partnership investments Net income Allocation of Partnership Income Price Total net income Total 0 Waterhouse $ $ PRICE, WATERHOUSE, AND COOPERS Statement of Partners' Equity For Year Ended December 31 Price Coopers 0 0 Waterhouse 0 0 0 $ For Industry H, prepare a statement of partners' equity for the…arrow_forwardManjiarrow_forwardAdmitting New Partner With Bonus L. Bowers and V. Lipscomb are partners in Elegant Event Consultants. Bowers and Lipscomb share income equally. M. Ortiz will be admitted to the partnership. Prior to the admission, equipment was revalued downward by $9,000. The capital balances of each partner are $74,500 and $103,000, respectively, prior to the revaluation. Question Content Area a. Provide the journal entry for the asset revaluation. For a compound transaction, if an amount box does not require an entry, leave it blank. blank EquipmentL. Bowers, CapitalL. Bowers, DrawingV. Lipscomb, DrawingM. Ortiz, Capital - Select - - Select - CashEquipmentL. Bowers, DrawingV. Lipscomb, CapitalM. Ortiz, Capital - Select - - Select - EquipmentL. Bowers, CapitalV. Lipscomb, CapitalM. Ortiz, CapitalM. Ortiz, Drawing - Select - - Select - Question Content Area b. Provide the journal entry for Ortiz’s admission under the following independent situations: 1. Ortiz purchased a 20%…arrow_forward

- Required information Important Note! Before you start working on this problem, watch the Hint video. This video shows you exactly how to work this problem. [The following information applies to the questions displayed below.] ** Ramer and Knox began a partnership by investing $68,000 and $102,000, respectively. During its first year, the partnership earned $205,000. Prepare calculations showing how the $205,000 income is allocated under each separate plan for sharing Income and loss. Important Notel Before you start working on this problem, watch the Hint video. This video shows you exactly how to work this problem. 1. The partners did not agree on a plan, and therefore share Income equally Ramer Knox Show Transcribed Textarrow_forwardPlease don't give image formatarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education