ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

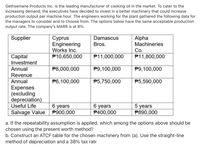

Transcribed Image Text:Gethsemane Products Inc. is the leading manufacturer of cooking oil in the market. To cater to the

increasing demand, the executives have decided to invest in a better machinery that could increase

production output per machine hour. The engineers working for the plant gathered the following data for

the managers to consider and to choose from. The options below have the same acceptable production

output rate. The company's MARR is at 8%.

Supplier

Суprus

Engineering

Works Inc.

P10,650,000

Damascus

Alpha

Machineries

Со.

Bros.

Capital

Investment

Annual

P11,000,000

P11,800,000

P8,000,000

P9,100,000

P9,100,000

Revenue

Annual

P6,100,000

P5,750,000

P5,590,000

Expenses

(excluding

depreciation)

Useful Life

6 years

Salvage Value P900,000

6 уears

P400,000

5 years

P890,000

a. If the repeatability assumption is applied, which among the options above should be

chosen using the present worth method?

b. Construct an ATCF table for the chosen machinery from (a). Use the straight-line

method of depreciation and a 38% tax rate

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- Three investments are being studied by Bright Star Construction Limited. The table below provides the estimated cash flow for each of the three investments over the next five years. Due to budget constraints, Bright Star can only select one investment out of the three investments. At a MARR (Minimum Acceptable Rate of Return) of 12%, answer the following. Investment 1 2 3 a) b) Initial Cost $9,000,000 $5,000,000 $7,000,000 Expenses per Year $3,000,000 $1,500,000 $2,000,000 Return at end of year 5 $38,000,000 $20,000,000 $29,000,000 Use a rate of return method to determine the economically best investment for Bright Star. Are you expecting different results if the comparison is based on Annual Worth? (Hint: no calculations are needed). c) What are the case(s) in which a rate of return method is recommended? d) Is it always necessary for the alternative with the highest rate of return to be the best alternative?arrow_forwardPlease answer fastarrow_forwardSuper Tennis Co is in the business of designing and manufacturing running shoes for long distance runners. They are considering a $500 million upgrade to their production line for the iPhone/iPad/ iWatch connected shoe that has Bluetooth connectivity. The potential cash flow is estimated at net revenues of $460 million per year for four years. Recently, they were advised of potential patent infringement and to eliminate this problem they are considering buying a license. YezzCo will sell a license that is good for four years of exclusive use of the patent and associated intellectual property. Super Tennis Co uses a corporate MARR of 14% and their risk-free alternatives are 6%. The VP of Engineering at Super Tennis Co estimates market volatility in demand is 40%. The VP of Marketing estimates market volatility in demand at 35%. 1.Since the VPAc€?cs trust you, they asked you to figure out the most they should pay for a license from YezzCo. 2. Super Tennis Co is known to be liberal in…arrow_forward

- Hint: You need to do the following three things; 1) PWC Old & PWC New 2) Incremental NPV 3) Incremental RORarrow_forwardTwo investment projects are being evaluated based on their payback periods. The first alternative requires an initial investment of $520,000, has gross revenues of $85,000, annual O&M costs of $17,000 and a service life of 23 years. What is the project's discounted payback period if the MARR is 10% per year? OA. 8.8 years OB. 19.1 years OC. 15.2 years OD. 9.9 years If the second alternative has a payback period of 20 years, which alternative should be preferred based on the payback period? OA. The second alternative OB. The first alternativearrow_forwardam. 117.arrow_forward

- Swiss franc 1-year forward rate $1.17 !! Swiss franc spot rate now $1.09 %3D Also assume that a U.S. exporter denominates its Swiss exports in Swiss francs and expects to receive SF500,000 in 1 year. Using the information above, what will be the approximate value of these exports in 1 year in U.S. dollars given that the firm executes a forward hedge? O$545,000 O$438,596 $585,000 O $570,000arrow_forwardTempura, Inc., is considering two projects Project Arequires an investment of $44,000. Estimated annual receipts for 20 years are $23,000; estimated annual costs are $12,500. An alternative project, B, requires an investment of $77,000, has annual receipts for 20 years of $27,000, and has annual costs of $18,000. Assume both projects have a zero salvage value and that MARR is 15.5 %/year. Click here to access the TVM Factor Table Calculator Part a Your answer is incorrect. What is the present worth of each project? Project A: $ Project B: $ 573083 -26658arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education