Advanced Engineering Mathematics

10th Edition

ISBN: 9780470458365

Author: Erwin Kreyszig

Publisher: Wiley, John & Sons, Incorporated

expand_more

expand_more

format_list_bulleted

Question

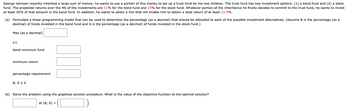

Transcribed Image Text:George Johnson recently inherited a large sum of money; he wants to use a portion of this money to set up a trust fund for his two children. The trust fund has two investment options: (1) a bond fund and (2) a stock

fund. The projected returns over the life of the investments are 11% for the bond fund and 15% for the stock fund. Whatever portion of the inheritance he finally decides to commit to the trust fund, he wants to invest

at least 30% of that amount in the bond fund. In addition, he wants to select a mix that will enable him to obtain a total return of at least 12.5%.

(a) Formulate a linear programming model that can be used to determine the percentage (as a decimal) that should be allocated to each of the possible investment alternatives. (Assume B is the percentage (as a

decimal) of funds invested in the bond fund and S is the percentage (as a decimal) of funds invested in the stock fund.)

Max (as a decimal)

s.t.

bond minimum fund

minimum return

percentage requirement

B, S≥ 0

(b) Solve the problem using the graphical solution procedure. What is the value of the objective function at the optimal solution?

at (B, S) =

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 79 images

Knowledge Booster

Similar questions

- Sarah's insurance plan includes a $1,000 annual deductible, 20% coinsurance after the deductible is met, and a $5,000 out-of-pocket maximum. Sarah has already met her deductible and incurred an additional $2,000 in covered medical expenses. How much more will Sarah need to pay if she incurs another $4,000 in covered medical expenses?arrow_forwardRichard invests $205.42 every month into his retirement. At the end of 30 years, he has a balance of $137,090.97. What interest has accrued over 30 years?arrow_forwardTina and Mike have sold their house, but they will not get the proceeds from the sale for an estimated 4 months. The owner of the house they want to buy will not hold the house that long. Tina and Mike have two choices: let their dream house go or take out a bridge loan. The bridge loan would be for $85,000, at 8.5% simple interest, due in 120days. How much interest would they pay for this loan? (Round your answer to the nearest cent.)$arrow_forward

- Mark's mother is planning to borrow $25,000 to remodel the restaurant she owns. She contacted several loan companies, and she is comparing two different options. • Company 1 offers an interest rate of 5.25%. • Company 2 offers an interest rate of 8.5%. Both loan options involve simple interest and must be repaid in exactly 3 years. How much more will Mark's mother pay in interest if she chooses to borrow the money from Company 2? A $812.50 B В $3,937.50 C $2,437.50 D $6,375.00 in a sayings account that earns 3% simple interest annually. If he does not make anyarrow_forwardYou bought a bond with 8% coupon rate, 10 year maturity, and $1000 par value for $1,039 one year ago. Today the bond has a price of $901. If you sell the bond today, what is your return on the investment?arrow_forwardMr. Smith is 35 years old. He has the following 2 goals: First goal: To retire when he is 60 years old. He expects to live up to 80 years old. He projects his annual retirement spending to be $200,000 in today's value. He will withdraw the annual spending at the beginning of each year when he retires. Second goal: To leave an amount of $5,000,000 to his son when he passes away when he is 80 years old. He has set up an investment account for the above2 goals a few years ago. Currently, there is $400,000 in that investment account. The rates of return for the investment account are expected to be 4% p.a. before he retires and 3% p.a. after his retires. If inflation rate is expected to be 2% p.a., how much should he save at the end of each year from now until he retires to achieve his goals?arrow_forward

- Suppose a mutual fund has a portfolio of stocks that have a market value of $10.75 billion and the company has 900 million shares of stock. What is the net asset value (in dollars) of a share of the mutual fund?arrow_forwardMutual Fund X owns 0.5% of the total stock of Company Y. In one particular year, Company Y announces annual profits of $12,000,000, and decides to pay dividends to its shareholders at a rate of 15% of its annual profits. How much will Mutual Fund X receive in the form of dividends from Company Y? Give your answer in dollars.arrow_forwardYou are considering in investing one of the two options: Investment A requires a $80,000 upfront payment and generates $59,000 annually, Investment B requires a $68,000 upfront payment. How much should Investment B generate annually so that the total returns from Investment A and B become equal after 3 years?arrow_forward

- Compute the total and annual return on the following investment. Three years after paying $2100 for shares in a startup company, you sell the shares for $1200 (at a loss). The total return is nothing%. (Do not round until the final answer. Then round to the nearest tenth as needed.)arrow_forwardA local Dunkin’ Donuts franchise must buy a new piece of equipment in 5 years that will cost $83,000. The company is setting up a sinking fund to finance the purchase. What will the quarterly deposit be if the fund earns 8% interestarrow_forwardYour credit card has a balance of $4200 and an annual interest rate of 13%. You decide to pay off the balance over four years. If there are no further purchases charged to the card, you must pay $112.70 each month, and you will pay a total interest of $1209.60. Assume you decide to pay off the balance over one year rather than four. How much more must you pay each month and how much less will you pay in total interest? A. You will pay $__ more each month. B. You will pay $__ less each month.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education

Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY

Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Advanced Engineering Mathematics

Advanced Math

ISBN:9780470458365

Author:Erwin Kreyszig

Publisher:Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:9780073397924

Author:Steven C. Chapra Dr., Raymond P. Canale

Publisher:McGraw-Hill Education

Introductory Mathematics for Engineering Applicat...

Advanced Math

ISBN:9781118141809

Author:Nathan Klingbeil

Publisher:WILEY

Mathematics For Machine Technology

Advanced Math

ISBN:9781337798310

Author:Peterson, John.

Publisher:Cengage Learning,