Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

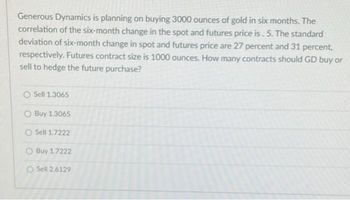

Transcribed Image Text:Generous Dynamics is planning on buying 3000 ounces of gold in six months. The

correlation of the six-month change in the spot and futures price is. 5. The standard

deviation of six-month change in spot and futures price are 27 percent and 31 percent,

respectively. Futures contract size is 1000 ounces. How many contracts should GD buy or

sell to hedge the future purchase?

O Sell 1.3065

O Buy 1.3065

O Sell 1.7222

O Buy 1.7222

O Sell 2.6129

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The yield on a one-year Treasury security is 4.6900%, and the two-year Treasury security has a 6.3315% yield. Assuming that the pure expectations theory is correct, what is the market's estimate of the one-year Treasury rate one year from now? (Note: Do not round your intermediate calculations.) 6.799% O7.9988% O9.1186% O 10.1585% Recall that on a one-year Treasury security the yield is 4.6900% and 6.3315% on a two-year Treasury security. Suppose the one-year security does not have a maturity risk premium, but the two-year security does and it is 0.15%. What is the market's estimate of the one-year Treasury rate one year from now? (Note: Do not round your intermediate calculations.) O 7.6942% O 8.7714% O9.7716% O 6.5401% Suppose the yield on a two-year Treasury security is 5.83%, and the yield on a five-year Treasury security is 6.20%. Assuming that the pure expectations theory is correct, what is the market's estimate of the three-year Treasury rate two years from now? (Note: Do not…arrow_forwardConsider a 6-months futures contract on gold. We assume no income and that $1 per ounce per 6-months to store gold, with the payment being made at the end of the period. The spot price is $1620 and risk free rate is 2% for all maturities. How can an arbitrageur earn profit is the price of 6-month gold futures is 1630$?arrow_forwardSuppose it is Jan 1st, and the futures price for August 1st delivery of a 1-year zero-coupon government T-bill is $96/$100FV. The size of one contract is for $1M face value If your bank goes long 20 contracts, is this a bet that interest rates are going to increase, or decrease? (type ‘increase’ or ‘decrease’) If your bank goes long 20 contracts, and the price of the August 1st future increases to $97, how much money is the bank up in this contract? The current $-Duration of a bank’s assets minus liabilities is 200M. If interest rates rise and the interest rate factor on all securities increases by 3%, how does the banks book value of equity change (in millions)? (note: a change which is a decrease would be a negative change)arrow_forward

- Assume a futures price of Php5000 at the start of the transaction, with Php250 initial margin requirement and a Ph150 maintenance margin requirement. The trader takes in a short position of 10 contracts. Marking-to-market process occurs over the period of seven trading days. A. Complete the table above for the holder of the long position. B. When could there be a margin call? C. How much are the total gains or losses by the end of day 7?arrow_forwardConsider a farmer who plans to sell 6,000 bushels of corns on date T. The date-T spot price of corn is normally distributed with mean $500 per bushel and standard deviation $50 per bushel. To hedge the price risk, the farmer considers shorting corn futures with delivery on date T. The futures price is $480 per bushel, and one contract is to deliver 5,000 bushels. In addition, the farmer can take only integer number of contracts (i.e, a fraction of contract such as 0.1 is NOT allowed). (a) How may contracts does the farmer need to take? (b) What is the mean of the total revenue? (c) What is the standard deviation of the total revenue?arrow_forwardAssume oat forward prices over the next 3 years are $2.30, $2.40, and $2.33, respectively. Effective annual interest rates over the same period are 5.5%, 5.8%, and 6.1%. What is the 3-year swap price if the delivery in year 1 is 100,000 bushels, the delivery in year 2 is 125,000 bushels and the delivery in year 3 is 175,000 bushels?arrow_forward

- Suppose you sell seven March 2021 silver futures contracts on December 4, 2020, at the last price of the day. Use Table 25.2. a. What will your profit or loss be if silver prices turn out to be $25.01 per ounce at expiration? (Enter your answer as a positive value. Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) b. What will your profit or loss be if silver prices are $23.13 per ounce at expiration? (Enter your answer as a positive value. Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) a. b.arrow_forwardSuppose you borrow RM10,000,000 in the interbank money market at a KLIBOR yield of 6% p.a for aterm of 1 month. Should you buy or sell KLIBOR futures contract if you were to hedge against interest rate risks?arrow_forward2.2. The price of a commodity is £45. Its volatility is 20% and the risk-free rate of interest is 3% per annum with continuous compounding (for all maturities). Use a three-step binomial tree to value (i) a nine-month European call option with strike £45 and (ii) a nine-month American put option with strike £48. Up and down movement can be calculated using volatility and expiration date (9 month call option).arrow_forward

- Suppose that your company is planning to sell 1.25 million litres of fuel in two years. Thecurrent price of fuel is £1.60 per litre. a) Suppose there is a two-year heating oil futures contract available. The futuresprice is £1.63 per litre. How many contracts would you need to fully eliminate yourrisk exposure over the next two years? How many contracts would you need ifyour optimal hedging ratio was 0.75? What position in these contracts would youtake today? Explain. b) Evaluate the outcomes of your hedging strategy if the price of fuel in two years is(1) £1.72 per litre, and (2) £1.58 per litre. In each case assume the heating oilfutures price to be equal to that of the fuel. Comment on your results.arrow_forwardSuppose an investor purchases $114,000 of TIPS with a 6.14% coupon rate and 12 years until maturity. How much with the second coupon payment be if the level of CPI adjusts to the levels below? Today 6 months from now 12 months from now 18 months from now 228 246.2 256.1 265.5arrow_forwardWalmart has taken a yen futures position to hedge a 125 million yen account payable at a yen futures price of 0.009483 $/yen. As you know, yen futures are quoted to six decimal places, and each yen futures contract is for 12.5 million yen. How much does Walmart make or lose on their futures position in $ for each point the yen futures price increases?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education