Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

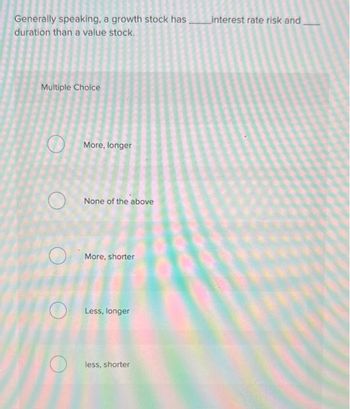

Transcribed Image Text:Generally speaking, a growth stock has ________interest rate risk and

duration than a value stock.

Multiple Choice

More, longer

None of the above

More, shorter

Less, longer

less, shorter

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- In efficient markets, the rate of return on a stock should be: A. always greater than the risk-free rate B. Less than zero C. Related to the systemic risk of the stock D. Zero; no stock should earn a positive returnarrow_forwardWhat is Stock Beta and Describe a Stock with little risk and Stock with high risk? Define Beta and provide industries that fall into low risk and high risk categories.arrow_forwardWhat could you comment on this statement? "Caution is warranted when using PE ratio to value stocks"arrow_forward

- Explain the difference between expected rate of return, required rate of return, and historical rate of return when applied to common stock.arrow_forwardA portfolio's manager's views on the term structure of interest rates: "Yields reflect expected spot rates and risk premiums. Investors demand risk premiums for holding long-term bonds, and these risk premiums increase with maturity. This manager's views are most consistent with the: A. Segmented markets theory B. Local expectations theory C. Preferred habitat theory OD. Liquidity preference theoryarrow_forwardDescribe how adding a risk-free security to modern portfolio theory allows investors to do better than the efficient frontier. Additionally, explain how might the magnitude of the market risk premium impact people's desire to buy stocks?arrow_forward

- Which of the following statements is CORRECT? a. Lower beta stocks have higher required returns. b. A stock's beta indicates its diversifiable risk. c. Diversifiable risk cannot be completely diversified away. d. Two securities with the same stand-alone risk must have the same betas. e. The slope of the security market line is equal to the market risk premium.arrow_forwardIf markets are efficient then: All stocks will have the same expected returns All stocks will have the same risk Two stocks will the same volatility will have the same expected returns Two stocks with the same priced risks will have the same expected returnsarrow_forwardcan be progressively eliminated by adding stocks to a portfolio? Systematic risk Specific risk Market risk Inflation rate riskarrow_forward

- Investors can use certain metrics to assess a stock or stock portfolio's risk. One of them is the Sortino ratio. What is this ratio and what is unique in its measurement?arrow_forwardLet's explore the difference between "expected" and "actual" return of a stock. 1) How might we calculate what the expected return of a stock should be? 2) How might we calculate the "actual" return of a stock?arrow_forwardHow do you calculate conditional volatility of a stock returns?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education