Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

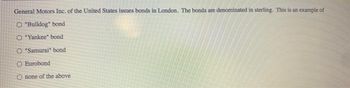

Transcribed Image Text:General Motors Inc. of the United States issues bonds in London. The bonds are denominated in sterling. This is an example of

O "Bulldog" bond

O "Yankee" bond

O "Samurai" bond

O Eurobond

O none of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward1.How do term bonds differ from serial bonds? Which type of bonds have governments been more likely to issue in recent years? Why do you think this trend has occurred? 2. Under what circumstances might a government consider an advance refunding of general obligation bonds outstanding? provide any sourcearrow_forward17. Which of the following statements is true about bonds in the US? A) State and local governments have no default risk on their bonds. B) Bonds issued by the state and local governments are referred to as municipal bonds. C) All bonds issued by state, local, and federal governments are exempt from federal income tax. D) Local government bond coupons are usually higher than Treasury bonds coupons. 18. Under normal economic conditions, the yield curve is A) gently upward sloping. B) mound shaped. C) flats. D) bowl-shaped. 19. The main assumption in the segmented market theory is that bonds have different maturities A) are not substitutes for each other. B) is a perfect substitution. C) is substitutes only if the investor is given a premium incentive. D) is substitutes but not a perfect substitution.arrow_forward

- 16. Euro credits a. are short-term and medium-term loans are denominated in Euro b. are extended by banks in Europe / the Eurozone C. are offered to corporations, sovereign governments, non-prime banks, or international organizations. d. all of the options 17. So-called subprime mortgages were typically all of the following, except for a. mortgages granted to borrowers with less-than-perfect credit. b. backed by the full faith and credit of the U.S. government. C. not held to maturity by the originating lender but instead resold to servicing banks. d. aggregated and sliced into tranches representing a different risk class.arrow_forwardA dual-currency bond makes coupon interest payments in one currency and the principal repayment at maturity in another currency. Select one: True Falsearrow_forwardHow does the interest paid on U.S. savings bonds compare to the savings account rates paid by banks and credit unions? A.The interest paid on U.S. savings bonds is higher than the savings account rates paid by banks and credit unions. B.The interest paid on U.S. savings bonds is lower than the savings account rates paid by banks and credit unions. C.The interest paid on U.S. savings bonds is twice as much as the savings account rates paid by banks and credit unions. D.The interest paid on U.S. savings bonds is the same as the savings account rates paid by banks and credit unions.arrow_forward

- The table below shows interest rates on 10-year bonds for a sample of countries that share a common currency (the euro) (Source: Bloomberg, 08/2018). Assume that investors are not entertaining the possibility that one of these countries will abandon the euro (and expose investors to exchange rate risk). Which country is likely considered to be the greatest default risk among the group? Spain Greece Netherlands Italy France Italy Spain Netherlands Portugal Greece 0.68% 3.09% 1.45% 0.42% 1.82% 4.21%arrow_forwardBond X has a higher yield than Bond Y, what can be the reason? A Bond X has a longer history of selling to customers on credit B Bond X is issued by a service oriented company while bond Y is from a manufacturer C Bond X is in India, where the inflation rate is higher than the US, where Bond Y is issued D Bond X has a single A credit rating and Bond Y has a BBB credit ratingarrow_forwardWhich of the following are reasons why an MNC might issue bonds in a particular foreign market? Check all that apply. There is stronger demand for bonds issued by the MNC in a foreign market as opposed to the domestic market. The currency in that foreign market is expected to appreciate against the MNC's home currency. There is a lower interest rate in that foreign country. The MNC intends to finance a project in a specific country and in a specific currency. If there is for a bond, a bondholder may not be able to sell a bond at the desired time or may have to decrease the price of their bonds in order to sell them. The risk of this occurrence is known as risk.arrow_forward

- Why does the Government bond market play a central role in New Zealand’s capital markets? What are the main factors influencing NZ Govt bond rates? Why are Govt bond rates currently trending upwards?arrow_forwardQ.4. What are some of the basic features of bonds that affect their risk, return, and value? What is the current country structure of the world bond market, and how has the makeup of the global bond market changed in recent years? What are the major components of the world bond market and the international bond market?arrow_forwardA: B: Issuer Fee Freddie Mac; (2) Telecom, and The Underwriter B A The entity issuing the debt obligation is the borrower in the transaction. Some of the biggest issuers in the bond market are (1) which H Purchaser corporations such as the U.S. government and the government of U.K.; (2) government-related agencies, such as Fannie Mae and , such as British , such as the state of California, Sakai City, Japan; (3) such as the European Investment Bank and the World Bank. Why do entities municipal governments ebt obligations? Economies around supranational banks ering during 2012 after the 2008-2009 recession. Governments and central banks continued their efforts to facilitate economic recovery. The U.S. rederal Reserve Bank (the Fed) kept interest rates at record lows. This, along with several other reasons, found the bond markets flooded with new bond issues. The following article highlights some reasons why firms issued debt obligations to raise funds.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education