ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

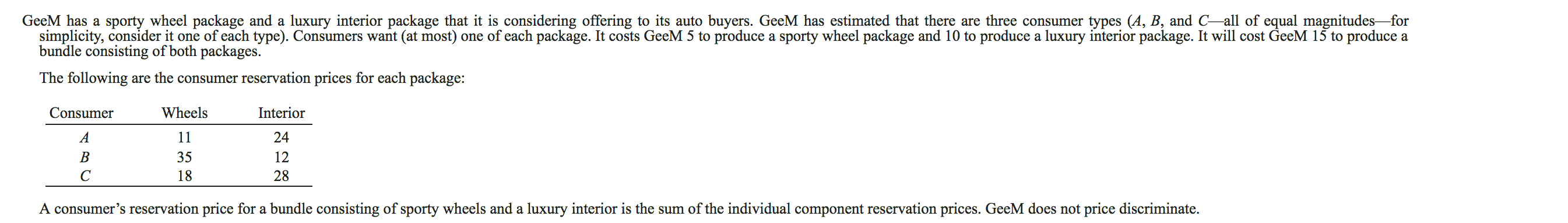

Transcribed Image Text:GeeM has a sporty wheel package and a luxury interior package that it is considering offering to its auto buyers. GeeM has estimated that there are three consumer types (A, B, and C-all of equal magnitudes--for

simplicity, consider it one of each type). Consumers want (at most) one of each package. It costs GeeM 5 to produce a sporty wheel package and 10 to produce a luxury interior package. It will cost GeeM 15 to produce a

bundle consisting of both packages.

The following are the consumer reservation prices for each package:

Wheels

Consumer

Interior

A

11

24

В

35

12

С

18

28

A consumer's reservation price for a bundle consisting of sporty wheels and a luxury interior is the sum of the individual component reservation prices. GeeM does not price discriminate

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 9 steps with 1 images

Knowledge Booster

Similar questions

- e(p, v(p, w)) = v(p, w) - ((p1 * w1) + (p2 * w2)) how to map the correct numbers: there four prices one for the inital then ther other ((p1 * w1) + (p2 * w2))arrow_forwardif the profit- maximising quantity is 120kg,what is the answer?arrow_forwardMostly need help with the graph, but a short explanation on how to arrive at the answer for the fill in the blank section would also be great. Thanks!arrow_forward

- !arrow_forwardSuppose a consumer with income I has preferences over consumption bundles that can be represented by the utility function U(X,Y) = XY. Suppose the price of X, px, is 1 and the price of Y, py, is 2. At the consumer's optimal consumption bundle, (X*,Y*), what must the value of the ratio be? (a) 10 (b) √5 (c) 4 (d) 2 (e) 8arrow_forwardThere is a road between the suburbs and downtown. The road becomes congested at rush hour. As long as no more than 99 people use the road at rush hour, the trip takes 30 minutes. When the 100st person enters the road, everyone slows down and the trip now takes 31 minutes. People value their time at $6 per hour (i.e., $0.10 per minute) and so a 30-minute trip costs $3. What is the total social cost of 100 people using the road?arrow_forward

- Your own a chocolate producing company which can advertise on both television (T) and internet(I). The effect of TV and online commercials on sales is again given byS(T,I) = 500 + 48T−6T2+ 112I−6I2+ 4TI. You have a budget of $25 that you can spend on T and I. The price of aTV commercial is $12per unit and the price of an online commercial is also $12 per unit. 1. Determine the optimal level of TV commercials T and online commercials I if you have to spend all of your budget. You should provide two methods to solve this, by direct substitution and by setting up the Lagrangian. Is the Lagrange multiplier positive or negative? Give an intuitive interpretation of why this is the case? 2. Now determine the optimal level of TV commercials T and online commercials I if you DO NOT have to spend all of your budget. Do you obtain the same answer as subquestion 5.1? What is the Lagrange multiplier equal to in this case? Discuss.arrow_forward1. Dave Grohl wants to buy drums and guitars. Drums are sold in an unusual way. There is only one supplier, and the more drums you buy from him, the higher the price you have to pay per unit. In fact, y units of drums will cost Dave y² dollars. Guitars are sold in the usual way at a price of 2 dollars per unit. Dave's income is 20 dollars, and his utility function is U (x,y) = x+2y, where x is his consumption of guitars and y is his consumption of drums. A. Sketch Dave's budget set and shade its in. B. Sketch some of his indifference curves and label the point that he chooses. C. Calculate the number of drums and guitars that Dave demands at these prices and this income.arrow_forwardQuestion Google is considering an advertising campaign that is expected to increase the sales of its Pixel phone by 20%. Suppose that currently Google sells 1,000,000 units at $500 per unit and the variable cost per unit is $300. If the cost of the advertising campaign is $50 million, will Google find it acceptable? Question An attractive feature of new cell phones that was introduce d in recent years is that you can switch carriers easily with the same device. How does this feature affect demand for wireless phone services? What are the likely effects on the demand that a particular US carrier is facing? Are there any elasticities that were likely to be affected?arrow_forward

- Becasue of the housing bubble, many houses are now selling for much less than their selling price just two to three years ago. There is evidence that home owners with virtually identical houses tend to asl for more if they paid more for the house.What fallacy are they making?arrow_forwardDataware is trying to determine whether to give a $10 rebate, cut the price $6, or have no price change on a software product. Currently, 40,000 units of the product are sold each week for $45 apiece. The variable cost ofthe product is $5. The most likely case appears to bethat a $10 rebate will increase sales 30%, and half of all people will claim the rebate. For the price cut, the most likely case is that sales will increase 20%.a. Given all other assumptions, what increase in sales from the rebate would make the rebate and price cut equally desirable?b. Dataware does not really know the increase in sales that will result from a rebate or price cut. However, the company is sure that the rebate will increase sales by between 15% and 40% and that the pricecut will increase sales by between 10% and 30%.Perform a sensitivity analysis that could be used to help determine Dataware’s best decision.arrow_forwardFor distract drivingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education