ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

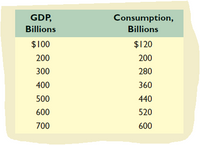

Assume that, without taxes, the consumption schedule of an economy is as follows: a. Graph this consumption schedule and determine the MPC.

b. Assume now that a lump-sum tax is imposed such that the government collects $10 billion in taxes at all levels of

Transcribed Image Text:GDP,

Consumption,

Billions

Billions

$100

$120

200

200

300

280

400

360

500

440

600

520

700

600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- For the following problem, assume that the MPC, b, takes into account how much consumers spend as total income (Y) in the economy is changes. (Also: Hint GDP = Total Y) So we can rewrite our consumption function as :C= a +bYAssume:a= $2900 billionb=.75GDP= $9,000 billion.A) What is C=B) What is S=C) If consumers were the only ones buying goods in the economy, would the economy have an excess supply of goods, excess demand of goods or would the economy be at equilibrium ?arrow_forwardn an effort to make sales projections, M/s K, B and A, the three B-school executives of Vengaboys Inc., were discussing about the national income and its growth in Ibiza. K had estimated a linear consumption function for Ibiza to be C = 100 + 0.6 Y, and investment to be I = 100 per ear. In Ibiza, there was no income tax and government spending was minimal (assume 0). Ibiza was a closed economy, and hence no exports and imports. (i)K immediately knew what the investment Multiplier was. Can you find out? (ii)What is the level of income in Ibiza? (iii)K estimated that with Government spending 100 on a new road to be constructed, the income levels are sure to go up. K quickly calculated the change in income and the new income level to be:arrow_forwardHow would I do D?arrow_forward

- Consider a hypothetical economy in which the marginal propensity to consume (MPC) is 0.50. That is, if disposable income increases by $1, consumption increases by 50c. Suppose further that last year disposable income in the economy was $400 billion and consumption was $350 billion. On the following graph, use the blue line (arcle symbol) to pict this economy's consumption function based on these data. CONSUMPTION (Bions of dollars) ) 700 600 500 400 300 200 100 0 -100 9 100 200 300 400 500 000 DISPOSABLE INCOME (Billions of dollars) 700 000 From the preceding data, you know that the level of savings in the economy last year was 3 economy is billion and the marginal propensity to save in this Suppose that this year, disposable income is projected to be $600 billion. Based on your analysis, you would expect consumption to be 3 billion and savings to be S billion,arrow_forwarda=$250b, I=$500b, G= $350b, MPC=80%; Calculate: the multiplier the equilibrium level of income the equilibrium level of consumption the equilibrium level of saving Now assume that individuals in the aggregate would like to save more. Write a new consumption function that reflects this change. What is your new assumption?arrow_forwardConsider the following economy. What is the mpc in this economy? Planned Government Net Exports Aggregate Change in Real GDP (Y) Consumption (C) Investment (I') Purchases (G) (NX) Expenditures (AE) Inventories 10000 8200 800 11000 9000 600 12000 9800 13000 14000 15000 800 Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a 0.50 b 0.75 C 0.80 d 0.90arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education