Gayle has a HELOC with MCAP Financial Corporation at an interest rate of prime +2.5%. Her current balance owing on November 1 is $13,750.00 and she is required to make interest-only payments on the first of every month. The prime rate is set at 4.25%. She makes one payment of $2,500.00 on January 19. Create three months of her repayment schedule. (Round all monetary values to the nearest penny) (Use a minus sign before the dollar sign to denote a negative monetary value. For example, $149 63) (Give all "Number of Days" quantities as fractions with denominator 365) Date Nov 1 Dec 1 Jan 1 Jan 19 Feb 1 Balance before Transaction Annual Interest Rate 6.75% 6.75% 6.75% 6.75% Number Interest Accrued of Days Charged Interest 20 25 Payment (+) or Advance (-) $2,500.00 Principal Balance after Amount Transaction $13,750.00

Gayle has a HELOC with MCAP Financial Corporation at an interest rate of prime +2.5%. Her current balance owing on November 1 is $13,750.00 and she is required to make interest-only payments on the first of every month. The prime rate is set at 4.25%. She makes one payment of $2,500.00 on January 19. Create three months of her repayment schedule. (Round all monetary values to the nearest penny) (Use a minus sign before the dollar sign to denote a negative monetary value. For example, $149 63) (Give all "Number of Days" quantities as fractions with denominator 365) Date Nov 1 Dec 1 Jan 1 Jan 19 Feb 1 Balance before Transaction Annual Interest Rate 6.75% 6.75% 6.75% 6.75% Number Interest Accrued of Days Charged Interest 20 25 Payment (+) or Advance (-) $2,500.00 Principal Balance after Amount Transaction $13,750.00

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 12EA: Scrimiger Paints wants to upgrade its machinery and on September 20 takes out a loan from the bank...

Related questions

Question

Note:-

- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism.

- Answer completely.

- You will get up vote for sure.

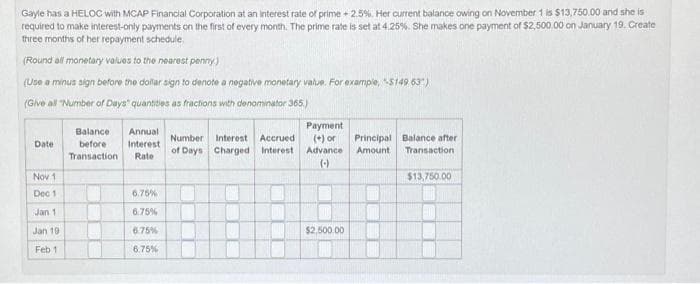

Transcribed Image Text:Gayle has a HELOC with MCAP Financial Corporation at an interest rate of prime +2.5%. Her current balance owing on November 1 is $13,750.00 and she is

required to make interest-only payments on the first of every month. The prime rate is set at 4.25%. She makes one payment of $2,500.00 on January 19. Create

three months of her repayment schedule.

(Round all monetary values to the nearest penny.)

(Use a minus sign before the dollar sign to denote a negative monetary value. For example, $149 63)

(Give all "Number of Days" quantities as fractions with denominator 365.)

Date

Nov 1

Dec 1

Jan 1

Jan 19

Feb 1

Balance Annual

before Interest

Transaction Rate

6.75%

6.75%

6.75%

6.75%

Payment

Number Interest Accrued (+) or

of Days Charged Interest Advance

(-)

$2,500.00

Principal Balance after

Amount

Transaction

$13,750.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT