Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

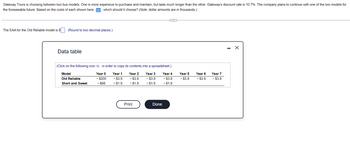

the foreseeable future. Based on the costs of each shown here: 囲, which should it choose? (Note: dollar amounts are in thousands.)

Transcribed Image Text:Gateway Tours is choosing between two bus models. One is more expensive to purchase and maintain, but lasts much longer than the other. Gateway's discount rate is 10.7%. The company plans to continue with one of the two models for

the foreseeable future. Based on the costs of each shown here: which should it choose? (Note: dollar amounts are in thousands.)

1

The EAA for the Old Reliable model is $

(Round to two decimal places.)

Data table

(Click on the following icon in order to copy its contents into a spreadsheet.)

Model

Year 0

Year 1

Year 2

Year 3

Old Reliable

- $200

- $3.9

- $3.9

- $3.9

Year 4

- $3.9

Year 5

- $3.9

Year 6

- $3.9

Year 7

- $3.9

Short and Sweet

- $98

-$1.9

- $1.9

- $1.9

- $1.9

Print

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- If the net present value of A is +$60 and of B is +$30, then what is the net present value of the combined project?arrow_forwardBasic NPV methods tell us that the value of a project today is NPV0. Time value of money issues also lead us to believe that if we choose not to do the project that it will be worth NPV1 one period from now, such that NPV0 > NPV1. Why then do we see some firms choosing to defer taking on a project. Be complete and thorough in your answer.arrow_forwardSubject :- Accountingarrow_forward

- How can we calculate the net annual sponsor's costs?arrow_forwardOk I understand that they all sum to one now and how to calculate the weights. How do I find the rate of return?arrow_forwardAn investor is consider four different opportunities, A, B, C, or D. The payoff for each opportunity will depend on the economic conditions, represented in the payoff table below. Economic Condition Investment Poor Average Good Excellent (S1) (S2) (S3) (S4) A 50 75 20 30 B 80 15 40 50 C -100 300 -50 10 D 25 25 25 25 What decision would be made under minimax regret?arrow_forward

- PLEASE ANSWER ASAP.....arrow_forwardComputing Present and Future Values Under Different Assumptions Determine the unknown variables in each of the four separate investment scenarios. Round the RATE to one percentage point (for example, enter 8.5 for 8.54444%). Round NPER, PV, and PMT to the nearest whole number. Use a negative sign only for an amount related to PMT. Investment 1 Investment 2 Investment 3 Investment 4 RATE Answer 7% 6% 1% NPER 10 Answer 4 24 PV $216,000 $9,000 Answer $21,600 PMT $(35,000) $(2,300) $(16,200) Answer TYPE End of period Beg. of period End of period Beg. of periodarrow_forwardThe Pan American Bottling Company is considering the purchase of a new machine that would increase the speed of bottling and save money. The net cost of this machine is $70,000. The annual cash flows have the following projections. Use Appendix B and Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods. Year 1 2 3 4 5 Cash Flow $ 38,000 40,000 36,000 30,000 13,000 a. If the cost of capital is 12 percent, what is the net present value of selecting a new machine? Note: Do not round intermediate calculations and round your final answer to 2 decimal places. Net present valuearrow_forward

- What would you recommend if the benefit / cost ratio is >1: Select one: a. The project must be accepted. b. Benefit / cost ratio cannot be >1 c. The project must be rejected. d. Benefit / cost ratio always =1arrow_forward5) Which of the following will cause a movement from one point on an AD curve to another point on the same AD curve? a) a change in government expenditures b) a change in the price level c) a change in net exports d) all of the options provided 6) Here is a consumption function: C = CO + MPC(Yd). If MPC is 0.80, then we know that a) as Co rises by $0.80, Yd rises by $1. b) Yd rises by $0.80. c) as Yd rises by $1. Co rises by $0.80. d) as Yd rises by $1, C rises by $0.80. 7) An aggregate demand (AD) curve shows the a) none of the options provided is correct b) quantity of output that people are willing and can afford to buy at different price levels, ceteris paribus c) quantity of output that people are willing as well as able to produce and sell at different price levels, ceteris paribus. d) value of a particular good that people are willing and able to buy at a particular price, ceteris paribus. d) value of a particular good that people are willing and able to buy at a particular…arrow_forwardWhat is the risk neutral probability of state 1?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education