Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

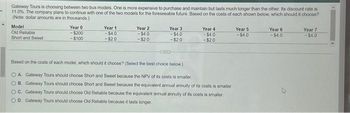

Transcribed Image Text:Gateway Tours is choosing between two bus models. One is more expensive to purchase and maintain but lasts much longer than the other. Its discount rate is

11.0%. The company plans to continue with one of the two models for the foreseeable future. Based on the costs of each shown below, which should it choose?

(Note: dollar amounts are in thousands.)

Model

Old Reliable

Short and Sweet

Year 0

-$200

-$100

Year 1

-$4.0

-$2.0

Year 2

-$4.0

-$2.0

Year 3

-$4.0

-$2.0

Year 4

-$4.0

-$2.0

Based on the costs of each model, which should it choose? (Select the best choice below)

OA. Gateway Tours should choose Short and Sweet because the NPV of its costs is smaller.

OB. Gateway Tours should choose Short and Sweet because the equivalent annual annuity of its costs is smaller.

OC. Gateway Tours should choose Old Reliable because the equivalent annual annuity of its costs is smaller.

D. Gateway Tours should choose Old Reliable because it lasts longer.

Year 5

-$4.0

Year 6

-$4.0

Year 7

-$4.0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 9 images

Knowledge Booster

Similar questions

- Grove Audio is considering the introduction of a new model of wireless speakers with the following price and cost characteristics. Sales price $ 570.00 per unit Variable costs 330.00 per unit Fixed costs 960,000 per year Required: What number must Grove Audio sell annually to break even? What number must Grove Audio sell to make an operating profit of $180,000 for the year?arrow_forwardTotally Tanked, Inc. sells tank tops. The firm is considering making some changes in order to achieve its goal of increasing its profit. If it makes no changes, the company anticipates the following for the coming year: # of tank tops to be sold 3,000,000 Selling price per tank top $20 Variable expense per tank top $8 Fixed expenses for the year $20,000,000 Maria, one of the company’s managers suggests the following: “I think if we cut our price to $17 a tank top, we will increase our sales to 3,700,000 tank tops. I think that will help us achieve our goal”. Question: Prepare a contribution margin income statement (CMIS) for each of the two scenarios below: A) The company makes no changes B)The company implements Maria’s suggestion.arrow_forwardYou have two machines under consideration for an improved automated wrapping process for Snickers Fun Size candy bars as detailed below. (a) Using an AW analysis, determine which should be selected at i = 15% per year. (b) Assume you want machine D to be selected and are willing to extend its estimated life, if necessary. Perform this analysis to ensure D’s selection using factors or a spreadsheet. Machine C D First cost, $ −40,000 −65,000 Annual cost, $/year −10,000 −12,000 Salvage value, $ 12,000 25,000 Life, years 3 6arrow_forward

- You are trying to pick the least expensive car for your new delivery service. You have two choices: the Kia Rio, which will cost $19, 500 to purchase and which will have OCF of -$ 2,300 annually throughout the vehicle's expected life of three years as a delivery vehicle; and the Toyota Prius, which will cost $28, 000 to purchase and which will have OCF of -$1,200 annually throughout that vehicle's expected 4-year life. Both cars will be worthless at the end of their life. If you intend to replace whichever type of car you choose with the same thing when its life runs out, again and again out into the foreseeable future. If the business has a cost of capital of 13 percent, calculate the EAC. Note: Negative amounts should be indicated by a minus sign. Do not round your intermediate calculations. Round your answers to 2 decimal places.arrow_forwardSkip Consulting helped Schmidt Roofers put various cost saving techniques into place. Thecontract specifies that Skip will receive a flat fee of $70,000 and an additional $19,000 if Schmidtattains a target amount of cost savings. Skip estimates a 20% chance that Schmidt will reach thetarget for cost savings. Assuming that Skip uses the expected-value approach, what is thetransaction price for this product?a. $19,000b. $70,000c. $73,800d. $89,000arrow_forwardHello tutor please provide Solutionsarrow_forward

- You are trying to pick the least-expensive car for your new delivery service. You have two choices: the Scion xA, which will cost $23,500 to purchase and which will have OCF of −$3,100 annually throughout the vehicle’s expected life of three years as a delivery vehicle; and the Toyota Prius, which will cost $32,000 to purchase and which will have OCF of −$1,600 annually throughout that vehicle’s expected 4-year life. Both cars will be worthless at the end of their life. You intend to replace whichever type of car you choose with the same thing when its life runs out, again and again out into the foreseeable future. If the business has a cost of capital of 11 percent, calculate the EAC. (Negative amounts should be indicated by a minus sign. Round your answers to 2 decimal places.) Scion EAC_____? Toyota EAC____?arrow_forwardQuestion: The Savannah Shirt Company is considering adding a new product line, a cloth shopping bag with custom screen printing that will be sold to grocery stores. If the current market price of cloth shopping bags is $1.25 and the company desires a net profit of 40%, what is the target cost? The company estimates the full product cost of the cloth bags will be $0.60. Should the company manufacture the cloth bags? Why or why not?arrow_forwardNeed Helparrow_forward

- can you help me with the last two questions, pleasearrow_forwardC-Cubed makes bikes. It's standard bike is called the Speed Racer. It's Contribution Margin Income Statement for 2020 when it sold 350 bikes is as follows: Sales $175,000 64.750 Less: Variable Expenses Contribution Margin Less: Fixed Expenses Net Operating Income In 2021, C-Cubed is thinking that it can increase its sales to 375 if it takes the following actions: 1) cuts its sales price by $100 per bike and 2) switches to a more fixed pay structure for its sales people by eliminating the $35 per unit sales commission and increasing its selling salaries by $5,000. What would be profit impact of these changes? 110,250 27,000 $83,250 Multiple Choice $21,500 decrease $25,250 decrease $20,625 decrease $30.000 decreasearrow_forward5. What is the Contribution Margin Ratio (CMR) if the price is $8.82 per gallon? IceLess is an anti-icing solution sold in gallon plastic jugs. It is poured into the windshield washer bottle of your car. Wash your windshield and the solution prevents the glass from icing over for about four hours. Production incurs the following fixed and variable costs. It is priced initially at $5.50 per gallon. Fixed costs (per year) Variable Costs per gallon Rent: $18000 Glycol: $1.50 Utilities: 13200 FreezeFree 312: .50 Managerial salaries: 20000 Mfg labor: .20 Flammability permit: 12000 Packaging: .20 Other fixed expense: 2400 Inert ingredients: .60 Total fixed: $65600 Advertising: .30 Total: $3.30arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education