ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Number 6a, 6b, 6c

Transcribed Image Text:GAMES AND STRATEGIC BEHAVIOR

260

CHAPTER 9

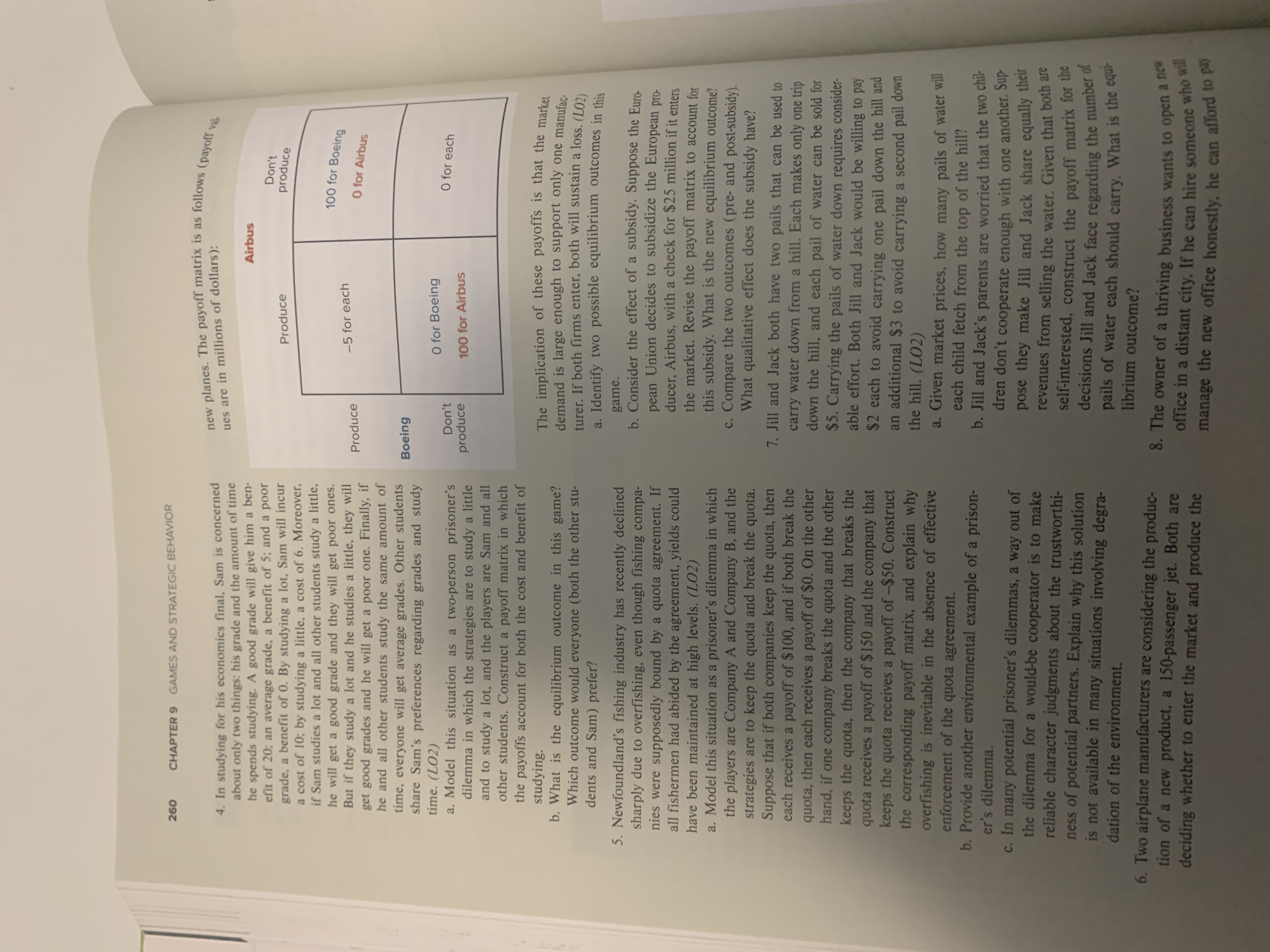

new planes. The payoff matrix is as follows (payoff val.

4. In studying for his economics final, Sam is concerned

about only two things: his grade and the amount of time

he spends studying. A good grade will give him a ben-

efit of 20; an average grade, a benefit of 5; and a poor

grade, a benefit of 0. By studying a lot. Sam will incur

a cost of 10; by studying a little, a cost of 6. Moreover,

if Sam studies a lot and all other students study a little,

he will get a good grade and they will get poor ones.

But if they study a lot and he studies a little, they will

get good grades and he will get a poor one. Finally, if

he and all other students study the same amount of

time, everyone will get average grades. Other students

share Sam's preferences regarding grades and study

time. (LO2)

a. Model this situation as a two-person prisoner's

dilemma in which the strategies are to study a little

and to study a lot, and the players are Sam and all

other students. Construct a payoff matrix in which

the payoffs account for both the cost and benefit of

studying.

b. What is the equilibrium outcome in this game?

Which outcome would everyone (both the other stu-

dents and Sam) prefer?

ues are in millions of dollars ):

Airbus

Don't

produce

Produce

100 for Boeing

-5 for each

O for Airbus

Produce

Boeing

O for Boeing

O for each

Don't

produce

100 for Airbus

The implication of these payoffs is that the market

demand is large enough to support only one manufac-

turer. If both firms enter, both will sustain a loss. (LO2)

a. Identify two possible equilibrium outcomes in this

5. Newfoundland's fishing industry has recently declined

sharply due to overfishing, even though fishing compa-

nies were supposedly bound by a quota agreement. If

all fishermen had abided by the agreement, yields could

have been maintained at high levels. (LO2)

a. Model this situation as a prisoner's dilemma in which

the players are Company A and Company B, and the

strategies are to keep the quota and break the quota.

Suppose that if both companies keep the quota, then

each receives a payoff of $100, and if both break the

quota, then each receives a payoff of $0. On the other

hand, if one company breaks the quota and the other

keeps the quota, then the company that breaks the

quota receives a payoff of $150 and the company that

keeps the quota receives a payoff of -$50. Construct

the corresponding

overfishing is inevitable in the absence of effective

enforcement of the quota agreement.

b.Provide another environmental example of a prison-

er's dilemma

c. In many potential prisoner's dilemmas, a way out of

the dilemma for a would-be cooperator is to make

reliable character judgments about the trustworthi-

ness of potential partners. Explain why this solution

is not available in many situations involving degra-

dation of the environment.

game.

b. Consider the effect of a subsidy. Suppose the Euro-

pean Union decides to subsidize the European pro-

ducer, Airbus, with a check for $25 million if it enters

the market. Revise the payoff matrix to account for

this subsidy. What is the new equilibrium outcome?

c. Compare the two outcomes (pre- and post-subsidy).

What qualitative effect does the subsidy have?

7. Jill and Jack both have two pails that can be used to

carry water down from a hill. Each makes only one trip

down the hill, and each pail of water can be sold for

$5. Carrying the pails of water down requires consider-

able effort. Both Jill and Jack would be willing to pay

$2 each to avoid carrying one pail down the hill and

an additional $3 to avoid carrying a second pail down

the hill. (LO2)

payoff matrix, and explain why

a. Given market prices, how many pails of water will

each child fetch from the top of the hill?

b. Jill and Jack's parents are worried that the two chil-

dren don't cooperate enough with one another. Sup

pose they make Jill and Jack share equally their

revenues from selling the water. Given that both are

self-interested, construct the payoff matrix for the

decisions Jill and Jack face regarding the number of

pails of water each should carry. What is the equi-

librium outcome?

6. Two airplane manufacturers are considering the produc-

tion of a new product, a 150-passenger jet. Both are

deciding whether to enter the market and produce the

8. The owner of a thriving business wants to open a new

office in a distant city. If he can hire someone who will

manage the new office honestly. he can afford to

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- "Disinvestment" is a part of revenue receipts True/Falsearrow_forwardthe earnings on the assest funds of a permanent fund are to be used to support the city's library special revenue fund. How would the earnings be recorded?arrow_forward280 View Policies Current Attempt in Progress Carla Vista Company took a physical inventory on December 31 and determined that goods costing $236,000 were on hand. Not included in the physical count were $29,500 of goods purchased from Pelzer Corporation, FOB, shipping point, and $25,960 of goods sold to Alvarez Company for $35,400, FOB destination. Both the Pelzer purchase and the Alvarez sale were in transit at year-end. What amount should Carla Vista report as its December 31 inventory? Ending inventory Save for Later LA eTextbook and Media A $ 2 MAR 1 Attempts: 0 of 3 used Submit Answerarrow_forward

- Time-series data: are always associated with price-making firms. may exhibit trend or cyclical variation, but not both at the same time. may exhibit trend or cyclical variation at the same time. all of these answers are correct. Typed and correct answer please. I will rate accordingly.arrow_forwardA = ? n = 00 i = 3% P = $12,000,000 Find: Aarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education