FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Gallatin Carpet Cleaning is a small, family-owned business operating out of Bozeman, Montana. For its services, the company has

always charged a flat fee per hundred square feet of carpet cleaned. The current fee is $23.25 per hundred square feet. However,

there is some question about whether the company is actually making any money on jobs for some customers-particularly those

located on remote ranches that require considerable travel time. The owner's daughter, home for the summer from college, has

suggested investigating this question using activity-based costing. After some discussion, she designed a simple system consisting of

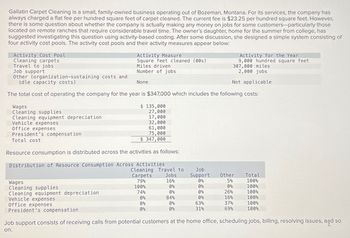

four activity cost pools. The activity cost pools and their activity measures appear below:

Activity Cost Pool

Cleaning carpets

Travel to jobs

Job support

Other (organization-sustaining costs and

idle capacity costs)

Activity Measure

Square feet cleaned (00s)

Miles driven

Number of jobs

None

Activity for the Year

9,000 hundred square feet

307,000 miles

2,000 jobs

Not applicable

The total cost of operating the company for the year is $347,000 which includes the following costs:

Wages

Cleaning supplies

Cleaning equipment depreciation

Vehicle expenses

Office expenses

President's compensation

Total cost

$ 135,000

27,000

17,000

32,000

61,000

75,000

$ 347,000

Resource consumption is distributed across the activities as follows:

Distribution of Resource Consumption Across Activities

Wages

Cleaning supplies

Cleaning equipment depreciation

Vehicle expenses

Office expenses

President's compensation

Cleaning Travel to

Job

Carpets

Jobs

Support

Other

Total

79%

16%

0%

5%

100%

100%

0%

0%

0%

100%

74%

0%

0%

26%

100%

0%

84%

0%

16%

100%

0%

0%

63%

37%

100%

0%

0%

31%

69%

100%

Job support consists of receiving calls from potential customers at the home office, scheduling jobs, billing, resolving issues, and so

on.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Many small businesses have to squeeze down costs any way they can just to survive. One way many businesses do this is by hiring workers as independent contractors rather than as regular employees. Unlike rules for regular employees, a business does not have to pay social security (FICA) taxes and unemployment insurance payments for independent contractors. Similarly, it does not have to withhold federal, state, or local income taxes or the employee’s share of FICA taxes. The IRS has a 20-factor test determining whether a worker should be considered an employee or a contractor, but many businesses ignore those rules or interpret them loosely in their favor. When workers are treated as independent contractors, they do not get a W-2 form at tax time (they geta 1099 instead), they do not have any income taxes withheld, and they find themselves subject to self-employment taxes, by which they bear the brunt of both the employees and the employer’s share of FICA taxes. Requirements…arrow_forwardSturbridge Company manufactures fine furniture and grandfather clocks. Sturbridge has an excellent reputation, and each grandfather clock sells for several thousand dollars. Which of the following is an indirect cost, assuming the cost object is the Clock Department? Multiple Choice Salary of the clock production supervisor. Depreciation on the factory building. Depreciation on clock-making equipment. All of the answers are correct.arrow_forwardGreenGrow Limited is a local landscaping company that does household and commercial landscaping. Primarily, they help business select plants and manage the plants. They also have regular maintenance contracts such as watering, weeding, and mowing. In the winter, they have some contracts for managing the indoor plants of shopping malls, and do snow clearing to help boost that low income season. Joey, the majority shareholder of GreenGrow is ecstatic. He has managed to come in as the low bidder for a new type of contract. He bid on the construction of a track for the track and field area of a local college. A piece of land on the north end of the college is being cleared and GreenGrow will be leveling the land and placing a bed of crushed stone for the track. Joey has just the right person to be in charge. Jack has previous experience working as an assistant on a road crew and knows how to use the surveying equipment needed to keep the track level. This is a big contract, representing…arrow_forward

- Bobby Reynolds, a new client of yours, is a self-employed caterer in Santa Fe, New Mexico. Bobby drives his personal van when delivering catered meals to customers. You have asked him to provide the amount of business miles driven using his vehicle. You are planning on using the standard mileage method to calculate Bobby’s deduction for transportation costs. Bobby has responded by saying, “Well, I don’t really keep track of my miles. I guess I drove around 3,000 miles last year for the business.” What would you say to Bobby? Please give a response as if you are a professional tax accountant.arrow_forwardBecause of a job change, Seth Armstrong has just relocated to the southeastern United States. He sold his furniture before he moved, so he's now shopping for new furnishings. At a local furniture store, he's found an assortment of couches, chairs, tables, and beds that he thinks would look great in his new two-bedroom apartment; the total cost for everything is $6,400. Because of moving costs, Seth is a bit short of cash right now, so he's decided to take out an installment loan for $6,400 to pay for the furniture. The furniture store offers to lend him the money for 48 months at an add-on interest rate of 6.5 percent. The credit union at Seth's firm also offers to lend him the money - they'll give him the loan at an interest rate of 10 percent simple, but only for a term of 24 months. Compute the monthly payments for the loan from the furniture store. Round the answer to the nearest cent. $ per month Compute the monthly payments for the loan from the credit union. Round the…arrow_forwardEthics Case Electronics, Inc. is a high-volume, wholesale merchandising company. Most of its inventory turns over four or five times a year. The company has had 50 units of a particular brand of computers on hand for over a year. These computers have not sold and probably will not sell unless they are discounted 60 to 70%. The accountant is carrying them on the books at cost and intends to recognize the loss when they are sold. This way, she can avoid a significant write-down in inventory on the current year’s financial statements. 1. Is the accountant correct in her treatment of the inventory? Why or why not? 2. If the computers cost $1,000 each and their market value is 40% of their cost, journalize the entry necessary for the write-down. 3. In groups of three or four, make a list of reasons why inventories of electronic equipment might have to be written down.arrow_forward

- Vishalarrow_forwardThornton Airlines is a small airline that occasionally carries overload shipments for the overnight delivery company Never-Fall, Incorporated. Never-Fall is a multimillion-dollar company started by Wes Never Immediately after he falled to finish his first accounting course. The company's motto is "We Never-Fall to Deliver Your Package on Time." When Never-Fall has more freight than It can deliver, It pays Thornton to carry the excess. Thornton contracts with Independent pilots to fly its planes on a per-trip basis. Thornton recently purchased an airplane that cost the company $5,588,000. The plane has an estimated useful life of 25,400,000 miles and a zero salvage value. During the first week In January, Thornton flew two trips. The first trip was a round trip flight from Chicago to San Francisco, for which Thornton pald $370 for the pilot and $320 for fuel. The second flight was a round trip from Chicago to New York. For this trip, It paid $320 for the pilot and $160 for fuel. The…arrow_forwardZachary Airlines is a small airline that occasionally carries overload shipments for the overnight delivery company Never-Fail, Incorporated. Never-Fail is a multimillion-dollar company started by Wes Never immediately after he failed to finish his first accounting course. The company's motto is "We Never-Fail to Deliver Your Package on Time." When Never-Fail has more freight than it can deliver, it pays Zachary to carry the excess. Zachary contracts with independent pilots to fly its planes on a per-trip basis. Zachary recently purchased an airplane that cost the company $4,883,000. The plane has an estimated useful life of 25,700,000 miles and a zero salvage value. During the first week in January, Zachary flew two trips. The first trip was a round trip flight from Chicago to San Francisco, for which Zachary paid $300 for the pilot and $250 for fuel. The second flight was a round trip from Chicago to New York. For this trip, it paid $250 for the pilot and $125 for fuel. The round…arrow_forward

- Manzeck Company operates a snow-removal service. The company owns five trucks, each of which has a snowplow in the front to plow driveways and a snowthrower in the back to clear sidewalks. Because plowing snow is very tough on trucks, the company incurs significant maintenance costs. Truck depreciation and maintenance represent a significant portion of the company’s overhead. The company removes snow at residential locations, in which case the drivers spend the bulk of their time walking behind the snow thrower machine to clear sidewalks. On commercial jobs, the drivers spend most of their time plowing. Manzeck allocates overhead based on labor hours. Total overhead costs for the year are $42,000. Total estimated labor hours are 1,500 hours. The average estimated residential property requires 0.5 hours of labor, while the average commercial property requires 2.5 hours of labor. The following additional information is available.Activity Cost Pools Cost Drivers…arrow_forwardRecently, the owner of a Trader Joe's franchise decided to change how she compensated her top manager. Last year, she paid him a fixed salary of $65,000, and her store made $120,000 in profits (not counting payment to her top manager). She suspected the store could do much better and feared the fixed salary was causing her top manager to shirk on the job. Therefore, this year she decided to offer him a fixed salary of $30,000 plus 15 percent of the store's profits. Since the change, the store is performing much better, and she forecasts profits this year to be $280,000 (again, not counting the payment to her top manager). Assuming the change in compensation is the reason for the increased profits, and that the forecast is accurate, (a) Which compensation method (the old one or the new one) will the manager prefer? Please explain why. (b) Which compensation method (the old one or the new one) would the owner of the franchise prefer? Please explain why. (c) If there was another…arrow_forwardSafe Travel produces car seats for children from newborn to 2 years old. The company is worried because one of its competitors has recently come under public scrutiny because of product failure. Historically, Safe Travel's only problem with its car seats was stitching in the straps. The problem can usually be detected and repaired during an internal inspection. The cost of the inspection is $5.00 per car seat, and the repair cost is $1.00 per car seat. All 200,000 car seats were inspected last year, and 5% were found to have problems with the stitching in the straps during the internal inspection. Another 1% of the 200,000 car seats had problems with the stitching, but the internal inspection did not discover them. Defective units that were sold and shipped to customers needed to be shipped back to Safe Travel and repaired. Shipping costs are $8.00 per car seat, and repair costs are $1.00 per car seat. However, the out-of-pocket costs (shipping and repair) are not the only costs of…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education