Concept explainers

Topic Video

Question

Please do not give solution in image format thanku

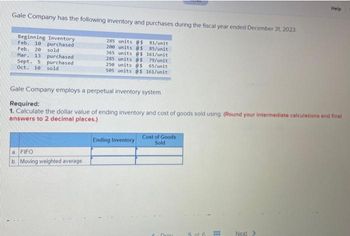

Transcribed Image Text:Gale Company has the following inventory and purchases during the fiscal year ended December 31, 2023.

Beginning Inventory

Feb. 10 purchased

Feb. 20 sold

Mar. 13 purchased

Sept. 5

purchased

Oct. 10 sold

285 units @s 81/unit

200 units @$ 85/unit

365 units @$ 161/unit

285 units @s 79/unit

250 units @$

65/unit

505 units @$ 161/unit

a FIFO

b. Moving weighted average

Gale Company employs a perpetual inventory system.

Required:

1. Calculate the dollar value of ending inventory and cost of goods sold using: (Round your intermediate calculations and final

answers to 2 decimal places.)

Ending Inventory

Cost of Goods

Sold

Drou

5 of 6

Help

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.