Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

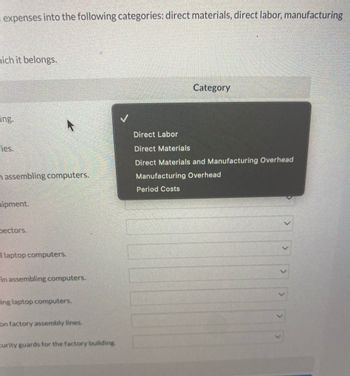

Transcribed Image Text:expenses into the following categories: direct materials, direct labor, manufacturing

hich it belongs.

ing.

ries.

assembling computers.

ipment.

pectors.

I laptop computers.

in assembling computers.

ing laptop computers.

on factory assembly lines.

curity guards for the factory building.

Category

Direct Labor

Direct Materials

Direct Materials and Manufacturing Overhead

Manufacturing Overhead

Period Costs

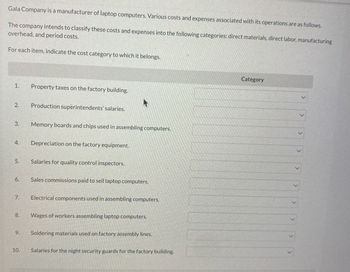

Transcribed Image Text:Gala Company is a manufacturer of laptop computers. Various costs and expenses associated with its operations are as follows.

The company intends to classify these costs and expenses into the following categories: direct materials, direct labor, manufacturing

overhead, and period costs.

For each item, indicate the cost category to which it belongs.

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

Property taxes on the factory building.

Production superintendents' salaries.

Memory boards and chips used in assembling computers.

Depreciation on the factory equipment.

Salaries for quality control inspectors.

Sales commissions paid to sell laptop computers.

Electrical components used in assembling computers.

Wages of workers assembling laptop computers.

Soldering materials used on factory assembly lines.

Salaries for the night security guards for the factory building.

Category

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Listed as follows are various costs found in businesses. Classify each cost as a fixed or variable cost, and as a product and/or period cost. Wages of administrative staff Shipping costs on merchandise sold Wages of workers assembling computers Cost of lease on factory equipment Insurance on factory Direct materials used in production of lamps Supervisor salary, factory Advertising costs Property taxes, factory Health insurance cost for company executives Rent on factoryarrow_forwardA manufacturing company has two service and two production departments. Building Maintenance and Factory Office are the service departments. The production departments are Assembly and Machining. The following data have been estimated for next years operations: The direct charges identified with each of the departments are as follows: The building maintenance department services all departments of the company, and its costs are allocated using floor space occupied, while factory office costs are allocable to Assembly and Machining on the basis of direct labor hours. 1. Distribute the service department costs, using the direct method. 2. Distribute the service department costs, using the sequential distribution method, with the department servicing the greatest number of other departments distributed first.arrow_forwardGala Company is a manufacturer of laptop computers. Various costs and expenses associated with its operations are as follows.The company intends to classify these costs and expenses into the following categories: (a) direct materials, (b) direct labor, (c) manufacturing overhead, and (d) period costs.For each item, indicate the cost category to which it belongs. (A,B,C, or D) Item Category 1. Property taxes on the factory building. select the cost category 2. Production superintendents’ salaries. select the cost category 3. Memory boards and chips used in assembling computers. select the cost category 4. Depreciation on the factory equipment. select the cost category 5. Salaries for assembly-line quality control inspectors. select the cost category 6. Sales commissions paid to sell laptop computers. select the cost category 7. Electrical components used in assembling computers. select the…arrow_forward

- Following are selected costs of a company that manufactures computer chips. Classify each as either a product cost or a period cost. Then classify each of the product costs as direct material, direct labor, or overhead. 1. Plastic boards used to mount chips 2. Advertising costs 3. Factory maintenance workers’ salaries 4. Real estate taxes paid on the sales office 5. Real estate taxes paid on the factory 6. Factory supervisor salary 7. Depreciation on factory equipment 8. Assembly worker hourly pay to make chipsarrow_forwardPresented below is a list of costs and expenses usually incurred by Barnum Corporation, a manufacturer of furniture, in its factory.Classify the below items into the following categories: (a) direct materials, (b) direct labor, and (c) manufacturing overhead. Item Category 1. Salaries for assembly line inspectors. select a category 2. Insurance on factory machines. select a category 3. Property taxes on the factory building. select a category 4. Factory repairs. select a category 5. Upholstery used in manufacturing furniture. select a category 6. Wages paid to assembly line workers. select a category…arrow_forwardThe following is a list of costs incurred by several manufacturing companies: Classify each of the following costs as product cost or period cost. Indicate whether each product cost is a direct materials cost, a direct labor cost, or a factory overhead cost. Indicate whether each period cost is a selling expense or an administrative expense: Costs Classification a. Annual picnic for plant employees and their families b. Cost of fabric used by clothing manufacturer c. Cost of plastic for a toy manufacturer d. Cost of sewing machine needles used by a shirt manufacturer e. Cost of television commercials f. Depreciation of copying machines used by the Marketing Department g. Depreciation of microcomputers used in the factory to coordinate and monitor the production schedules h. Depreciation of office building i. Depreciation of robotic equipment used to assemble a product j. Electricity used to operate factory machinery k. Factory…arrow_forward

- Listed below are costs found in various organizations.1. Property taxes, factory.2. Boxes used for packaging detergent produced by the company.3. Salespersons’ commissions.4. Supervisor’s salary, factory.5. Depreciation, executive autos.6. Wages of workers assembling computers.7. Insurance, finished goods warehouses.8. Lubricants for production equipment.9. Advertising costs.10. Microchips used in producing calculators.11. Shipping costs on merchandise sold.12. Magazine subscriptions, factory lunchroom.13. Thread in a garment factory.14. Billing costs.15. Executive life insurance.16. Ink used in textbook production.17. Fringe benefits, assembly-line workers.18. Yarn used in sweater production.19. Wages of receptionist, executive offices.Required:Prepare an answer sheet with column headings as shown below. For each cost item, indicate whetherit would be variable or fixed with respect to the number of units produced and sold; and then whetherit would be a selling cost, an administrative…arrow_forwardThe following is a list of costs and expenses usually incurred by Barnum Corporation, a manufacturer of furniture, in its factory. Classify these items into the following categories: (a) direct materials, (b) direct labor, and (c) manufacturing overhead. 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Salaries for product inspectors. Insurance on factory machines. Property taxes on the factory building. Factory repairs. Upholstery used in manufacturing furniture. Wages paid to assembly-line workers. Factory machinery depreciation. Glue, nails, paint, and other small parts used in production. Factory supervisors' salaries. Wood used in manufacturing furniture. Category Manufacturing Overhead Manufacturing Overhead Direct Materialsarrow_forwardListed as follows are various costs found in businesses. Classify each cost as a fixed or variable cost, and as a product and/or period cost. a. Wages of administrative staff b. Shipping costs on merchandise sold C. Wages of workers assembling computers d. Cost of lease on factory equipment e. Insurance on factory f. Direct materials used in production of lamps g. Supervisor salary, factory h. Advertising costs_ i. Property taxes, factory j. Health insurance cost for company executives k. Rent on factoryarrow_forward

- For apparel manufacturer Abercrobmie & Fitch, Inc., classify each of the following costs as either a product cost or a period cost: Research and development costs Depreciation on sewing machines Fabric used during production Depreciation on office equipment Advertising expenses Repairs and maintenance costs for sewing machines Salary of production quality control supervisor Utility costs for office building Sales commissions Salaries of distribution center personnel Wages of sewing machine operators Factory janitorial supplies Chief financial officer’s salary Travel costs of media relations employees Factory supervisors’ salaries Oil used to lubricate sewing machines Property taxes on factory building and equipmentarrow_forwardSelected costs related to Apple's iPhone are listed below. Classify each cost as either direct materials, direct labor, factory overhead, selling expenses, or general and administrative expenses. 1. Microphone component 2. Camera component 3. Wages for factory equipment operators 4. Office accountant salary 5. Wages for retail store salesperson 6. Salary of chief executive officer 7. Depreciation on office equipment 8. Wages for assembly workersarrow_forwardSelected costs related to Apple's iPhone are listed below. Classify each cost as either direct materials, direct labor, factory overhead, selling expenses, or general and administrative expenses. 1. Wages for assembly workers 2. Battery component 3. Microphone component 4. Wages for factory equipment operators 5. Camera component 6. Office accountant salary 7. Office building insurance used up 8. Depreciation (straight-line) on robotic equipment used in assemblyarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning