Personal Finance

13th Edition

ISBN: 9781337669214

Author: GARMAN

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

None

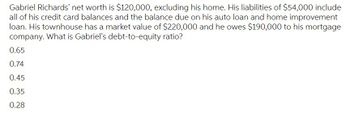

Transcribed Image Text:Gabriel Richards' net worth is $120,000, excluding his home. His liabilities of $54,000 include

all of his credit card balances and the balance due on his auto loan and home improvement

loan. His townhouse has a market value of $220,000 and he owes $190,000 to his mortgage

company. What is Gabriel's debt-to-equity ratio?

0.65

0.74

0.45

0.35

0.28

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- S Robert owns a $187,000 town house and still has an unpaid mortgage of $119,000. In addition to his mortgage, he has the following liabilities: Liabilities Visa MasterCard Discover card Education loan Personal bank loan Auto loan Total Robert's net worth (not including his home) is about $24,100. This equity is in mutual funds, an automobile, a coin collection, furniture, and other personal property. $ 595 527 399 994 838 5,170 $ 8,523 a. What is Robert's debt-to-equity ratio? Note: Round your answer to 2 decimal places. Debt-to-equity ratio b. Has he reached the upper limit of debt obligations? Yesarrow_forwardAndy's yearly income is $40,000. What would Andy's debt load be on a $15,000 personal loan? Would Andy's debt load follow the guidelines of the 20/10 rule? Provide a reason for Your answer.arrow_forwardMm. 138.arrow_forward

- Larry borrowed $1,000 through a loan shark, two years later he ended uppaying $1,500 to settle his debt. What was the interest rate on his loan?arrow_forwardAns plzarrow_forwardIsaiah and Allison Burton have a home with an appraised value of $190,000 and a mortgage balance of only $95,000. Given that an S&L is willing to lend money at a loan-to-value ratio of 70 percent, how big of a home equity credit line can Isaiah and Allison obtain? $ How much, if any, of this line would qualify as tax-deductible interest if their house originally cost $100,000? $arrow_forward

- Give me true answer this general accounting questionarrow_forwardRyan and Nicole have $186,440 in assets, and the following liabilities: Mortgage $47,122 Car loan 3,472 Credit card balance 301 Student loans 16,602 Furniture note (6 months) 1,282 The total of the current liabilities is $____ The total of the long-term liabilities is $____ Ryan and Nicole's net worth is $____ arrow_forward5. Determine the net worth and debt equity ratio for each of the following situations and describe their financial situation. a. Betty's assests are worth $240 000.0. She has a mortgage worth $120 000.00 and a car loan for $17 000. b. Jim has a house worth $350 000, investments worth $65 000 and a car worth $21 000. He has a mortgage for $202 000, a car loan for $17000, a line credit with $9000 on it and two credit cards with a total of $7500 on them. c. Jay and Jane pay rent of $1500 per month, a total of $8000 in RRSP's and two cars, one worth $16 000 and one worth $10 000. They have car loans worth $4000 and $6000 as well as student loans totally $12 000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT