FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:A1

1

2

(O

3

4

5 Pre-withdrawl ratio

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

fx Textbook Ref

22

23

A

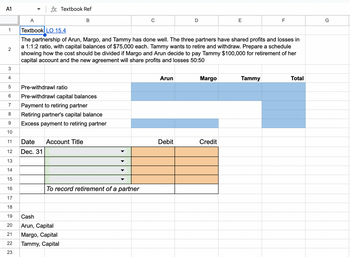

Textbook LO 15.4

The partnership of Arun, Margo, and Tammy has done well. The three partners have shared profits and losses in

a 1:1:2 ratio, with capital balances of $75,000 each. Tammy wants to retire and withdraw. Prepare a schedule

showing how the cost should be divided if Margo and Arun decide to pay Tammy $100,000 for retirement of her

capital account and the new agreement will share profits and losses 50:50

Pre-withdrawl capital balances

Payment to retiring partner

Retiring partner's capital balance

Excess payment to retiring partner

Date Account Title

Dec. 31

B

To record retirement of a partner

Cash

Arun, Capital

Margo, Capital

Tammy, Capital

C

Arun

Debit

D

Margo

E

Credit

F

Tammy

Total

G

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The partnership of Michelle, Amal, and Maureen has done well. The three partners have shared profits and losses in a 1:3 ratio, with capital balances of $60,000 each. Maureen wants to retire and withdraw. Prepare a schedule showing how the cost should be divided if Amal and Michelle decide to pay Maureen $70,000 for retirement of her capital account and the new agreement will share profits and losses 50:50.arrow_forwardDo not give answer in imagearrow_forwardProblem 14-54 (LO 14-2, 14-3) Wade has a beginning basis in a partnership of $23,000. His share of income and expense from the partnership consists of the following amounts: Ordinary income Guaranteed payment Long-term capital gain 5 1231 gain Charitable contributions $ 179 expense Cash distribution Required: a. What is Wade's self-employment income? $ 43,000 12,000 15,500 4,300 2,000 b. Calculate Wade's basis at the end of the year. 18,000 6,000 a. Self-employment income b. Ending basis Amountarrow_forward

- PA2. LO 15.4Arun and Margot want to admit Tammy as a third partner for their partnership. Their capital balances prior to Tammy's admission are $50,000 each. Prepare a schedule showing how the bonus should be divided among the three, assuming the profit or loss agreement will be 1:3 once Tammy has been admitted and her contribution is: A. $20,000 B. $80,000 C. $50,000.arrow_forwardPartners W, X, Y, and Z form the Ace partnership, contributing the following: W X Y Z Interest 40% 40% 10% 10% Prop. 1 Prop. 2 Prop. 3 Prop. 4 Basis $40,000 $120,000 $10,000 $30,000 FMV $200,000 $60,000 $70,000 $20,000 How much is each partner's basis in their partnership interest? Liability $160,000 $20,000 $60,000 $10,000arrow_forwardI am having trouble finishing my accounitng hoemwork, could you help me? thank you!arrow_forward

- I need correct answer and correct computation. Thank you!arrow_forwardPROBLEM 6 – 3: RECONSTRUCTION OF INFORMATION A and B's partnership agreement stipulates the following: Annual salary of P20,000 to A 10% bonus to A, based on profit after salaries and bonus The balances are shared on 60:40 ratio. Requirement: If B's share in the pai tnership profit for the year is P32,000, how much is the partnership profit before salary and bonus? A В Total Amount being allocated 7 Allocation: 1. Salaries 20,000 20,000 2. Bonus 4 3. Allocation of remaining profit As allocated 32,000 32,000 5 3 6arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education