Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

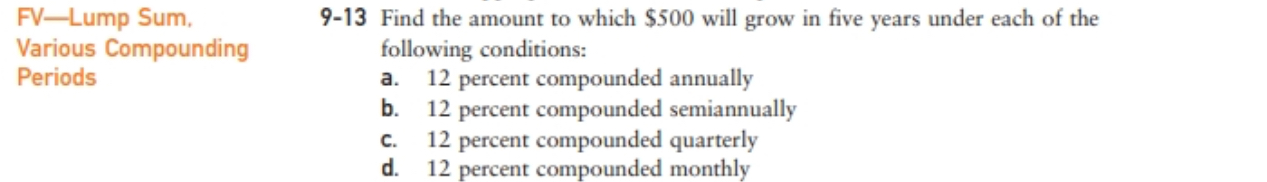

Transcribed Image Text:FV-Lump Sum,

Various Compounding

9-13 Find the amount to which $500 will grow in five years under each of the

following conditions:

a.

12 percent compounded annually

b.

12 percent compounded semiannually

C.

12 percent compounded quarterly

d.

Periods

12 percent compounded monthly

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Question 1 $100,000 for 20 years compounded at 4% annually results in a rate per period of: *** 3% 5% 4% 1% None of thesearrow_forwards. How much must be deposited at 6% each yearbeginning on January 1, year 1, in order toaccumulate 500,000.00 after 6 deposits were made?Interest is (a) 10% compounded semi-annually include a non-excel cash flowarrow_forwardprinciple 26,000 , 10 years, 5% , interest compound amount annually, compound amount _, compound interest _?arrow_forward

- What is the future value of $3,078 invested for 8 years at 6 percent compounded annually? Multiple Choice O O O O $7,819.20 $7,621.01 $3,885.90 $4,905.86 $3,899.12arrow_forwardA series of equal semi-annual payments of $1,000 for 3 years is equivalent to what present amount at an interest rate of 12% compounded annually A $4,944 B) $2,402 $4,804 $4,111arrow_forwardFind the amount to which $1,000 will mature in 3.5 years at 7 ¾% p.a.arrow_forward

- Find the amount to which $500 will grow under each of these conditions:a. 12% compounded annually for 5 yearsb. 12% compounded semiannually for 5 yearsc. 12% compounded quarterly for 5 yearsd. 12% compounded monthly for 5 yearse. 12% compounded daily for 5 yearsf. Why does the observed pattern of FVs occur? Please only do parts d,e and farrow_forwardFind the present value of $1,000 to be received at the end of 4 years at 12% compounded semi-annually. $627 $637 $675 $622arrow_forwardManually calculate the compound interest on an investment of $7,500 at 6% interest, compounded semiannually, for 1 year. Group of answer choices $7,950.00 $7,956.75 $456.75 $450.00arrow_forward

- Find the amount to which $675 will grow under each of the following conditions. Do not round intermediate calculations. Round your answers to the nearest cent. 9% compounded annually for 5 years. $ 9% compounded semiannually for 5 years. $ 9% compounded quarterly for 5 years. $ 9% compounded monthly for 5 years. $arrow_forwardFind the accumulated value of an investment of $15,000 at 5% compounded semiannually for 12 years. $20,173.33 $27,130.89 $26,937.84 $24,000.00arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education