FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

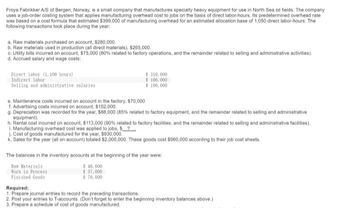

Transcribed Image Text:Froya Fabrikker A/S of Bergen, Norway, is a small company that manufactures specialty heavy equipment for use in North Sea oil fields. The company

uses a job-order costing system that applies manufacturing overhead cost to jobs on the basis of direct labor-hours. Its predetermined overhead rate

was based on a cost formula that estimated $399,000 of manufacturing overhead for an estimated allocation base of 1,050 direct labor-hours. The

following transactions took place during the year.

a. Raw materials purchased on account, $280,000.

b. Raw materials used in production (all direct materials), $265.000.

c. Utility bills incurred on account, $75,000 (80% related to factory operations, and the remainder related to selling and administrative activities).

d. Accrued salary and wage costs:

Direct labor (1.100 hours)

Indirect labor

Selling and administrative salaries

$ 310,000

$ 106,000

$ 190,000

e. Maintenance costs incurred on account in the factory, $70,000

f. Advertising costs incurred on account, $152,000.

g. Depreciation was recorded for the year, $88,000 (85% related to factory equipment, and the remainder related to selling and administrative

equipment).

h. Rental cost incurred on account, $113,000 (90% related to factory facilities, and the remainder related to selling and administrative facilities).

1. Manufacturing overhead cost was applied to jobs, $?

j. Cost of goods manufactured for the year, $930,000.

k. Sales for the year (all on account) totaled $2,000,000. These goods cost $960,000 according to their job cost sheets.

The balances in the inventory accounts at the beginning of the year were:

$ 46,000

$ 37,000

$.76.000

Raw Materials

Work in Process

Finished Goods

Required:

1. Prepare journal entries to record the preceding transactions.

2. Post your entries to T-accounts. (Don't forget to enter the beginning inventory balances above.)

3. Prepare a schedule of cost of goods manufactured.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hahn Company uses a job-order costing system. Its plantwide predetermined overhead rate uses direct labor-hours as the allocation base. The company pays its direct laborers $21.50 per hour. During the year, the company started and completed only two jobs-Job Alpha, which used 64,900 direct labor-hours, and Job Omega. The job cost sheets for these two jobs are shown below: Job Alpha Direct materials Direct labor Manufacturing overhead applied Total job cost Job Omega Direct materials Direct labor Manufacturing overhead applied Total job cost $ 2,806,000 $ 443,900 571,900 385,700 $ 1,401,500 Required: 1. Calculate the plantwide predetermined overhead rate. 2. Complete the job cost sheet for Job Alpha. Required 1 Required 2 Complete this question by entering your answers in the tabs below. Calculate the plantwide predetermined overhead rate. (Round your answer to 2 decimal places.) Plantwide predetermined overhead rate Eper DLHarrow_forwardFroya Fabrikker A/S of Bergen, Norway, is a small company that manufactures specialty heavy equipment for use in North Sea oil fields. The company uses a job-order costing system that applies manufacturing overhead cost to jobs on the basis of direct labor-hours. Its predetermined overhead rate was based on a cost formula that estimated $351,500 of manufacturing overhead for an estimated allocation base of 950 direct labor-hours. The following transactions took place during the year: Raw materials purchased on account, $215,000. Raw materials used in production (all direct materials), $200,000. Utility bills incurred on account, $62,000 (85% related to factory operations, and the remainder related to selling and administrative activities). Accrued salary and wage costs: Direct labor (1,025 hours) $ 245,000 Indirect labor $ 93,000 Selling and administrative salaries $ 125,000 Maintenance costs incurred on account in the factory, $57,000 Advertising costs incurred on…arrow_forwardMoody Corporation uses a job-order costing system with a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, the company made the following estimates: Machine-hours required to support estimated production Fixed manufacturing overhead cost Variable manufacturing overhead cost per machine-hour Required: 1. Compute the plantwide predetermined overhead rate. 2. During the year, Job 400 was started and completed. The following information was available with respect to this job: Direct materials Direct labor cost Machine-hours used $380 $ 270 39 Compute the total manufacturing cost assigned to Job 400. 3. If Job 400 includes 50 units, what is the unit product cost for this job? 4. If Moody uses a markup percentage of 130% of its total manufacturing cost, then what selling price per unit would it have established for Job 400? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 152,000 $ 657,000…arrow_forward

- High Desert Potteryworks makes a variety of pottery products that it sells to retailers. The company uses a job-order costing system in which departmental predetermined overhead rates are used to apply manufacturing overhead cost to jobs. The predetermined overhead rate in the Molding Department is based on machine-hours, and the rate in the Painting Department is based on direct labor- hours. At the beginning of the year, the company provided the following estimates: Direct labor-hours Machine-hours Fixed manufacturing overhead cost Variable manufacturing overhead per machine-hour Variable manufacturing overhead per direct labor-hour Department Molding 38,500 81,000 $ 251,100 $ 2.60 Painting 50,000 40,000 $ 460,000 $ 4.60 Job 205 was started on August 1 and completed on August 10. The company's cost records show the following information concerning the job: Direct labor-hours Machine-hours Direct materials Direct labor cost Required: Department Molding 70 Painting 390 $ 934 $ 720 126…arrow_forwardComplete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3A Required 3B Compute the Predetermined Overhead Rates used in the Molding Department and the Painting Department. (Round your answers to 2 decimal places.)arrow_forwardThe balances in the inventory accounts at the beginning of the year were: Raw Materials Work in Process Finished Goods Required: $ 42,000 $ 33,000 $ 72,000 1. Prepare journal entries to record the preceding transactions. 2. Post your entries to T-accounts. (Don't forget to enter the beginning inventory balances above.) 3. Prepare a schedule of cost of goods manufactured. 4A. Prepare a journal entry to close any balance in the Manufacturing Overhead account to Cost of Goods Sold. 4B. Prepare a schedule of cost of goods sold. 5. Prepare an income statement for the year.arrow_forward

- Landen Corporation uses a job-order costing system. At the beginning of the year, the company made the following estimates: Direct labor-hours required to support estimated production Machine-hours required to support estimated production Fixed manufacturing overhead cost Variable manufacturing overhead cost per direct labor-hour Variable manufacturing overhead cost per machine-hour During the year, Job 550 was started and completed. The following information is available with respect to this job: Direct materials Direct labor cost Direct labor-hours Machine-hours $ 216 $ 327 15 5 Required: 1. Assume that Landen has historically used a plantwide predetermined overhead rate with direct labor-hours as the allocation base. Under this approach: a. Compute the plantwide predetermined overhead rate. b. Compute the total manufacturing cost of Job 550. c. If Landen uses a markup percentage of 200% of its total manufacturing cost, what selling price would it establish for Job 550? 2. Assume…arrow_forwardComans Corporation has two production departments, Milling and Customizing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Milling Department’s predetermined overhead rate is based on machine-hours and the Customizing Department’s predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates: Milling Customizing Machine-hours 16,000 11,000 Direct labor-hours 18,000 6,000 Total fixed manufacturing overhead cost $ 92,800 $ 28,800 Variable manufacturing overhead per machine-hour $ 1.20 Variable manufacturing overhead per direct labor-hour $ 5.00 During the current month the company started and finished Job A319. The following data were recorded for this job: Job A319: Milling Customizing Machine-hours 50 40 Direct labor-hours 60 30 Direct materials $ 430 $ 180 Direct labor cost $ 800 $ 540…arrow_forwarda. Predetermined overhead rate b. Manufacturing overhead applied c. Manufacturing cost d. Selling price e. f. Customizing predetermined overhead rate g. Manufacturing overhead applied job L Forming predetermined overhead rate per MH per MH per MHarrow_forward

- Dehner Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on the following data: Total direct labor-hours Total fixed manufacturing overhead cost Variable manufacturing overhead per direct labor-hour Recently, Job P951 was completed with the following characteristics: Number of units in the job Total direct labor-hours Direct materials Direct labor cost Multiple Choice The total job cost for Job P951 is closest to: (Round your intermediate calculations to 2 decimal places.) $10,780 20 100 $ 880 $ 9,900 $11,530 99,000 $ 544,500 $ 2.00arrow_forwardGold Nest Company of Guandong, China, makes birdcages for the South China market. The company sells its birdcages through an extensive network of street vendors who receive commissions on their sales. The company uses a job-order costing system that applies overhead to jobs based on direct labor cost. Its predetermined overhead rate is based on a cost formula that estimated $94,500 of manufacturing overhead for an estimated activity level of $45,000 direct labor dollars. The beginning inventory balances were as follows: Raw materials $ 10,800 Work in process $ 4,900 Finished goods $ 8,800 During the year, the following transactions were completed: Raw materials purchased on account, $162,000. Raw materials used in production, $144,000 (materials costing $123,000 were charged directly to jobs; the remaining materials were indirect). Cash paid to employees: Direct labor $ 155,000 Indirect labor $ 248,800 Sales commissions $ 23,000 Administrative salaries $ 42,000…arrow_forwardMoody Corporation uses a job-order costing system with a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, the company made the following estimates: Machine-hours required to support estimated production Fixed manufacturing overhead cost Variable manufacturing overhead cost per machine-hour Required: 1. Compute the plantwide predetermined overhead rate. 2. During the year, Job 400 was started and completed. The following information was available with respect to this job: Direct materials Direct labor cost Machine-hours used $ 400 $ 210 32 Compute the total manufacturing cost assigned to Job 400. 3. If Job 400 includes 60 units, what is the unit product cost for this job? 4. If Moody uses a markup percentage of 120% of its total manufacturing cost, then what selling price per unit would it have established for Job 400? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 152,000 $…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education