FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

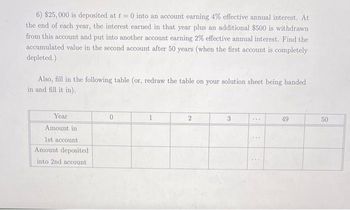

Transcribed Image Text:6) $25,000 is deposited at t= 0 into an account earning 4% effective annual interest. At

the end of each year, the interest earned in that year plus an additional $500 is withdrawn

from this account and put into another account earning 2% effective annual interest. Find the

accumulated value in the second account after 50 years (when the first account is completely

depleted.)

Also, fill in the following table (or, redraw the table on your solution sheet being handed

in and fill it in).

Year

Amount in

1st account

Amount deposited

into 2nd account

0

2

3

...

B

49

50

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the present value of $3,000 to be received 2 years from now, if the discount rate is: (a) 6%, (b) 10%, and (c) 13% ? 1. Use the appropriate table (Appendix C: Table 1) to answer the above questions. 2. Use the formula shown at the bottom of Appendix C. Table 1, to answer the above questions. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Use the formula shown at the bottom of Appendix C, Table 1, to answer the above questions, (Round "PV Factor" to 5 decimal places and "PV values" to 2 decimal places.) Future after-tax cash Bow Cash flow received at the end of year (a) (b) [(0) Answer is complete but not entirely correct. Rate 6% 10% 13% PV Factor 0.89000 $ 0.82645 $ 0.78315 S PV < Required 1 7,553 18,406 2,669.99 2,479.34 2,349 44 **arrow_forwardSaving Later Plan 2: Invest $350 at the end of each month into an account paying 7.5% compounded monthly for 15 years then leave the money in the account earning interest until retirement (making no additional withdrawals or investments until retirement). Using the assumptions above, write down your answer to each of the following questions. 19. Create the following table of values for this investment plan. Saving Later Plan 2, tuho table should be handwritten) to find the amount available after 15 years. Write N/A next to any variable that does not apply and write Solve next to the appropriate varlable. P%3D r = A = M = n = 20. Indicate the best formula to use to compute the amount available after 15 years. 21. Substitute the values into the formula and compute how much money will be available after 15 years.arrow_forwardSolve the following problems without using any software, do everything in digital format, explain the formulas, substitutions and result 3. A person has available the amount of $ 1,250,000 he wants to use to ensure a fixed monthly income for the next three years. For this purpose, deposit that amount in a revolving bank account every 30 days and a monthly interest rate of 0.8% (9.6% per year). Assuming the interest rate was held constant, what amount should you withdraw each month so that by the end of the three years the amount initially deposited would have been completely used up?arrow_forward

- Saving Later Plan 2: Invest $350 at the end of each month into an account paying 7.5% compounded monthly for 15 years then leave the money in the account earning interest until retirement (making no additional withdrawals or investments until retirement). Using the assumptions above, write down your answer to each of the following questions: 19. Create the following table of values for this investment plan, Saving Later Plan 2, (the table should be handwritten) to find the amount available after 15 years. Write N/A next to any variable that does not apply and write Solve next to the appropriate variable. P = A = t 3D M =arrow_forwardFind the future values of these ordinary annuities. Compounding occurs once a year. a.$ 500 per year for 8 years at 14% b. $250 per year for 4 years at 7% c $700 per year for 4 years at 0% d. Rework parts a, b, and c assuming they are annuities due. Please show all your work.arrow_forwardFind the present value, using the present value formula and a calculator. (Round your answer to the nearest cent.) Achieve $6,000 in three years at 2.5% simple interest.arrow_forward

- Complete each requirement on a separate worksheet. Each requirement must have a user input section. Makeup and enter your own numbers for the user inputs for each requirement. Requirements: 1. Create a user input section for the user to input the annual effective interest rate and number of periods per year. Calculate the annual nominal interest rate. 2. The user can invest money at the end of each year. Create a user input section for the user to input the amount that they will invest at the end of each year. Using an annual interest rate of 9%, how much will the user have at the end of 7 years? 3. The user wants to save money to buy a new car 10 years from today. The new car will cost $125,000. Create a user input section for the user to input the amount that they can invest at the beginning of each year. What annual interest rate will they need to earn to have enough cash to buy the car 10 years from today? 4. The user wants to save $60,000.00 for a once in a lifetime…arrow_forwardFind the future value, using the future value formula and a calculator. (Round your answer to the nearest cent.) $350 at 42% simple interest for 2 years $4 Need Help? Read Itarrow_forwardyou have just won the lottery and will receive $460,000 in one year. you will receive payments for 21 years, and the payments will increase 4 percent per year. if the appropriate discount rate is 11 percent, what is the present value of your winnings? Please explain how to solve using the financial calculator to show and explain steps thanksarrow_forward

- Find the future value, using the future value formula and a calculator. (Round your answer to the nearest cent.) $47.67 at 4.5% compounded daily for 5 yearsarrow_forward4. If you receive $116 each month for 28 years and the discount rate is 0.08, what is the present value? (show the process and can use financial calculator)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education