Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

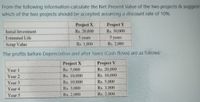

Transcribed Image Text:From the following information calculate the Net Present Value of the two projects & suggest

which of the two projects should be accepted assuming a discount rate of 10 %.

Project Y

Rs. 30,000

Project X

Initial Investment

Estimated Life

Rs. 20,000

5 years

5 years

Scrap Value

Rs. 1,000

Rs. 2,000

The profits before Depreciation and after Taxes (Cash flows) are as follows:

Project X

Rs. 5,000

Project Y

Year I

Rs. 20,000

Year 2

Rs. 10,000

Rs. 10,000

Rs. 5,000

Rs. 3,000

Rs. 2,000

Year 3

Rs. 10,000

Year 4

Rs. 3.000

Year 5

Rs, 2,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- To Duo Corporation is evaluating a project with the following cash flows: Cash Flow -$ 15,100 6,200 7,400 7,000 Year 8 1 2 3 4 5 5,000 -3,200 The company uses an interest rate of 11 percent on all of its projects. Calculate the MIRR of the project using all three methods. Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. Discounting approach Raimustment appr Combination approach %arrow_forwardThe following information regarding an investment project is available. Discount rate 7% Year Cash Flow 0 (£125,000) 1 £60,000 2 £50,000 3 £10,000 4 £10,000 5 £50,000 A). What is the Net Present Value of the Project? Choose one from the following: A. £56,076 B. £43,670 C. £125,000 D. £26,188arrow_forwardYou are given the following information about the cash flows for Projects A and B: Project B $12,643.00 $6,264.00 $5.119.00 $4,284.00 $3,265.00 $2,884.00 Year 0 1 2 3 4 5 Given this information, and assuming a risk-adjusted discount rate of 14.0 percent for both projects, determine the internal rate of return (IRR) for the project with the highest net present value (NPV). 26.0818% 25.6301% 25.1784% Project A -$10,356.00 $2,185.00 $4,294.00 $4,642.00 $6,360.00 $3,125.00 O24.2750%arrow_forward

- Newland Company is considering investing in one of two projects – A or B. The initial cost and net cash inflows from each project are shown below. The discount rate for both projects is 18% per cent. Cash Flow Project A Project B $ $ Initial Cost 3,000,000 3,500,000 Net Cash Inflows Year 1 800,000 1,000,000 Year 2 800,000 1,000,000 Year 3 1,200,000 700,000 Year 4 1,200,000 800,000 Year 5 1,200,000 800,000 Year Factor 1 0.8475 2 0.7182 3 0.6086 4 0.5158 5 0.4371 Discount factors for the projects @18% per annum are as follows: Required: Calculate the payback period for each project and identify the project in which the company should invest, giving ONE reason for your choice. Calculate the Accounting Rate of Return on initial capital for each projectarrow_forwardWhat is the NPV of the following project if the discount rate is 11%? Round to the nearest cent.Investment today: $-121,000; Cash flow in year 1: $66,000; Cash flow in year 2: $72,000; Cash flow in year 3: $66,000arrow_forwardConsider the following two mutually exclusive projects: Year Cash Flow(A) -$ 63,000 39,000 33,000 22,500 14,600 Cash Flow(B) -$ 63,000 25,700 29,700 35,000 24,700 4 1-What is the IRR for each project? Project A Project B % % 2.IF you apply the IRR decision rule, which project should ti 3.Assume the required return is 14 percent. What is the NP Project A Project B 0123arrow_forward

- Calculate the payback period, the discounted payback period and the NPV for the following project using a rate of 5%. Time Cash Flow 0 - $53,000 1 $ 21,000 2 $ 21,000 3 $ 21,000 NPV = Payback = Discounted Payback =arrow_forwardCalculate the payback period, the discounted payback period and the NPV for the following project using a rate of 5%. Time Cash Flow 0 - $63,000 $ 21,000 $ 21,000 $ 21,000 $ 21,000 Payback = Discounted Payback =arrow_forwardConsider the cash flows for the following investment projects: (a) For Project A. find the value of X that makes the equivalent annual receiptsequal the equivalent annual disbursement at i = 13%.(b) Would you accept Project Bat i = 15% based on the AE criterion?arrow_forward

- Duo Corporation is evaluating a project with the following cash flows: Year Cash Flow0 −$ 29,8001 12,0002 14,7003 16,6004 13,7005 −10,200 The company uses an interest rate of 9 percent on all of its projects. Calculate the MIRR of the project using the discounting approach.arrow_forwardMendez Company has identified an investment project with the following cash flows. Year Cash Flow 1 $ 810 2 1,110 3 1,370 4 1,500 a. If the discount rate is 11 percent, what is the present value of these cash flows? b. If the discount rate is 17 percent, what is the present value of these cash flows? c. If the discount rate is 25 percent, what is the present value of these cash flows?arrow_forward3) Consider the following two projects: Net Cash Flow Each Period Initial Outlay 1 2 3 4 Project A $4,000,000 $2,003,000 $2,003,000 $2,003,000 $2,003,000 Project B $4,000,000 0 0 0 $11,000,000 Calculate the net present value of each of the above projects, assuming a 14 percent discount rate. What is the internal rate of return for each of the above projects? Compare and explain the conflicting rankings of the NPVs and IRRs obtained in parts a and b above. If 14 percent is the required rate of return, and these projects are independent, what decision should be made? If 14 percent is the required rate of return, and the projects are mutually exclusive, what decision should be made?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education