FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

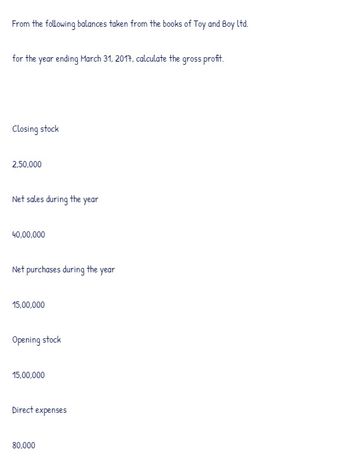

Transcribed Image Text:From the following balances taken from the books of Toy and Boy Ltd.

for the year ending March 31, 2017, calculate the gross profit.

Closing stock

2,50,000

Net sales during the year

40,00,000

Net purchases during the year

15,00,000

Opening stock

15,00,000

Direct expenses

80,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Suppose selected comparative statement data for the giant bookseller Barnes & Noble are as follows. All balance sheet data are as of the end of the fiscal year (in millions). Net sales Cost of goods sold Net income Accounts receivable Inventory Total assets Total common stockholders' equity 2022 $4,750.0 3.300.3 85.3 75.1 1,150.0 2,850.0 900.2 2021 $5,500.6 3,700.6 110.1 102.2 1.250.0 3,250.1 1.120.7arrow_forwardA company reported the following data for the year ending 2018: Description Amount Sales $400,000 Sales discount $16,000 Sales returns and allowances $13,000 Cost of goods sold $117,000 Operating expense $153,000 Income tax expense $23,750 There are 25,000 shares outstanding throughout the year. What is the earnings per share? $2.08 per share $4.04 per share $3.09 per share $3.01 per sharearrow_forwardAlpesharrow_forward

- The following information was available for the year ended December 31, 2016: Sales $ 460,000 Net income 66,140 Average total assets 760,000 Average total stockholders' equity 365,000 Dividends per share 1.33 Earnings per share 3.00 Market price per share at year-end 27.60 a. Calculate margin, turnover, and ROI for the year ended December 31, 2016. (Round your intermediate calculations and final answers to 2 decimal places.) b. Calculate ROE for the year ended December 31, 2016. (Round your answer to 2 decimal places.) c. Calculate the price/earnings ratio for 2016. (Round your answer to 2 decimal places.) d. Calculate the dividend payout ratio for 2016. (Round your answer to 2 decimal places.) e. Calculate the dividend yield for 2016. (Round your answer to 2 decimal places.)arrow_forwardSelected hypothetical comparative statement data for the giant bookseller Barnes & Noble are presented here. All balance sheet data are as of the end of the fiscal year (in millions). Net sales Cost of goods sold Net income Accounts receivable (net) Inventory Total assets Total common stockholders' equity a. b. C. d. e. Profit margin Asset turnover Return on assets 2025 $5,050.3 Gross profit rate 3,700.7 65.1 65.0 1.250.1 Compute the following ratios for 2025. (Round asset turnover to 2 decimal places, e.g 1.83 and all other answers to 1 decimal place, e.g. 1.8 or 2.5%) 2,950.1 940.6 Return on common stockholders' equity 2024 $5,800.9 3,200.1 190.9 106.6 1,350.1 3,250.1 1,100.5 % times % % %arrow_forwardExcerpts from Hulkster Company's December 31, 2024 and 2023, financial statements are presented below: 2024 2023 Accounts receivable $ 62,000 $ 47,000 Merchandise inventory 39,000 57,000 Net sales 261,600 251,000 Cost of goods sold 136,000 119,000 Total assets 447,000 416,000 Total shareholders' equity 262,000 236,000 Net income 49,000 39,000 Hulkster's 2024 average collection period is:arrow_forward

- The following is an income statement from the financial records of Peace, Love and Joy Company for the year ended December 31, 2015: Income Statement Sales (net) $ 245,675 Cost of Goods Sold (67,500) Gross Profit $ 178,175 Operating expenses (125,000) Operating Income $ 53,175 Interest revenue 5,600 Interest expense (8,750) Income before taxes $ 50,025 Income tax expense (15,008) Net Income $ 35,017 Refer to Exhibit 5-2. Compute earnings-based interest coverage for Peace, Love, and Joy Company. 6.72 times 5.72 times 16.88 times 6.08 timesarrow_forwardYou are provided with the following information taken from Splish Brothers Inc.’s March 31, 2022, balance sheet. Cash $ 12,330 Accounts receivable 20,370 Inventory 36,900 Property, plant, and equipment, net of depreciation 120,500 Accounts payable 22,640 Common stock 153,800 Retained earnings 12,460 Additional information concerning Splish Brothers Inc. is as follows. 1. Gross profit is 26% of sales. 2. Actual and budgeted sales data: March (actual) $47,000 April (budgeted) 73,100 3. Sales are both cash and credit. Cash collections expected in April are: March $18,800 (40% of $47,000) April 43,860 (60% of $73,100) $62,660 4. Half of a month’s purchases are paid for in the month of purchase and half in the following month. Cash disbursements expected in April are: Purchases March $22,640…arrow_forwardPizza, Inc. balance sheet statement for December 31. 2015 with the following information tound to the nearest thousand i Data Table Barron Pizza, Inc. Balance Sheet as of Decemb Retained earnings: $43,512 Accounts payable: $74,547 Accounts receivable: $34,808 Common stock: $119,856 Cash: $8,258 Short-term debt $188 ($ in thousands) LIABILIT Current Inventory: $23,487 Goodwill: $48,302 Long-term debt S80,147 Other noncurrent liabilities: $42,597 Net plant, property, and equipment. $192,340 Other noncurrent assets.$16,738 Long-term investments: $22,330 Other current assets: $14,584 Total cur Total liat OWNER! Print Done a意前 %24 %24 %24 %24 %24arrow_forward

- The Cullumber Supply Company reported the following information for 2017. Prepare a common-size income statement for the year ended June 30, 2017. (Round answers to 1 decimal place, e.g. 52.7%.) Cullumber Supply CompanyIncome Statement for the Fiscal Year Ended June 30, 2017($ thousands) % of Net Sales Net sales $2,111,000 enter percentages of net sales % Cost of goods sold 1,464,000 enter percentages of net sales % Selling and administrative expenses 312,200 enter percentages of net sales % Nonrecurring expenses 27,600 enter percentages of net sales % Earnings before interest, taxes, depreciation, and amortization (EBITDA) $307,200 enter percentages of net sales % Depreciation 117,000 enter percentages of net sales % Earnings before interest and taxes (EBIT) 190,200 enter percentages of net sales % Interest expense 118,600 enter percentages of net sales % Earnings before taxes (EBT)…arrow_forwardBC Training reports sales revenue of $2,800,000. Average inventory during the year was $130,000. The inventory turnover ratio for the year is 8.0.What amount of gross profit would the company report in its income statement? Gross profitarrow_forwardThe 2024 income statement of Adrian Express reports sales of $17,931,000, cost of goods sold of $11,154,000, and net income of $1,660,000. Balance sheet information is provided in the following table. ADRIAN EXPRESS Balance Sheets Assets Current assets: Cash Accounts receivable December 31, 2024 and 2023 2024 $660,000 1,520,000 Inventory Long-term assets Total assets Liabilities and Stockholders' Equity Current liabilities Long-term debt Common stock Retained earnings 2023 1,920,000 4,860,000 $ 8,960,000 $ 1,960,000 2,360,000 1,940,000 2,700,000 $ 820,000 1,060,000 1,460,000 4,300,000 $ 7,640,000 $ 1,720,000 2,460,000 1,940,000 1,520,000 Total liabilities and stockholders' equity $ 8,960,000 $ 7,640,000 Industry averages for the following four ratios are as follows: Average collection period Average days in inventory Current ratio Debt to equity ratio Required: 26 days 63 days 2 to 1 35% 1. Calculate the four ratios listed above for Adrian Express in 2024 assuming all sales are on…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education