FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

1. From page 5-6 of the VLN, when does a company write off an account?

Group of answer choices

A. At the end of the year as an adjusting entry.

B. At the beginning of the year as an opening entry.

C. As soon as the account goes bad.

D. At the end of the year as a closing entry.

2. From page 5-7 of the VLN, CCT writes off customer W’s account receivable. Which is true?

Group of answer choices

A. Cash decreased $1,000.

B. Bad debt expense increased $1,000.

C. Accounts receivable decreased by $1,000.

D. Net Accounts receivable decreased by $1,000.

Transcribed Image Text:Notice that before and after the write-of1, the company still

expects to collect the $25,500 of credit sales made last

Revenues Expenses Net income

year.

Asset

Liabilities

Stockholders' Equity

JA/R -400

1/2 AUA -400à

NE

Common Stock Retained Earnings

NE

NE

NE

A+400

NE

NE

Before Write off After

S30.000

Accounts Receivable

Allowance for uncollectible accounts $4,500

Net accounts receivable

-400

29,600

-400

4,100

$25,500

S25,500

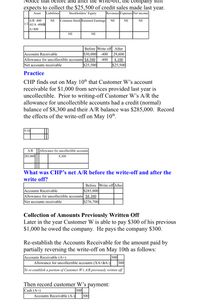

Practice

CHP finds out on May 10th that Customer W's account

receivable for $1,000 from services provided last year is

uncollectible. Prior to writing-off Customer W's A/R the

allowance for uncollectible accounts had a credit (normal)

balance of $8,300 and their A/R balance was $285,000. Record

the effects of the write-off on May 10th.

5/10

A/R

Allowance for uncollectible accounts

285.000|

8,300

What was CHP’s net A/R before the write-off and after the

write off?

Before Write off After

Accounts Receivable

Allowance for uncollectible accounts $8,300

$285,000

Net accounts receivable

$276,700

Collection of Amounts Previously Written Off

Later in the year Customer W is able to pay $300 of his previous

$1,000 he owed the company. He pays the company $300.

Re-establish the Accounts Receivable for the amount paid by

partially reversing the write-off on May 10th as follows:

300

Accounts Receivable (A+)

Allowance for uncollectible accounts (XA+àA-)

300

To re-establish a portion of Customer W's A/R previously written off

Then record customer W's payment:

300

Cash (A+)

Accounts Receivable (A-)

300

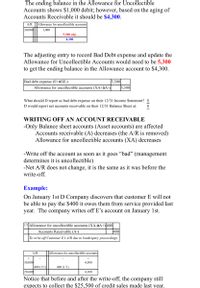

Transcribed Image Text:The ending balance in the Allowance for Uncollectible

Accounts shows $1,000 debit; however, based on the aging of

Accounts Receivable it should be $4,300.

A/R

Allowance for uncollectible accounts

30,000

1,000

5,300 adj.

4,300

The adjusting entry to record Bad Debt expense and update the

Allowance for Uncollectible Accounts would need to be 5,300

to get the ending balance in the Allowance account to $4,300.

5,300

5,300

Bad debt expense (E+àSE-)

Allowance for uncollectible accounts (XA+àA-)

What should D report as bad debt expense on their 12/31 Income Statement? $

D would report net accounts receivable on their 12/31 Balance Sheet at:

WRITING OFF AN ACCOUNT RECEIVABLE

-Only Balance sheet accounts (Asset accounts) are affected

Accounts receivable (A) decreases (the A/R is removed)

Allowance for uncollectible accounts (XA) decreases

-Write off the account as soon as it goes "bad" (management

determines it is uncollectible)

-Net A/R does not change, it is the same as it was before the

write-off.

Example:

On January 1st D Company discovers that customer E will not

be able to pay the $400 it owes them from service provided last

year. The company writes off E’s account on January 1st.

|1/1 Allowance for uncollectible accounts (XA-àA+)400|

400

Accounts Receivable (A-)

To write off Customer E's A/R due to bankruptcy proceedings

A/R

Allowance for uncollectible accounts

30,000

400 (1/1)

29,600

4,500

400 (1/1)

4,100

Notice that before and after the write-off, the company still

expects to collect the $25,500 of credit sales made last year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following are the job cost related accounts for the law firm of Cullumber Associates and their manufacturing equivalents: Law Firm Accounts Supplies Salaries and Wages Payable Operating Overhead Service Contracts in Process Cost of Completed Service Contracts Cost data for the month of March follow. 1. 2. 3. 4. 5. 6. Manufacturing Firm Accounts Raw Materials Factory Wages Payable Manufacturing Overhead Work in Process Cost of Goods Sold Purchased supplies on account $2,400. Issued supplies $1,680 (60% direct and 40% indirect). Assigned labor costs based on time cards for the month which indicated labor costs of $89,600 (80% direct and 20% indirect). Operating overhead costs incurred for cash totaled $51,200. Operating overhead is applied at a rate of 90% of direct labor cost. Work completed totaled $96,000.arrow_forwardYour company just hired a new employee who is unsure about proper accounting procedures. There was a "sales transaction" on Sept. 4 with the terms 3/15, n/60, followed by a "refund" on Sept. 17, and the customer paid on Sept. 21. Which accounts would be creditied on sept 21?arrow_forwardPrepare a journal entry on December 23 for the withdrawal of $22,500 by Graeme Schneider for personal use. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered.arrow_forward

- Prepare the journal entry under basis 2, assuming that Chester Company did not remit payment until July 29. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.)arrow_forwardThe company uses the allowance method to write off bad debts. What entry will they make to write off the accounts? 20. A company performs $5,780 of services for a customer on account. Write the entry to record this transaction.arrow_forward.arrow_forward

- In the account below, calculate the balance for September 16, 20-. Then perform the forwarding procedures required to start a new account page. 3. Account: A/R – Manitoba Equipment Co. No. 211 Date(2021) PARTICULARS P.R. DEBIT CREDIT Dr/Cr BALANCE Aug 15 J22 1,600 00 Sep 4 J26 825 00 16 Ј30 176 00 Асcount: No. Date2021) PARTICULARS P.R. DEBIT CREDIT Dr/Cr BALANCEarrow_forwardOn July 1, 2020, Bridgeport Corporation purchased Johnson Company by paying $189,700 cash and issuing a $64,500 note payable to Steve Johnson. At July 1, 2020, the balance sheet of Johnson Company was as follows. Cash $38,100 Accounts payable $160,000 Accounts Receivable 67,500 Stockholders' equity 165,800 Inventory 75,800 $325,800 Land 29,400 Buildings (net) 55,200 Equipment (net) 52,200 Copyrights 7,600 $325,800 The recorded amounts all approximate current fair values except for land (worth $45,400), inventory (worth $94,900), and copyrights (worth $11,300).arrow_forwardplease answer do not image.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education