FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

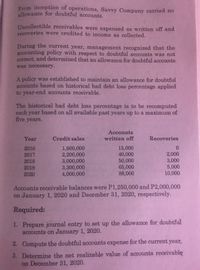

Transcribed Image Text:allowance for doubtful accounts.

From inception of operations, Savvy Company carried no

Uncollectible receivables were expensed as written off and

recoveries were credited to income as collected.

During the current year, management recognized that the

accounting policy with respect to doubtful accounts was not

correct, and determined that an allowance for doubtful accounts

was necessary.

A policy was established to maintain an allowance for doubtful

accounts based on historical bad debt loss percentage applied

to year-end accounts receivable.

The historical bad debt loss percentage is to be recomputed

each year based on all available past years up to a maximum of

five years.

Accounts

Year

Credit sales

written off

Recoveries

15,000

40,000

50,000

65,000

88,000

0.

1,500,000

2,200,000

3,000,000

3,300,000

4,000,000

2016

2,000

3,000

5,000

10,000.

2017

2018

2019

2020

Accounts receivable balances were P1,250,000 and P2,000,000

on January 1, 2020 and December 31, 2020, respectively.

Required:

1. Prepare journal entry to set up the allowance for doubtful

accounts on January 1, 2020.

2. Compute the doubtful accounts expense for the current year,

3. Determine the net realizable value of accounts receivable

on December 31, 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Winstead & Company has accounts receivable of $288,000 and a negative balance of $2,400 in the Allowance for Doubtful Accounts.Two-thirds of the accounts receivable are current and one-third is past due. The firm estimates that two percent of the current accounts and five percent of the past due accounts will prove to be uncollectible.The adjustment to provide for the bad debt expense under the aging method should be for what amount?arrow_forwardAn aging of a company's accounts receivable indicates that the estimate of uncollectible accounts totals $4,139. If Allowance for Doubtful Accounts has a $1,071 debit balance, the adjustment to record the bad debt expense for the period will require a Select the correct answer. debit to Bad Debt Expense for $1,071. debit to Bad Debt Expense for $5,210. credit to Allowance for Doubtful Accounts for $4,139. debit to Bad Debt Expense for $4,139.arrow_forwardAn aging of a company's accounts receivable indicates that $5,539 are estimated to be uncollectible. If Allowance for Doubtful Accounts has a $900 credit balance, the adjustment to record bad debts for the period will require a credit to the Allowance for Doubtful Accounts of:arrow_forward

- An aging of a company's accounts receivable indicates an estimate of uncollectible accounts of $5,353. If Allowance for Doubtful Accounts has a $1,093 debit balance, the adjustment to journalize the bad debt expense for the period will require a a. debit to Bad Debt Expense for $6,446 b. debit to Bad Debt Expense for $5,353 c. credit to Allowance for Doubtful Accounts for $1,093 d. debit to Bad Debt Expense for $4,260arrow_forwardAn aging of a company's accounts receivable indicates that $9700 is estimated to be uncollectible. If Allowance for Doubtful Accounts has a $3010 balance, the adjustment to record bad debts for the period will require a(n)arrow_forwardThe method of accounting for bad debts records the loss from an uncollectible account receivable when it is determined to be uncollectible. No attempt is made to predict bad debts expense. percentage of sales percentage of receivables direct write-off allowancearrow_forward

- Bidiyah Co. estimates that RO 6,500 of its accounts receivable to be uncollectible. If Allowance for Doubtful Accounts has a RO 1,200 debit balance, the company should record a: Select one: O a. None of the answers are correct O b. debit to Bad Debt Expense for RO 5,300. O c credit to Allowance for Doubtful Accounts for RO 6,500. Od. debit to Allowance for Doubtful Accounts for RO 5,300. O e. credit to Bad Debt Expense for RO 7,700.arrow_forwardProblem 7-4 (Bad Debt Reporting) From inception of operations to 31 December 2019, Fortner Corporation provided for uncollectible accounts receivable under the allowance method. The provisions were recorded based on analysis of customers with different risk characteristics. Bad debts written off were charged to the allowance account; recoveries of bad debts previously written off were credited to the allowance account; and no year-end adjustments to the allowance account were made. Fortner's usual credit terms are net 30 days. The balance in Allowance for Doubtful Accounts was $130,000 at 1 January 2019. During 2019, credit sales totalled $9,000,000, the provision for doubtful accounts was determined to be $180,000, $90,000 of bad debts were written off, and recoveries of accounts previously written off amounted to $15,000. Fortner installed a computer system in November 2019, and an aging of accounts receivable was prepared for the first time as of 31 December 2019. A summary of the…arrow_forwardMarshall Companies, Inc., holds a note receivable from a former subsidiary. Due to financial difficulties, the former subsidiary has been unable to pay the previous year’s interest on the note. Marshall agreed to restructure the debt by both delaying and reducing remaining cash payments. The concessions result in a credit loss on the creditor’s investment in the receivable. How is the credit loss on the troubled debt restructuring calculated?arrow_forward

- 13. When the estimate used for bad debt expense is changed, bad debt expense for all past periods must be recalculated. there is no change in the amount of bad debt expense recorded for future years. bad debt expense for current and future years is affected. The company must change its write-off policy as well. 14. Which of the following methods of determining bad debt expense does not generally (assuming materiality) provide a level of matching of expense and revenue that is acceptable following GAAP? Debiting bad debt expense with a percentage of sales under the allowance method. Debiting bad debt expense as accounts are written off as uncollectible. Debiting bad debt expense with an amount derived from aging accounts receivable under the allowance method. Debiting bad debt expense with a percentage of accounts receivable under the allowance method.arrow_forwardNeville accounts for bad debt using the direct method. Receivables from Draco Industries were determined to be uncollectible on 3/1/20. On 7/1/20, partial payment was received. The following entry is required on 7/1/20 a. Debt to Bad Debt Expense b. Credit to Allowance for Doubtful Accounts c. Debit to Accounts Receivable d. Debit to Allowance for Doubtful Accountsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education