Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

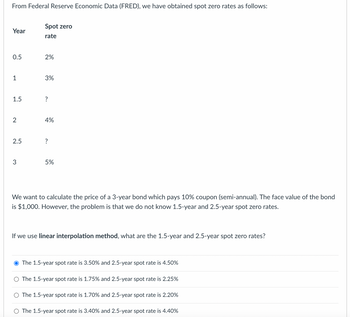

Transcribed Image Text:From Federal Reserve Economic Data (FRED), we have obtained spot zero rates as follows:

Spot zero

Year

rate

0.5

2%

1

3%

1.5

2

4%

2.5

?

3

5%

We want to calculate the price of a 3-year bond which pays 10% coupon (semi-annual). The face value of the bond

is $1,000. However, the problem is that we do not know 1.5-year and 2.5-year spot zero rates.

If we use linear interpolation method, what are the 1.5-year and 2.5-year spot zero rates?

The 1.5-year spot rate is 3.50% and 2.5-year spot rate is 4.50%

The 1.5-year spot rate is 1.75% and 2.5-year spot rate is 2.25%

The 1.5-year spot rate is 1.70% and 2.5-year spot rate is 2.20%

The 1.5-year spot rate is 3.40% and 2.5-year spot rate is 4.40%

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Suppose that the current one-year rate (one-year spot rate) and expected one-year government bonds over years 2, 3 and 4 are as follows: 1R1 = 4.80%, E(2r1) = 5.45%, E(3r1) = 5.95%, E(4r1) = 6.10% Assume that there are no liquidity premiums. To the nearest basis point, what is the current rate for the four-year-maturity government bond? 5.57% 5.62% 5.83% 6.10%arrow_forwardThe yield curve currently observed in the market is as follows: y1 = 7%, Y2 = 8%, and yz = 9%. You are trying to decide between buying a two-year bond (Bond A) and three-year bond (Bond B), each of which is default-risk free and pays annual coupons of 8% per year. You strongly believe that yield curve in one year will become flat at 9%. Which one of the two bonds should you buy today if you plan to sell this bond in exactly one year (right after you receive the first coupon payment)? Assume interest is compounded annually, and each bond has a face value of $1,000. Bond B O Neither bond -- The expected total return of both bonds will be negative if interest rates increase to 9% in one year Bond A Both bonds provide the same return over a one year investment horizon A portfolio that invests 50% of your wealth in each bond provides the highest total expected returnarrow_forwardBoth Bond Bill and Bond Ted have 11.6 percent coupons, make semiannual payments, and are priced at par value. Bond Bill has 6 years to maturity, whereas Bond Ted has 23 years to maturity. Both bonds have a par value of 1,000. a. If interest rates suddenly rise by 3 percent, what is the percentage change in the price of these bonds? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. If rates were to suddenly fall by 3 percent instead, what would be the percentage change in the price of these bonds? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forward

- Both Bond Bill and Bond Ted have 11.8 percent coupons, make semiannual payments, and are priced at par value. Bond Bill has 7 years to maturity, whereas Bond Ted has 24 years to maturity. Both bonds have a par value of 1,000. a. If interest rates suddenly rise by 2 percent, what is the percentage change in the price of these bonds? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. If rates were to suddenly fall by 2 percent instead, what would be the percentage change in the price of these bonds? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardSuppose the current yield on a one-year zero-coupon bond is 4%, while the yield on a five-year zero-coupon bond is 6%. Neither bond has any risk of default. Suppose you plan to invest for one year. You will earn more over the year by investing in the five-year bond as long as its yield does not rise above what level? (Assume $1 face value bond.) Hint: It is best not to round intermediate calculations-make sure to carry at least four decimal places in intermediate calculations. Note: Assume annual compounding. The yield should not rise above %. (Round to two decimal places.)arrow_forwardSuppose the interest rate on a 1-year government bond is 3.00%, on a 4-year government bond is 3.50% and that on a 6-year government bond is 4.90%. What is the market's forecast for 2-year rates 4 years from now, assuming the pure expectations theory is correct? Show your work.arrow_forward

- An insurance company must make payments to a customer of $10 million in one year and $4 million in five years. The yield curve is flat at 10%. a. If it wants to fully fund and immunize its obligation to this customer with a single issue of a zero-coupon bond, what maturity bond must it purchase? (Do not round intermediate calculations. Round your answer to 4 decimal places.) Maturity of zero coupon bond b. What must be the face value and market value of that zero-coupon bond? (Do not round intermediate calculations. Enter your answers in millions rounded to 2 decimal places.) Face value Market value years million millionarrow_forwardRecall that on a one-year Treasury security the yield is 4.4600% and 6.6900% on a two-year Treasury security. Suppose the one-year security does not have a maturity risk premium, but the two-year security does and it is 0.4%. What is the market’s estimate of the one-year Treasury rate one year from now? (Note: Do not round your intermediate calculations.) 9.2933% 8.152% 10.353% 6.9292%arrow_forward3. The following is a list of prices for zero-coupon bonds with different maturities and par value of $1,000. Suppose the interest rate is compounded once per year. Maturity (Years) Price ($) 970 960 910 870 1 2 3 4 Answer the following questions: (a) What is, according to the expectations theory, the one-year interest rate in the second year? (b) What is, according to the expectations theory, the one-year interest rate in the third year? (c) What is, according to the expectations theory, the one-year interest rate in the forth year?arrow_forward

- Please show work without calc or excel. In other words the actual equation.arrow_forwardBond J has a coupon rate of 5 percent. Bond K has a coupon rate of 15 percent. Both bonds have eight years to maturity, a par value of $1,000, and a YTM of 11 percent, and both make semiannual payments. a. If interest rates suddenly rise by 2 percent, what is the percentage change in the price of these bonds? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. b. If interest rates suddenly fall by 2 percent instead, what is the percentage change in the price of these bonds? Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. a. Percentage change in price b. Percentage change in price Bond J % % Bond K % %arrow_forwardI would love some expertise help on this question showing the formulas used. Thank you very much in advancearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education