FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

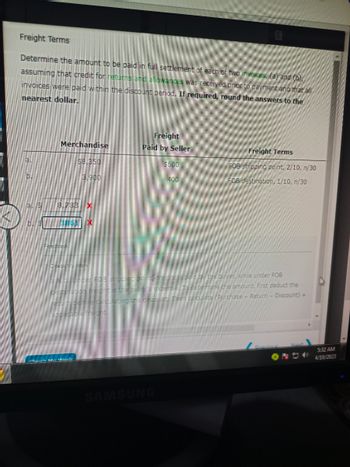

Transcribed Image Text:Freight Terms

Determine the amount to be paid in full settlement of each of two invoices, (a) and (b),

assuming that credit for returns and allowances was received prior to payment and that all

invoices were paid within the discount period. If required, round the answers to the

nearest dollar.

Merchandise

$8,350

3.900

8,738 X

385 X

Freight

Paid by Seller

$600

400

SAMSUNG

Freight Terms

FOB shipping point, 2/10, n/30

FOB destination, 1/10, n/30

bjufcer FOB shipping point, freight is paid by the buyer, while under FOB

pestination freight is the seller's expense. To determine the amount, first deduct the

return before calculating the discount. Then calculate (Purchase - Return - Discount) +

applicable reight.

Pravic

5:32 AM

4/10/2023

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Current Attempt in Progress Prepare the journal entries to record the following purchase transactions in Blossom Company's books. Blossom uses a perpetual inventory system. Mar. 12 13 14 21 Blossom purchased $20,000 of merchandise from Dalibor Company, terms 2/10, n/30, FOB destination. The correct company paid freight costs of $175. Blossom returned $3,100 of the merchandise purchased on March 12 because it was damaged. Blossom paid the balance owing to Dalibor. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem. List all debit entries before credit entries.)arrow_forwardQuestion Content Area Merchandise subject to terms 2/10, n/30, FOB shipping point, is sold on account to a customer for $19,700. What is the amount of sales discount allowable? a. $189 b. $142 c. $201 d. $394arrow_forwardaj.4arrow_forward

- MF2 9 Purchased merchandise from Keene Co. for $9,100 under credit terms of 2/15, n/60, FOB destination. Analysis Component: As the senior purchaser for Belton Company, you are concerned that the purchase discounts you have negotiated are not being taken advantage of by the accounts payable department. Calculate the cost of the lost discount regarding the July 9 purchase. Assume a 6% interest rate. (Do not round intermediate calculations. Round your final answer to 2 decimal places. Assume 365 days a year.)arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardEE 6-5 Statham Co. sold merchandise to Bloomingdale Co. on account, $147,600, terms FOB shipping point, 2/10, n/30. The cost of the merchandise sold is $88,600. Statham Co. paid freight of $2,400. Journalize the entries for Statham Co. and Bloomingdale Co. for the sale, purchase, and payment of amount due. Assume that all discounts are taken.arrow_forward

- Recording Inventory ActivitiesPerpetual SystemQuestion 1: Shipped merchandise that cost us $790 to a customer for $1050. The customer agreed to pay us in 30 days.Dr Account Dr AmountCr Account Cr AmountDr Account Dr AmountCr Account Cr Amountarrow_forwardEnrichment Activity 4-1. Missing Elements Net Sales Gross Sales Less: Sales Returns & Allowances P 54,000 Sales Discounts 19,200 Net Sales Less: Cost of Sales 225,000 Inventory, 1/1/21 Add: Net Purchases P. Purchases P 890,200 Less: Purchases Returns & Allow. P 31,000 Purchase Discounts 12,200 Add: Freight In 12,000 Net Purchases 859,000 P 1,084,000 Goods Available for Sales Less: Inventory, 12/31/21 Cost of Sales Gross Profit Less: Operating Expenses Distribution Expenses Administrative Expenses Total Expense 138.480 (258,780) Net Income 125,220 Required: Insert the missing figures in the income statement above. Note that Net Income is 10% of Gross Sales.arrow_forwarda. Chapters 1-7 G Traducir antaFe iriclars Sotems TB MC Qu. 6-137 Using a perpetual inventory system, how... Using a perpetual Iventory system, how should a company record the sale of Inventory costing $550 for $1,170 on account? 1. InventorY 550 Cost oE GOods Sold 550 Sales Revenue 1,170 Accounts Receivable 1,170 2. Accounts Receivable 1,170 Sales Revenue 1,170 Cost of Goods Sold 550 Inventory 550 550 3. Inventory 620 Gain 1,170 Sales Revenue 1,170 Accounts Receivable 550 Sales Revenues 620 Gain Multiple Choice Nearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education