FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

A. $2,543.33

B. $35

C. $2,613.33

D. $2,578.33

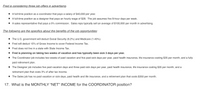

Transcribed Image Text:Fred is considering three job offers in advertising.

A full-time position as a coordinator that pays a salary of $40,000 per year.

A full-time position as a designer that pays an hourly wage of $28. The job assumes five 8-hour days per week.

A sales representative that pays a 5% commission. Sales reps typically sell an average of $100,000 per month in advertising.

The following are the specifics about the benefits of the job opportunities:

• The U.S. government will deduct Social Security (6.2%) and Medicare (1.45%).

Fred will deduct 15% of Gross Income to cover Federal Income Tax.

• Fred does not live in a state with State Income Tax.

• Fred is planning on taking two weeks of vacation and has typically been sick 3 days per year.

• The Coordinator job includes two weeks of paid vacation and five paid sick days per year, paid health insurance, life insurance costing $35 per month, and a fully

paid retirement plan.

• The Designer job includes five paid vacation days and three paid sick days per year, paid health insurance, life insurance costing $35 per month, and a

retirement plan that costs 3% of after tax income.

• The Sales job has no paid vacation or sick days, paid health and life insurance, and a retirement plan that costs $350 per month.

17. What is the MONTHLY “NET" INCOME for the COORDINATOR position?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 20Y8 2ΟΥ7 20Y6 20Y5 Net income 20Y4 $1,120,400 $965,900 $811,700 Interest expense $693,800 $588,000 380,900 347,700 300,300 229,000 Income tax expense 182,300 358,528 270,452 227,276 180,388 141,120 Total assets (ending balance) 6,308,280 6,633,962 4,788,646 4,965,740 3,765,686 Total stockholders' equity (ending balance) 2,021,243 2,424,789 1,550,109 1,918,695 1,151,217 Average total assets 6,471,121 5,711,304 4,877,193 4,138,117 3,517,352 Average stockholders' equity 2,223,016 1,987,449 1,734,402 1,534,956 You have been asked to evaluate the historical performance of the company over the last five years. 1,342,466 Selected industry ratios have remained relatively steady at the following levels for the last five years: 20Y4-20Y8 Return on total assets 22.9% Return on stockholders' equity 47.2% Times interest earned 4.6 Ratio of liabilities to stockholders' equity 2.1 Required: 1. Determine the following for the years 20Y4 through 20Y8. Round to one decimal place: a. Return on total…arrow_forward11 and 12arrow_forwardA28arrow_forward

- Kurtulus Corporation uses the weighted-average method in its process costing system. Data concerning the first processing department for the most recent month are listed below: Beginning work in process inventory: Units in beginning work in process inventory Materials costs Conversion costs Percent complete with respect to materials Percent complete with respect to conversion Units started into production during the month Units transferred to the next department during the month Materials costs added during the month Conversion costs added during the month Ending work in process inventory: Units in ending work in process inventory Percent complete with respect to materials Percent complete with respect to conversion 700 $ 7,100 $ 2,400 55% 25% 6,600 5,800 $ 110,200 $ 83,300 1,500 70% 55% The cost of ending work in process inventory in the first processing department according to the company's cost system is closest to: (Round "Cost per equivalent unit" to 3 decimal places. Round "Cost…arrow_forwardgeb 13 slabintice 5:00 er. Enn 1904 190 e Susbried atsioon ²000-0TR and to en 7. Jaja invested P6,700 for one year, part at 8%, part at 10% and the remainder at 12%. The total annual incomes from these investments was P716. The amount of money invested at 12% was P300 more than the amount invested at 8% and 10% combined. Find the amount invested at each ratearrow_forwardOn November 1, Jasper Company loaned another company $230,000 at a 12.0% interest rate. The note receivable plus interest will not be collected until March 1 of the following year. The company's annual accounting period ends on December 31. The amount of interest revenue that should be reported in the first year is: Multiple Choice $4,600. $6,675. $0. here to search 8:01 PM 100% 2/21/2022arrow_forward

- Che Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five- year period. His annual pay raises are determined by his division's return on investment (ROI), which has exceeded 19% each of the last three years. He has computed the cost and revenue estimates for each product as follows: ProductA Product B Initial investment: Cost of equipment (zero salvage value) Annual revenues and costs: Sales revenues Variable expenses $ 190,000 $ 400,000 $ 270,000 $ 128,000 $ 38,000 $ 72,000 $ 370,000 $ 178,000 $ 80,000 $ 52,000 Depreciation expense Fixed out-of-pocket operating costs The company's discount rate is 17%. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor using tables. Required: 1. Calculate the payback period for each product. 2. Calculate the net present value for each product. 3. Calculate the internal rate of return for each product. 4. Calculate the profitability…arrow_forwardUse the table below to calculate the tax owed. Round to the nearest cent. single man with a taxable income of $32,000 and a $1,000 tax credit. Single Tax Rate 10% 15% 25% 28% up to $9275 $9276 to $37,650 $37,651 to $91,150 A. $4,650.00 OB. $3,336.25 OC. $4,336.25 D. $2,247.50 $91,151 to +1nn 1CA Married Filing Separately up to $9275 $9276 to $37,650 $37,651 to $75.,950 $76,951 to (11C 75C Married Filing Jointly up to $13,550 $18,551 to $75,300 $75,301 to $151,900 $151,901 to 0001 CA Head of Household up to $13,250 $13,251 to $50,400 $50,401 to $130,150 $130,151 to 10 onn Calculate the tax owed by a single man with a taxable income of $32,000 and a $1,000 tax credit.arrow_forwardProb. of state S&P 500 Technology T-Bills -15% State International Fund + 1% GDP .25 8% 5% 30% + 2% GDP .50 12% 15% 15% + 3% GDP .25 16% 45% 5% 0%arrow_forward

- Dete for Utuyox735, a large merchandiser, is below Sales are budgeted at $307,000 for November, $327,000 for December, and $227,000 for January . Collections are expected to be 60% in the month of sale and 40% in the month following the sale The cost of goods sold is 75% of sales . Utuyoz735 desires to have an ending merchandise Inventory at the end of each month equal to 90% of the next month's cost of goods soid. Payment for merchandise is made in the month flowing the purchase Other monthly expenses to be paid in cash are $22,800. Monthly depreciation is $29,500 . Ignore taxes. . (D#38127) Annet Cash Balance Sheet October 31 Accounts receivable. Merchandise inventory Property, plant and equipment, net of $624,000 accumulated depreciation Total assets Liabilities and Stockholders' Equity Accounts payable Common stock Retained earnings Total liabilities and stockholders' equity Q) What are the accounts payable for Utuyoz735 at the end of December? Multiple Choice F 35,000 85,500…arrow_forward9arrow_forward! Required information PayNet Inc. (PayNet) and Shale Ltd. (Shale) had the following balance sheets on July 31, 2022: Cash Accounts receivable Inventory Plant and equipment (net) Goodwill Trademark Total assets Current liabilities Bonds payable Common shares Retained earnings Total liabilities and equity PayNet Inc (carrying value) $280.000 100,000 60,000 200,000 $640,000 $120,000 330,000 90,000 100,000 $640,000 Shale Ltd. (carrying value) $36.000 Shale Ltd. (fair value) $36,000 45,000 20,000 75,000 40,000 24,000 80,000 8,000 12,000 24,000 $200,000 $50,000 20,000 80,000 50,000 $200,000 50,000 30,000 Assuming that PayNet acquires 70% of Shale on August 1, 2022, for cash of $196,000, what is the amount of goodwill on PayNet's consolidated balance sheet at the date of acquisition if the fair value enterprise (FVE) method was used?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education