FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

provide answer plz

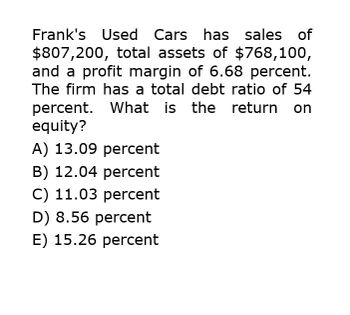

Transcribed Image Text:Frank's Used Cars has sales of

$807,200, total assets of $768,100,

and a profit margin of 6.68 percent.

The firm has a total debt ratio of 54

percent. What is the return on

equity?

A) 13.09 percent

B) 12.04 percent

C) 11.03 percent

D) 8.56 percent

E) 15.26 percent

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The lawrence company has a ratio of long term debt to long term debt plus equity of .25 and a current ratio of 1.5. current liabilities are 900, sales are 6230 , profit margin is 8.1 percent what is the amount of the firms net fixt assets ?arrow_forwardWhat is the return on equity? General accountingarrow_forwardUsing the DuPont method, evaluate the effects of the following relationships for the Butters Corporation. A.Butters Corporation has a profit margin of 5.5 percent and its return on assets (investment) is 8.75 percent. What is its assets turnover? Round your answer to 2 decimal places. ______ times B.If the Butters Corporation has a debt-to-total-assets ratio of 65.00 percent, what would the firm’s return on equity be? Note: Input your answer as a percent rounded to 2 decimal places. C.What would happen to return on equity if the debt-to-total-assets ratio decreased to 60.00 percent? Input your answer as a percent rounded to 2 decimal places.arrow_forward

- What is the return on assets?arrow_forwardPlease provide solutionarrow_forwardUsing the DuPont method, evaluate the effects of the following relationships for the Butters Corporation. a. Butters Corporation has a profit margin of 5.5 percent and its return on assets (investment) is 15.5 percent. What is its assets turnover? Note: Round your answer to 2 decimal places. Assets turnover ratio b. If the Butters Corporation has a debt-to-total-assets ratio of 25.00 percent, what would the firm's return on equity be? Note: Input your answer as a percent rounded to 2 decimal places. Return on equity % Return on equity times c. What would happen to return on equity if the debt-to-total-assets ratio decreased to 20.00 percent? Note: Input your answer as a percent rounded to 2 decimal places. $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education