FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

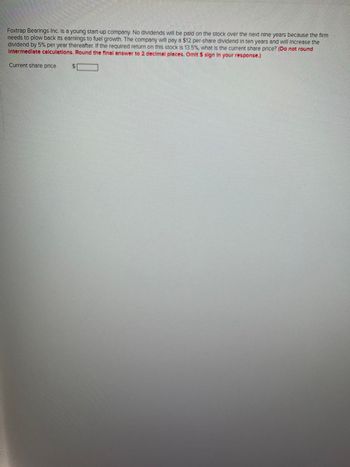

Transcribed Image Text:Foxtrap Bearings Inc. Is a young start-up company. No dividends will be paid on the stock over the next nine years because the firm

needs to plow back Its earnings to fuel growth. The company will pay a $12 per-share dividend In ten years and will increase the

dividend by 5% per year thereafter. If the required return on this stock is 13.5%, what is the current share price? (Do not round

Intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.)

Current share price

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Bretton, Inc., just paid a dividend of $3.15 on its stock. The growth rate in dividends is expected to be a constant 5 percent per year, indefinitely. Investors require a return of 13 percent on the stock for the first three years, a rate of return of 11 percent for the next three years, and then a return of 9 percent thereafter. What is the current share price for the stock? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Current share pricearrow_forwardMetallica Bearings, Incorporated, is a young start-up company. No dividends will be paid on the stock over the next 14 years because the firm needs to plow back its earnings to fuel growth. The company will pay a dividend of $8 per share 15 years from today and will increase the dividend by 5 percent per year thereafter. If the required return on this stock is 11 percent, what is the current share price? Multiple Choice O O O $27.87 $31.86 $30.93 $32.48 $29.39arrow_forwardMetallica Bearings, Inc., is a youngstart-up company. No dividends will be paid on the stock over the next nine yearsbecause the firm needs to plow back its earnings to fuel growth. The company will pay a$17 per share dividend 10 years from today and will increase the dividend by 3.9 percentper year thereafter. If the required return on this stock is 12.5 percent, what is the currentshare price?arrow_forward

- If you require a return of 12 percent on this stock, what will you pay for a share today?arrow_forwardORcell Co. has the following dividend policy. Next year, the company will pay a dividend of $3. In year 2 the company will pay a dividend of $2.75. After year 2, the company expects to decrease its dividend at a constant rate of 3% per year indefinitely. If the return required by share holders is 13%, what is the price of the stock today? answer must be 17.86arrow_forwardSidman Products's common stock currently sells for $67 a share. The firm is expected to earn $7.37 per share this year and to pay a year-end dividend of $2.60, and it finances only with common equity. a. If investors require an 11% return, what is the expected growth rate? Do not round intermediate calculations. Round your answer to two decimal places. % b. If Sidman reinvests retained earnings in projects whose average return is equal to the stock's expected rate of return, what will be next year's EPS? (Hint: g - (1 - Payout ratio)ROE). Do not round intermediate calculations. Round your answer to the near ent. per sharearrow_forward

- Metallica Bearings, Incorporated, is a young startup company. No dividends will be paid on the stock over the next 8 years because the firm needs to plow back its earnings to fuel growth. The company will then pay a dividend of $14.00 per share 9 years from today and will increase the dividend by 5.75 percent per year, thereafter. If the required return on this stock is 13.75 percent, what is the current share price? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Current share pricearrow_forwardAitube Company has an interesting dividend policy. The company has just paid a dividend of 10 dollars per share. Now, it announces that the dividends will increase by 2 dollars per share annually for the next 6 years, and then permanently stop paying dividends. What is the price of such a stock today if the required return is 4%?arrow_forwardMetallica Bearings, Inc., is a young start-up company. No dividends will be paid on the stock over the next 10 years because the firm needs to plow back its earnings to fuel growth. The company will then pay a dividend of $13.50 per share 11 years from today and will increase the dividend by 5.25 percent per year thereafter. If the required return on this stock is 13.25 percent, what is the current share price? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Current share pricearrow_forward

- The Jackson-Timberlake Wardrobe Co. just paid a dividend of $1.20 per share on its stock. The dividends are expected to grow at a constant rate of 4 percent per year indefinitely. Investors require a return of 10 percent on the company's stock. a. What is the current stock price? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What will the stock price be in 3 years? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. What will the stock price be in 10 years? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forwardAntiques R Us is a mature manufacturing firm. The company just paid a dividend of $11.00, but management expects to reduce the payout by 4.75 percent per year, indefinitely. If you require a return of 10 percent on this stock, what will you pay for a share today? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Share pricearrow_forwardImpossible Corporation just paid a dividend of $2.10 per share. The dividends are expected to grow at 21 percent for the next eight years and then level off to a growth rate of 7 percent indefinitely. If the required return is 14 percent, what is the price of the stock today? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Give typing answer with explanation and conclusionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education