FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

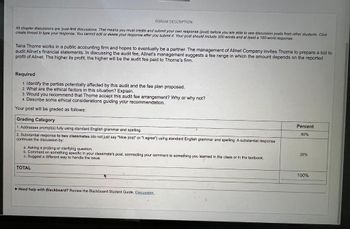

Transcribed Image Text:FORUM DESCRIPTION

All chapter discussions are 'post-first discussions. That means you must create and submit your own response (post) before you are able to see discussion posts from other students. Click

create thread to type your response. You cannot edit or delete your response after you submit it. Your post should include 300 words and at least a 100-word response.

Tana Thorne works in a public accounting firm and hopes to eventually be a partner. The management of Allnet Company invites Thorne to prepare a bid to

audit Allnet's financial statements. In discussing the audit fee, Allnet's management suggests a fee range in which the amount depends on the reported

profit of Allnet. The higher its profit, the higher will be the audit fee paid to Thorne's firm.

Required

1. Identify the parties potentially affected by this audit and the fee plan proposed.

2. What are the ethical factors in this situation? Explain.

3. Would you recommend that Thorne accept this audit fee arrangement? Why or why not?

4. Describe some ethical considerations guiding your recommendation.

Your post will be graded as follows:

Grading Category

1. Addresses prompt(s) fully using standard English grammar and spelling.

2. Substantial response to two classmates (do not just say "Nice post" or "I agree") using standard English grammar and spelling. A substantial response

continues the discussion by:

a. Asking a probing or clarifying question.

b. Comment on something specific in your classmate's post, connecting your comment to something you leared in the class or in the textbook.

c. Suggest a different way to handle the issue.

TOTAL

Need help with Blackboard? Review the Blackboard Student Guide, Discussion.

Percent

80%

20%

100%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- You were asked to make a presentation to a group of CSEC students on some areas related to non-profit making organisations. The specific areas are: i difference between accounts for non-profit and for-profit organisations 11. examples of non-profit organisations in your country 111. an explanation of the use of a subscription account iv. preparing a subscription account from given data For your presentation, research (i), (ii), (iii) and use the data below to complete (iv). A drama club charges its members an annual subscription of $40 per member. It accrues for subscriptions owing at the end of each year and also adjusts for subscriptions received in advance. i. ii. 111. On January 1, 2022, 36 members owed $720 for the 2021 year In December 2021, 8 members paid $160 for the year 2022 During the year 2022 the club received cash for subscriptions $$14,840 $720 $13840 $280 iv. At the end of December 31, 2022, 11 members had not paid their 2022 subscriptions. For 2021 For 2022 For 2023arrow_forwardI need the answer as soon as possiblearrow_forwardLamont black- navigating the digital finance future: crypto & blockchain is what this assignment is about the goal is to tell the class what I learned about the podcast. I want you to listen to this podcast or read the podcast and write how you would teach the class about what you have learned.arrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardnee You must negotiate virtually with a vendor in another country. The client relationship is sensitive and important to your company. Which of the following represents the best way to proceed? a) Use email to ensure complete understanding and to create a record of your conversation. b) Use a speakerphone to hear as much background conversation as possible. c) Conduct a video conversation with as many people as possible. d) Conduct a video conversation with a screen as large as possible.'arrow_forwardMatch each business description with the BEST model for fundraising. V A USC focused Matcha Cafe A. Bootstrap V A startup that wants to create NFTS for each cup of B. Venture Capital matcha it sells in the metaverse. C. Bank Loan V A Southern California Matcha Shop that has been in business for 10 years and wants to add another D. Friends and Family. location. a student company looking at creating a new and scalable matcha recipe to boost memory and performance.arrow_forward

- Students are required to work as an individual or Maximum group of three members. • Topic is Business Plan for a "Halal Business" Plan Business with 1-Million AED Capital and above (No upper limit). Your idea must be a unique as a new concept (Like Face book, google, etc) or modified existing business concept (e.g. Family airline for kids and moms) • Study market and justify the start of business-based on customer demands • Select location and collect correct information for required assets and purchase of assets (in AED) • Plan distribution channels-How to maintain supply line to customers • Estimate close to reality Human resource needs • Determine IT system requirement-closeto reality along with estimated cost (in AED) • Identify marketing channels-Include all electronic, print, event sponsor etc. Prepare a quarterly financial plan for at least five yearsarrow_forwardchoose the correct answer thenarrow_forwardie Calendar My MCDS Library English ien)- Hal Management ession i 2021/FIN 20A/ET/ Section 9/ Mid Term Exam Explain an agency problem for a corporation with examples, and Identify means by which the firm can help reduce or eliminate that problem. A- BI - Il mcbs.proctoring.online is sharing your sareen. Stop sharing Hide mid-98604&page-8# DELLarrow_forward

- Make a business plan with charts and everything. attached the picture what is requiredarrow_forwardDinesh bhaiarrow_forwardngageNOWv2 | Online teachin + takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false Cancel Your. F Startup Opportuniti. V How brands are co... Assignment Practic. A COVID-19 Student. C20-128PRO1-2016. O Final Exam Review -. Professional Certific. Syntech makes digital cameras for drones. Their basic digital camera uses $80 in variable costs and requires $1,600 per month in fixed costs. Syntech sells 100 cameras per month. If they process the camera further to enhance its functionality, it will require an additional $45 per unit of variable costs, plus an increase in fixed costs of $800 per month. The current price of the camera is $160. The marketing manager is positive that they can sell more and charge a higher price for the improved version. At what price level would the upgraded camera begin to improve operational earnings? Price to be charged $ Previous Nextarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education