Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

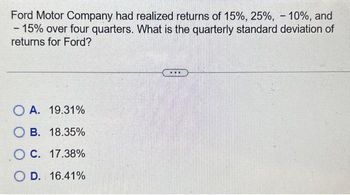

Transcribed Image Text:Ford Motor Company had realized returns of 15%, 25%, -10%, and

- 15% over four quarters. What is the quarterly standard deviation of

returns for Ford?

OA. 19.31%

OB. 18.35%

O C. 17.38%

O D. 16.41%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- IBM has expected earnings per share (EPS) of $0.39 and the industry's P/E ratio is 30.arrow_forwardLinear Technology had sales (all on credit) of $36 million and a gross profit margin of 30% last year. If Linear Technology's inventory averaged $3.9 million, and its accounts receivable were $5.0 million, what was the length of its operating cycle?arrow_forwardUnit sales are expected to reach 30,000 per year, the price per unit is expected to be $90, variable costs are $40 per unit and fixed costs are $80,000 per year. The company pays $250,000 in interest per year. What is the degree of financial leverage at the expected levels? Using the degree of financial leverage, what is the expected percentage change in earnings per share (EPS) if EBIT turns out to be 12% lower than expected?arrow_forward

- Fairchild Garden Supply expects $580 million of sales this year, and it forecasts a 15% increase for next year. The CFO uses this equation to forecast inventory requirements at different levels of sales: Inventories = $30.2 + 0.25(Sales). All dollars are in millions. The firm's cost of goods sold is expected to be 70% of sales. What is the projected inventory turnover ratio for the coming year? Please explain process and show calculations.arrow_forwardI need to find which year had the better performance . if : this years information : returns 8% with net sales of 756,000 last years information: returns 11.5% with gross sales of 875,000arrow_forwardThis year, ABC expects sales of $137,328,000 and a gross profit margin of 16 percent this year, along with an Inventory Turnover Ratio (COGS Basis) of 6.10. What is ABC's projected level of inventory, given these numbers?arrow_forward

- Need answerarrow_forwardA product has sales of $7M this year, but sales are expected to decline at 10% per year until it is discontinued after year 5. If the firm’s interest rate is 15%, calculate the PW of the revenues.arrow_forwardDigital Technology wishes to determine its coefficient of variation as a company over time. The firm projects the following data (in millions of dollars): Year 1 3 6 9 Profits: Expected Value $ 97 135 243 277 Year 1 3 6 a. Compute the coefficient of variation (V) for each time period. Note: Round your answers to 3 decimal places. 9 Standard Deviation $34 55 Yes 128 176 No b. Does the risk (V) appear to be increasing over a period of time? Coefficient of Variationarrow_forward

- Loreto Inc. has the following financial ratios: asset turnover = 2.40; net profit margin (i.e., net income/sales) = 5%; payout ratio = 30%; equity/assets = 0.40. a. What is Loreto's sustainable growth rate? b. What is its internal growth rate?arrow_forwardProblem: Jasper Jewelry has $150 million in sales. The company expects that its sales will increase 4% this year. Jasper's CFO uses a simple linear regression to forecast the company's inventory level for a given level of projected sales. On the basis of recent history, the estimated relationship between inventories and sales (in millions of dollars) is as follows: Inventories = $10 + 0.07(Sales) Given the estimated sales forecast and the estimated relationship between inventories and sales, what is your forecast of the company's year-end inventory level? Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55. Do not round intermediate calculations. Round your answer to two decimal places.arrow_forwardNeeded helparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education