FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:For the two independent cases that follow, determine the missing amount for

each letter. (Hint: You might not be able to calculate them in the order in which

they appear.) Case 1 Revenues Expenses Netincome Dividends declared

during the year Retained earnings: Beginning Ending Total assets: Beginning

Ending Total Liabilities: Beginning Ending Common shares: Begianing Ending

Proceeds from issuing additional common shares during the year Case 2 A $

857,000 549,000 223, 000 107,000 B

975.000 1,957.000 2, 258, 000 859, 000 860, 000 D E 245, 000 355, 000 108,000

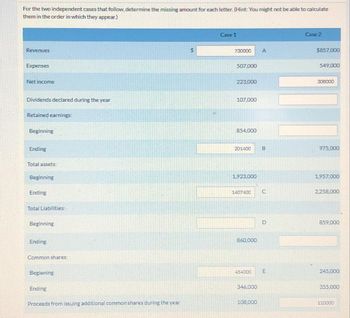

Transcribed Image Text:For the two independent cases that follow, determine the missing amount for each letter. (Hint: You might not be able to calculate

them in the order in which they appear.)

Revenues

Expenses

Net income

Dividends declared during the year

Retained earnings:

Beginning

Ending

Total assets:

Beginning

Ending

Total Liabilities:

Beginning

Ending

Common shares:

Beginning

Ending

Proceeds from issuing additional common shares during the year

Case 1

730000

507,000

223,000

107,000

854,000

201400

1,923,000

1407400

860,000

454000

346.000

108,000

A

B

C

D

E

Case 2

$857,000

549,000

308000

975.000

1,957,000

2,258,000

859,000

245,000

355,000

110000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Please help me with show all calculation thankuarrow_forwardView Policies Current Attempt in Progress A portion of the combined statement of income and retained earnings of Blossom Inc. for the current year follows. Income from continuing operations Loss from discontinued operations, net of applicable income tax (Note 1) Net income Retained earnings at the beginning of the year Dividends declared: On preferred stock-$6.00 per share On common stock-$1.75 per share Retained earnings at the end of the year Extraordinary Loss Income before Extraordinary Loss Net Income /(Loss) BLOSSOM INC. Income Statement December 31 eTextbook and Media Save for Later Note 1. During the year, Blossom Inc. suffered a major loss from discontinued operations of $1,325,200 after applicable income tax reduction of $1,190,000. $276,000 At the end of the current year, Blossom Inc. has outstanding 8,530,000 shares of $10 par common stock and 46,000 shares of 6% preferred. On April 1 of the current year, Blossom Inc. issued 990,000 shares of common stock for $33 per share…arrow_forwardPlease Do not Give image formatarrow_forward

- These financial statement items are for Sunland Corporation at year end, July 31, 2021: Operating expenses Salaries expense Deferred revenue Utilities expense Equipment Accounts payable Service revenue Rent revenue Common shares Cash Accounts receivable D Accumulated depreciation-equipment $32,500 46,700 12,000 2,600 70,200 5,020 116,100 19,000 27,500 5,560 16,100 5,800 Interest payable Supplies expense Dividends declared Depreciation expense Retained earnings, August 1, 2020 Rent expense Income tax expense Supplies Trading investments Bank loan payable (due December 31, 2021) Interest expense O $900 777891 700 14,500 3,500 22,940 11,500 5,700 2,100 20,500 24,800 Additional information: Sunland started the year with $14,000 of common shares and issued additional shares for $13,500 during the year. 1,900 O Warrow_forwardPlease do not give solution in image format thankuarrow_forwardE2.8 (LO 2) (Calculate ratios and evaluate profitability.) The following informat Saputo Inc. for the year ended March 31 (in millions, except share price): Income available for common shareholders Weighted average number of common shares Share price 2021 $625.6 409.8 $37.79 2020 $582.8 400.3 $33.84 Instructions a. Calculate the basic earnings per share and price-earnings ratio for each year. b. Based on your calculations above, how did the company's profitability change from 2020 to 2021? c. When income rose, did the share price increase? How does this affect the price-earnings ratio? d. Do you think investors are more or less optimistic about the company's profitability in the future? OC €arrow_forward

- [The following information applies to the questions displayed below.] Markus Company’s common stock sold for $5.25 per share at the end of this year. The company paid a common stock dividend of $0.63 per share this year. It also provided the following data excerpts from this year’s financial statements: EndingBalance BeginningBalance Cash $ 49,000 $ 44,200 Accounts receivable $ 92,000 $ 68,700 Inventory $ 76,300 $ 92,000 Current assets $ 217,300 $ 204,900 Total assets $ 801,000 $ 875,400 Current liabilities $ 85,500 $ 90,000 Total liabilities $ 206,000 $ 185,400 Common stock, $1 par value $ 165,000 $ 165,000 Total stockholders’ equity $ 595,000 $ 690,000 Total liabilities and stockholders’ equity $ 801,000 $ 875,400 This Year Sales (all on account) $ 1,095,000 Cost of goods sold $ 635,100 Gross margin $ 459,900 Net operating income $ 313,875 Interest expense $ 15,500 Net income $ 208,862 5. What is the return…arrow_forwardPresented below are selected ledger accounts of Tamarisk Corporation as of December 31, 2020. Cash Administrative expenses Selling expenses Net sales Cost of goods sold Cash dividends declared (2020) Cash dividends paid (2020) Discontinued operations (loss before income taxes) Depreciation expense, not recorded in 2019 Retained earnings, December 31, 2019 Effective tax rate 20% Your answer is correct. Compute net income for 2020. Net income tA $ 96800 $55,000 110,000 88,000 594,000 231,000 22,000 16,500 44,000 33,000 99,000arrow_forwardPlease do not give solution in image format thankuarrow_forward

- given the following data for the cheyenne company: current liabilities 602; long-term debt 630; common stock 858; retained earnings 1210; total liabilities & stockholders' equity 3300. how would common stock apprear on a common size balance sheet?arrow_forwardPlease do not give image formatarrow_forwardOn its Form 10-K for the year ended December 31, 2018, Bank of America Corp. reported information related to basic earnings per share.Fill in the missing information. Rounding instruction: Round answer a. to two decimal places.Round answer b., c., & d. to the nearest million.Round answer e. to one decimal place. $ millions, except per share amounts 2018 2017 2016 Net income $28,147 $18,232 d. Answer Preferred stock dividends 1,451 b. Answer $1,682 Net income applicable to common shareholders 26,696 c. Answer $16,140 Average common shares outstanding 10,096.5 10,195.6 e. Answer Basic earnings per share a. Answer $1.63 $1.57arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education