Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

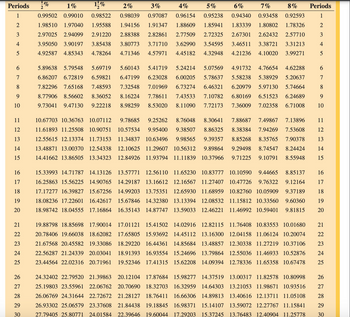

For the sinking fund, use Table 12-1 to calculate the amount (in $) of the periodic payments needed to amount to the financial objective (future value of the annuity ). (Round your answer to the nearest cent.)

| Sinking Fund Payment |

Payment Frequency |

Time Period (years) |

Nominal Rate (%) |

Interest Compounded |

Future Value (Objective) |

|---|---|---|---|---|---|

| $ | every year | 14 | 8 | annually | $450,000 |

TABLE 12:1is attached

Transcribed Image Text:Periods

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

-%

1%

1-%

2%

3%

4%

5%

6%

1.98510 1.97040

7%

0.99502 0.99010 0.98522 0.98039 0.97087 0.96154 0.95238 0.94340 0.93458 0.92593

1.95588 1.94156 1.91347 1.88609 1.85941 1.83339 1.80802 1.78326

2.91220 2.88388 2.82861 2.77509 2.72325 2.67301 2.62432 2.57710

3.95050 3.90197 3.85438 3.80773 3.71710 3.62990 3.54595 3.46511 3.38721 3.31213

4.92587 4.85343 4.78264 4.71346 4.57971 4.45182 4.32948 4.21236 4.10020 3.99271

2.97025 2.94099

2

5.41719 5.24214 5.07569 4.91732 4.76654 4.62288

5.89638 5.79548 5.69719 5.60143

6.86207 6.72819 6.59821 6.47199

6.23028

7.01969 6.73274

6.00205 5.78637

6.46321

5.58238 5.38929 5.20637

6.20979 5.97130 5.74664

7.82296 7.65168 7.48593 7.32548

8.77906 8.56602 8.36052 8.16224 7.78611 7.43533

9.73041 9.47130 9.22218 8.98259 8.53020 8.11090

7.10782 6.80169 6.51523 6.24689

7.72173 7.36009 7.02358 6.71008

8% Periods

1

2

3

4

5

19.88798 18.85698 17.90014 17.01121 15.41502 14.02916

20.78406 19.66038 18.62082 17.65805 15.93692 14.45112 13.16300

21.67568 20.45582 19.33086 18.29220 16.44361 14.85684 13.48857

22.56287 21.24339 20.03041 18.91393 16.93554 15.24696 13.79864

23.44564 22.02316 20.71961 19.52346 17.41315 15.62208

67∞a

8

24.32402 22.79520 21.39863 20.12104 17.87684 15.98277 14.37519

25.19803 23.55961 22.06762 20.70690 18.32703 16.32959 14.64303

26.06769 24.31644 22.72672 21.28127 18.76411 16.66306 14.89813

26.93302 25.06579 23.37608 21.84438 19.18845 16.98371 15.14107

27.79405 25.80771 24.01584 22.39646 19.60044 17.29203 15.37245

9

10

8.76048

7.13896

9.38507

10.67703 10.36763 10.07112 9.78685 9.25262

11.61893 11.25508 10.90751 10.57534 9.95400

12.55615 12.13374 11.73153 11.34837 10.63496 9.98565

13.48871 13.00370 12.54338 12.10625 11.29607 10.56312

14.41662 13.86505 13.34323 12.84926 11.93794 11.11839 10.37966 9.71225 9.10791 8.55948

8.30641 7.88687 7.49867

8.86325 8.38384 7.94269 7.53608

9.39357 8.85268 8.35765 7.90378 13

9.89864 9.29498 8.74547 8.24424 14

HDBHS

11

12

16

15.33993 14.71787 14.13126 13.57771 12.56110 11.65230 10.83777 10.10590 9.44665 8.85137

16.25863 15.56225 14.90765 14.29187 13.16612 12.16567 11.27407 10.47726 9.76322 9.12164 17

17.17277 16.39827 15.67256 14.99203 13.75351 12.65930 11.68959 10.82760 10.05909 9.37189 18

18.08236 17.22601 16.42617 15.67846 14.32380 13.13394 12.08532 11.15812 10.33560 9.60360 19

18.98742 18.04555 17.16864 16.35143 14.87747 13.59033 12.46221 11.46992 10.59401 9.81815 20

15

12.82115 11.76408 10.83553 10.01680 21

12.04158 11.06124 10.20074 22

12.30338 11.27219 10.37106 23

12.55036 11.46933 10.52876 24

14.09394 12.78336 11.65358 10.67478 25

13.00317 11.82578 10.80998 26

13.21053 11.98671 10.93516 27

13.40616 12.13711 11.05108 28

13.59072 12.27767 11.15841 29

13.76483 12.40904 11.25778 30

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Similar questions

- Hello sir please find the answer belowarrow_forwardFind the interest rate needed for the sinking fund to reach the required amount. Assume that the compounding period is the same as the payment period. $21,563 to be accumulated in 5 years; quarterly payments of $900 The interest rate needed is approximately%. (Type an integer or decimal rounded to two decimal places as needed.)arrow_forwardConsider an amount of 25,000 in a fund today. October 25, 2022. DETERMINE ITS value on the specified date given: 1. January 25, 2024 at 3.42% annual effective interestarrow_forward

- Create a complete sinking fund schedule and calculate the total payments and interest earned needed for a fund of $9,000 one year from now. The fund will receive deposits made at the end of every three months and earns 5% compounded quarterly. Payment Number 1 2 3 4 Total Payment Amout at End ($) (PMT) Number Number Number Number Total PMT = Number Interest Earned or Accrued ($) (INT) Number Number Number Number Total INT Number Principal Balance Accumulated at End of Payment Interval ($) (BAL) Number Number Number Numberarrow_forwardContemplating retirement an individual wants to create a fund on an 6% basis allowing $10,000. annual withdraws for 20 years. How much must the balance of the fund equal to allow the $ 10,000. equal annual withdraws beginning one year hence? Following are appropriate factors from tables: Table % / n Present Value of annuity due $1 Present Value of ordinary annuity of $1 Present value of $1 Future Value of ordinary annuity of $1 6%/20 12.15812 11.46992 .31180 36.78559 Required Computation:arrow_forwardK Find the amount of each payment into a sinking fund if $14,000 must be accumulated Payments are made at the end of each quarter for 3 years, with interest of 6% compounded quarterly Round to the nearest cent Click here to view part 1 of the Sinking Fund table. Click here to view part 2 of the Sinking Fund table. OA. $829.92 OB. $4,597 32 OC. $1,180.06 OD. $1,073.52arrow_forward

- An annual deposit of P1,500.00 is placed on a fund at the end of each year for 6 years. If the fund invested has a rate of interest of 5% compounded annually, how much is the worth of this fund at the end of 9 years? O a. P11,118.10 O b. P11,821.10 O c. P11,181.10 O d. P11,811.10arrow_forwardSdarrow_forwardA fund is built with annual payments increasing by $1 from $1 to $10 and then decreasing by $1 to $0. The first payment of $1 is made today. If the fund is used to purchase a ten-year level annuity with the first payment at twenty years from today, what is the amount of the level payment? (Assume an annual effective rate of interest of 4%.) Possible Answers A B D <$16 c≥ $17 but < $18 E ≥ $16 but < $17 ≥ $18 but < $19 ≥ $19arrow_forward

- What sum of money must be deposited in a trust fund to provide a scholarship of $1550, quarterly for infinite period, if interest is 7.2% compounded quarterly? (Money should be rounded to 2 decimal place) USE ONLY CALCULATOR TO CALCULATE YOUR ANSWERS. PMT VY CAY 1 PV 1550 0.072 4 0.018 86111.11 4arrow_forwardUsing the sinking fund Table 13.3, complete the following: (Do not round intermediate calculations. Round your answer to the nearest cent.) Frequency of payment Payment amount end of each Required Interest Length of time amount rate period 24,700 Quarterly 5 years 8% acer %24arrow_forwardUnder the extended fund facility, credits are drawn over a maximum period of _____ years, and are repayable over a maximum of _______ years. Three, Ten Three, Eight Two, Ten Two, Fivearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education