FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please help me with all answers I will give upvote thanku

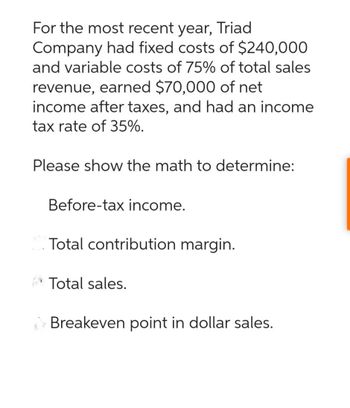

Transcribed Image Text:For the most recent year, Triad

Company had fixed costs of $240,000

and variable costs of 75% of total sales

revenue, earned $70,000 of net

income after taxes, and had an income

tax rate of 35%.

Please show the math to determine:

Before-tax income.

Total contribution margin.

Total sales.

Breakeven point in dollar sales.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardHi! Can you help me solve this problem? Thank youarrow_forwardonly answer d now pleasearrow_forward

- I need typing clear urjent no chatgpt use i will give 5 upvotes Full explanation pllssarrow_forwardHow would I calculate this problem? I just guessed on which answer made sense to me. Please help. thank you in advance.arrow_forwardStudents Home M Federal Financial Aid Program X Students Home Ch. 7 Hmwk: Invoices, Trade &X A Ch. 7 Hmwk Invoices, Trade & X A webassign.net/web/Student/Assignment-Responses/last?dep3D27277752 Apps M Gmail DYouTube Maps ... ... EReading list 7. [-/1 Points] DETAILS BRECMBC9 7.I1.010. MY NOTES ASK YOUR TEACHER PRACTICE ANOTHER Calculate the net price factor (as a %) and net price (in $) by using the complement method. Round your answer to the nearest cent. List Price Trade Discount Rate Net Price Factor Net Price $3,499.00 35% $4 Need Help? Read It 8. [-/1 Points] DETAILS BRECMBC9 7.J1.014. MY NOTES ASK YOUR TEACHER PRACTICE ANOTHER Calculate the trade discount (in $) and trade discount rate (as a %). Round your answer to the nearest tenth of a percent. List Price Trade Discount Rate Trade Discount Net Price $4,500.00 $3,515.00 Need Help? 11:28 PM 71°F (岁 10/9/2021 P Type here to searcharrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education