ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

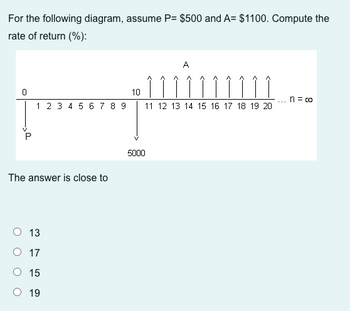

Transcribed Image Text:For the following diagram, assume P= $500 and A= $1100. Compute the

rate of return (%):

0

1 2 3 4 5 6 7 8 9

The answer is close to

O 13

O 17

O 15

O 19

10

5000

A

11 12 13 14 15 16 17 18 19 20

n = 00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The following figure shows the incremental cost of two units and the marginal cost (old) of the system, when all constraints are met. If both units were dispatched at their minimum values, what would be the marginal cost of the new system (new)? Select one: a The incremental cost of unit 1 Ob. Approximately 46.3 $/MWh S/MWh 49 48 C1=45+0.02Pg1 47 46 45 44 C2=43+0.006Pg2 I C. The incremental cost of unit 2 0 100 200 300 400 500- 600 MWarrow_forwardPlease help me solve it, thanks! Dont do handwritten.arrow_forward.Refer to Fig 9.4. At P = $24, how much is the per unit profit? %3D MC ATC 24 P MR 20 18 4 100 350 500 700 g Bales of hay Figure 9.4 $18 $4 $7 $20 Pricearrow_forward

- A bond has a face value of $1000 and a coupon rate of 5.2%. What would the rate of return be if the bond was bought for $983.6 and sold one year later for $1008.5? Select one: O a. 8.61% O b. 8.24% O c. 7.82% O d. 7.21%arrow_forwardAnswer the following questions in your own words. Start a new thread while replying. 1. What are the determinants of price elasticity of demand? Explain the determinants. 2. What is the difference between inelastic demand and elastic demand? Provide an example of each from real life. 3. Refer to the graph below: Price 22 20 + 18 +- 16 + 14 B 12 10 + 4 Demand +++ 100 200 300 400 500 600 700 800 900 Buaxtity From the graph above calculate: a. Price elasticity of demand from point A to point B (use the mid-point method). Is it an elastic situation or an inelastic situation? b. Price elasticity of demand from point B to point C (use the mid-point method). Is it an elastic situation or an inelastic situation?arrow_forward2. (This problem derives the general result that any polynomial function is of a lower asymptotic order than any exponential function.) First, we prove a special case. Suppose that we have two functions, f(n) = n² and g(n) = 2". We will prove that f(n) = O(g(n)). • port (a). (c) Show that, for any n ≥ no, it must be the case that f(n) ≤ cog(n) = f(n+1) ≤ cog(n+1). Precisely state the argument by induction that n² = 0(2¹). Now, define f(n) = nk where k ≥ 1, g(n) = a", where a ≥ 1. (d) (Slightly harder). Argue that, for any k and a, there exists some n₁ such that : (1₁+¹)* < a.arrow_forward

- A manufacturing company leases a building for $90,000 per year for its manufacturing facilities. In addition, the machinery in this building is being paid in installments of $21,000 per year. Each unit of product produced costs $16 in labour and $9 in materials. The product can be sold for $34. How many units must be sold each year for the company to earn a profit of $56,000 per year? Select one: O A. 16,701 B. 19,086 C. 9,543 D. 11,929 E. 7,157arrow_forward2. Please show solution thanksarrow_forwardAVC = 10-0.03q+0.00005q^2 ATC = 10-0.03q+0.00005q^2 +100/q and MC = 10-0.06q+0.00015q^2 Answer the following questions in EXCEL:1 At what value of q is AVC at its minimum? (Hint: The easiest way tocalculate this value is to solve AVC - MC = 0 for q.)2 At the above output level what value does AVC take?3 If the forecasted price of the firm's output is $10 per unit:a How much output will the firm produce in the short run?b How much profit (loss) will the firm earn)?4 If the forecasted price is $7 per unit:a How much output will the firm produce in the short run? (Keep only2 decimals)b How much profit (loss) will the firm earn)? (Keep only 2 decimals)arrow_forward

- The fixed cost related to the production of a product is $500,000 per year. Assume that the variable cost is $20,000 and the sell- ing price is $30,000 for each percentage point of annual output capacity (which equals sales demand). Thus, the maximum sales per year are $3,000,000 (at 100% of output capacity), and we have: (2.3) C; = $500,000 per year C, $20,000/1% of annual output capacity (Fixed cost) (Variable cost/unit) p = $30,000/1%' of annual output capacity (Selling price/unit) a. Determine the breakeven point for this situ- ation.arrow_forward8. The cost of producing a small transistor radio set consists of P23.00 for labor and P37.00 for materials. The fixed charges in operating the plant are P100,000 per month. The variable cost is P1.00 per set. The radio set can be sold for P75.00 each. Determine how many sets must be produced per month to break even.arrow_forwardIf MTR = 0.2; MPS = 0.2 what is the value of the MLR? O a. 0.8 O b. 0.5 OC. 0.04 O d. 0.4arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education