Amy Dyken, controller at Shamrock Pharmaceutical Industries, a public company, is currently preparing the calculation for basic and diluted earnings per share and the related disclosure for Shamrock’s financial statements. Below is selected financial information for the fiscal year ended June 30, 2020.

| Long-term debt | ||

| Notes payable, 10% |

$990,000

|

|

| 9% convertible bonds payable |

5,040,000

|

|

| 10% bonds payable |

6,080,000

|

|

| Total long-term debt |

$12,110,000

|

Shareholders’ equity

Common stock, $1 par, 10,000,000 shares authorized, 1,000,000 shares issued and outstanding

Additional paid-in capital 3,990,000

Total shareholders’ equity $12,380,000

The following transactions have also occurred at Shamrock.

| 1. | Options were granted on July 1, 2019, to purchase 180,000 shares at $15 per share. Although no options were exercised during fiscal year 2020, the average price per common share during fiscal year 2020 was $20 per share. | |

| 2. | Each bond was issued at face value. The 9% convertible bonds will convert into common stock at 50 shares per $1,000 bond. The bonds are exercisable after 5 years and were issued in fiscal year 2019. | |

| 3. | The preferred stock was issued in 2019. | |

| 4. | There are no preferred dividends in arrears; however, preferred dividends were not declared in fiscal year 2020. | |

| 5. | The 1,000,000 shares of common stock were outstanding for the entire 2020 fiscal year. | |

| 6. | Net income for fiscal year 2020 was $1,490,000, and the average income tax rate is 20%. |

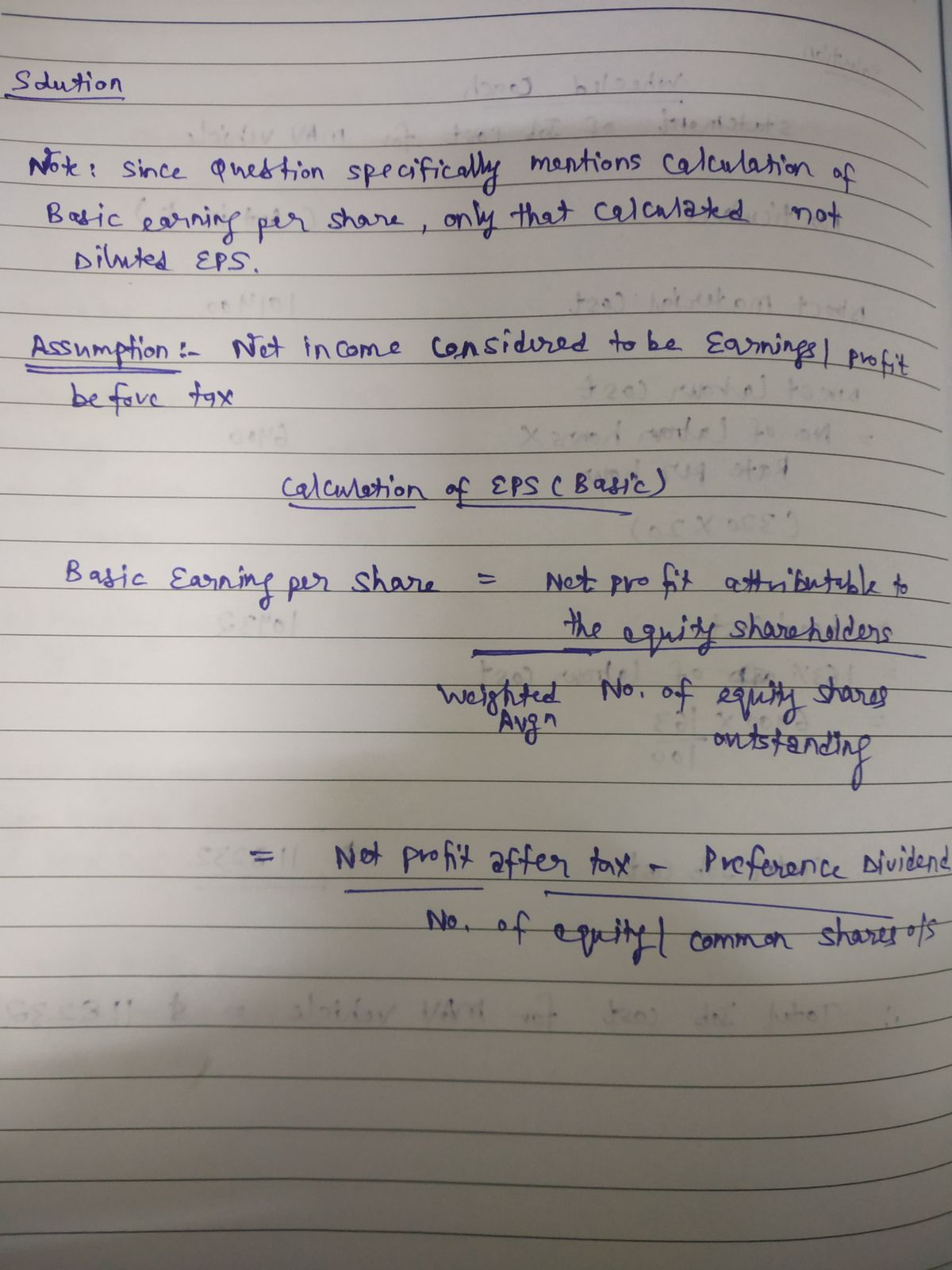

For the fiscal year ended June 30, 2020, calculate the following for Shamrock Pharmaceutical Industries. (Round answers to 2 decimal places, e.g. $2.45.)

Basic earnings per share. = ?

Basic earnings per share. = ?

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

- E-Tech Initiatives Limited plans to issue $650,000, 10-year, 7.00 percent bonds. Interest is payable annually on December 31. All of the bonds will be issued on January 1, 2019. Show how the bonds would be reported on the January 2, 2019, balance sheet if they are issued at 105. How would I create a partial balance sheet with the carrying vaule for the problem above?arrow_forwardKier Company issued $740,000 in bonds on January 1, Year 1. The bonds were issued at face value and carried a 3-year term to maturity. The bonds have a 5.50% stated rate of interest interest is payable in cash on December 31 each year. Based on this information alone, what are the amounts of interest expense and cash flows from operating activities, respectively, that will be reported in the financial statements for the year ending December 31, Year 1? Multiple Choice O Zero and $40,700 $40,700 and $40,700 Zero and Zero $40,700 and Zeroarrow_forwardRecording in the Accounting System On January 1, 2014, Jack Company issues the $4,110,000, 8%, 10-year bonds described above for cash of $3,373,263. Journalize the issuance of the Jack Company bonds.arrow_forward

- Deere & Company’s 2018 10-K reports the following footnote relating to long-term debt for its equipment operations subsidiary. Deere’s borrowings include $300 million, 7.125% notes, due in 2031arrow_forwardNeed complete and correct answer for all parts with all workings and steps in text form please show calculation narrations and explanation clearly for all steps answer in text formarrow_forwardcan you show me how to solve this problem for accounting? Presented here are long-term liability items for Metlock, Inc. at December 31, 2022. Bonds payable (due 2026) $660,000 Notes payable (due 2024) 90,000 Discount on bonds payable 28,000arrow_forward

- The following investment account was taken from the general ledger of One Dream Investment Company: Debt Investments - Fulfilled Dream 6% bonds (2,000,000 face value, due December 31, 2027) Date PR Debit Credit Balance January 2, 2022 VR P1,812,300 P1,812,300 June 30, 2022 CRJ 60,000 1,752,300 Dec. 31, 2022 CRJ 60,000 1,692,300 Dec. 31, 2022 195,000 1,497,300 In the course of your examination, you obtained the following information: Interest checks were received on June 30 and December 31 and were credited to the investment account. One dream sold P200,000 of its investment on December 31, 2022 for P195,000. Effective interest rate on this investment, as computed by your audit staff, is 8%. One Dream included this investment in a portfolio that is held to collect and for sale. The fair value at December 31, 2022 and 2023 is 97.5 and 105, respectively. Question 1: The entry to correct the interest income for 2022…arrow_forwardsaarrow_forwardSelected debt investment transactions for Easy A Inc., a retail business, are listed below. Easy A Inc. has a fiscal year ending on December 31. Year 1: Feb. 1 May 1 Jun. 1 Sept. 1 Oct. 1 Dec. 1 Dec. 31 Year 2: Mar. 1 Jun. 1 Sept. 1 Bought $35,000 of 6%, XYZ Co. 12-year bonds at their face amount plus accrued interest of $700. The bonds pay interest semiannually on June 1 and December 1. Bought $200,000 of Simple Tree 5%, 20-year bonds at their face amount plus accrued interest of $2,500. The bonds pay interest semiannually on March 1 and September 1. Received semiannual interest on the XYZ Co. bonds. Received semiannual interest on the Simple Tree bonds. Sold $15,000 of Simple Tree bonds at 102% plus accrued interest of $63. Received semiannual interest on the XYZ Co. bonds. Accrued $3,135 interest on the Simple Tree bonds. Accrued $175 interest on the XYZ Co. bonds. Received semiannual interest on the Simple Tree bonds. Received semiannual interest on the XYZ Co. bonds. Received…arrow_forward

- Luke Corp. issued $2,000,000 of 20-year, 9% callable bonds on July 1, Year 1, with interest payable on June 30 and December 31. The fiscal year of the company is the calendar year. What is the entry to record the payment of interest on December 31 in the year the bonds were issued? a. Interest Expense Cash Ob. Interest Payable Interest Expense Cash Oc. Interest Expense Cash d. Cash Interest Expense 90,000 90,000 90,000 180,000 90,000 90,000 180,000 180,000 90,000arrow_forwardMemanarrow_forwardAn accounting example: Otter Products inc issued bonds on January 1, 2019. Interest to be paid semi-annually. Term in years is 2; Face value of bonds issued is $200,000; Issue Price $206,000; Specified Interest Rate each payment period is 6% Question. Calculate a. the amount of interest paid in cash every payment period. b. The amount of amortization to be recorded at each interest payment date (use straight-line method) c. complete amoritzation table by calculating interest expense and beginning and ending bond carrying amounts at the each period over 2 years. The term is for 2 years however 3 years is showing on the workbook. How do I calcuate the 3rd year if the problem only says the term is 2 years?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education