FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

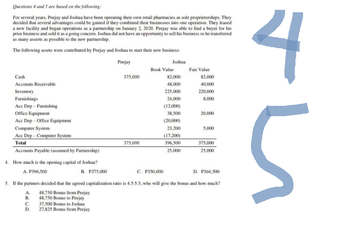

Transcribed Image Text:Questions 4 and 5 are based on the following:

For several years, Peejay and Joshua have been operating their own retail pharmacies as sole proprietorships. They

decided that several advantages could be gained if they combined their businesses into one operation. They leased

a new facility and began operations as a partnership on January 2, 2020. Peejay was able to find a buyer for his

prior business and sold it as a going concern. Joshua did not have an opportunity to sell his business so he transferred

as many asserts as possible to the new partnership.

The following assets were contributed by Peejay and Joshua to start their new business:

Peejay

Cash

Accounts Receivable

Inventory

Furnishings

Ace Dep-Furnishing

Office Equipment

Acc Dep-Office Equipment

Computer System

Acc Dep-Computer System

Total

Accounts Payable (assumed by Partnership)

4. How much is the opening capital of Joshua?

A. P396,500

A.

B.

B. P375,000

C

D.

375,000

37,500 Bonus to Joshua

27,825 Bonus from Peejay

375,000

Joshua

Book Value

C. P350,000

82,000

48,000

225,000

24,000

(12,000)

38,500

(20,000)

23,200

(17,200)

396,500

25,000

Fair Value

82,000

40,000

220,000

8,000

20,000

5,000

5. If the partners decided that the agreed capitalization ratio is 4.5:5.5, who will give the bonus and how much?

48,750 Bonus from Peejay

48,750 Bonus to Peejay

375,000

25,000

D. P366,500

na

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Roberto and Sangeeta have been in partnership for many years sharing profits and losses in the ratio 3:2. They decide to dissolve the partnership on 31 August 2021. Their summarized statement of financial position at that date was as follows: The following information is also available: Furniture and equipment were sold for $690,000. Roberto took over one of the vehicles at an agreed value of $90,000; the other was sold for $120,000. The firm paid $148,000 in full settlement of accounts payable Inventory realized $210,000. Accounts receivable were settled after allowing a 10% discount Dissolution expenses amounted to $4,000 Required: Prepare the following accounts: a. Realization b. Bank c. Capital accounts d. State two reasons why a partnership might be disolvedarrow_forwardthe early part of 2021, the partners of HughJacobs, and Thomas sought assistance from a local accountant. They had begun a new business in 2020 but had never used an accountant's services Hugh and Jacobs began the partnership by contributing $150,000 and $100,000 in cash, respectivelyHugh was to work occasionally at the business, and Jacobs was to be employed full-time. They decided that year-end profits and losses should be assigned as follows: Each partner was to be allocated 10 percent interest computed on the beginning capital balances for the period A compensation allowance of $5,000 was to go to Hugh with a $25,000 amount assigned to Jacobs Any remaining income would be split on a 4:6 basis to Hugh and Jacobs, respectively 2020, revenues totaled $175,000, and expenses were $146,000 (not including the partnerscompensation allowance)Hugh withdrew cash of $9,000 during the year, and Jacobs took out $14,000. In addition, the business paid $7,500 for repairs made to Hugh's home and…arrow_forwardJesse and Tim form a partnership by combining the assets of their separate businesses. Jesse contributes accounts receivable with a face amount of $46,000 and equipment with a cost of $181,000 and accumulated depreciation of $105,000. The partners agree that the equipment is to be valued at $67,900, that $3,000 of the accounts receivable are completely worthless and are not to be accepted by the partnership, and that $2,200 is a reasonable allowance for the uncollectibility of the remaining accounts receivable. Tim contributes cash of $21,500 and merchandise inventory of $45,000. The partners agree that the merchandise inventory is to be valued at $48,500. Journalize the entries to record in the partnership accounts (a) Jesse's investment and (b) Tim's investment. If an amount box does not require an entry,arrow_forward

- Cody Jenkins and Lacey Tanner formed a partnership to provide landscaping services. Jenkins and Tanner shared profits and losses equally. After all the tangible assets have been adjusted to current market prices, the capital accounts of Cody Jenkins and Lacey Tanner have balances of $78,000 and $46,000, respectively. Valeria Solano has expertise with using the computer to prepare landscape designs, cost estimates, and renderings.Jenkins and Tanner deem these skills useful; thus, Solano is admitted to the partnership at a 30% interest for a purchase price of $32,000.a. Determine the recipient and amount of the partner bonus.b. Provide the journal entry to admit Solano into the partnership.c. Why would a bonus be paid in this situation?arrow_forwardSteve Reese is a well-known interior designer in Fort Worth, Texas. He wants to start his own business and convinces Rob O’Donnell, a local merchant, to contribute the capital to form a partnership. On January 1, 2019, O’Donnell invests a building worth $74,000 and equipment valued at $44,000 as well as $32,000 in cash. Although Reese makes no tangible contribution to the partnership, he will operate the business and be an equal partner in the beginning capital balances. To entice O’Donnell to join this partnership, Reese draws up the following profit and loss agreement: O’Donnell will be credited annually with interest equal to 10 percent of the beginning capital balance for the year.O’Donnell will also have added to his capital account 10 percent of partnership income each year (without regard for the preceding interest figure) or $6,000, whichever is larger. All remaining income is credited to Reese.Neither partner is allowed to withdraw funds from the partnership during 2019.…arrow_forwardJesse and Tim form a partnership by combining the assets of their separate businesses. Jesse contributes accounts receivable with a face amount of $50,000 and equipment with a cost of $185,000 and accumulated depreciation of $101,000. The partners agree that the equipment is to be valued at $67,800, that $4,000 of the accounts receivable are completely worthless and are not to be accepted by the partnership, and that $1,800 is a reasonable allowance for the uncollectibility of the remaining accounts receivable. Tim contributes cash of $21,500 and merchandise inventory of $45,000. The partners agree that the merchandise inventory is to be valued at $48,500. Journalize the entries in the partnership accounts for (a) Jesse's investment and (b) Tim's investment. If an amount box does not require an entry, leave it blank. a. b.arrow_forward

- Manjiarrow_forwardMarcus and Madison are equal members of an LLC. On January 1 of the current year, to acquire a one-third interest in the entity, Nora contributed a parcel of land she had held for investment. (At this time, the entity will be renamed MMN LLC.) Nora had purchased the land for $120,000; its fair market value was $90,000 at the contribution date. A few years later, the LLC sells Nora’s land for $84,000. At the beginning of that year, Nora’s capital account (determined using the tax basis) was $200,000 and Marcus and Madison’s capital accounts (also calculated on the tax basis) were $170,000. a. What is the LLC’s recognized gain or loss? How is it allocated among the LLC members? b. Use Microsoft Excel to prepare schedules that compute the partners’ tax basis capital accounts immediately after the sale. Use variables to input the amount allocated to each LLC member and the total not specially allocated.arrow_forwardPhillips and Harris are partners in a used car business. Under their oral partnership, each has an equal voice in the conduct and management of the business. Because of their irregular business hours, the two further agreed that they could use any partnership vehicle as desired. This use includes transportation to and from work, even though the vehicles are for sale at all times. Harris conducted partnership business both at the used car lot and from his home. He was on call by Phillips or customers at his home, and he went back to the lot two or three times after going home. While driving a partnership vehicle home from the used car lot, Harris negligently hit a car driven by Cook, who brought this action against Harris and Phillips individually and as copartners for his injuries. Who is liable?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education