ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Please answer these two question with proper solution and write it on a paper Thank you.

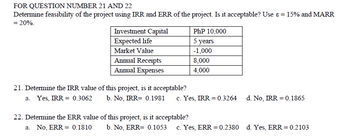

Transcribed Image Text:FOR QUESTION NUMBER 21 AND 22

Determine feasibility of the project using IRR and ERR of the project. Is it acceptable? Use & = 15% and MARR

= 20%.

Investment Capital

PhP 10,000

Expected life

5 years

Market Value

-1,000

Annual Receipts

8,000

Annual Expenses

4,000

21. Determine the IRR value of this project, is it acceptable?

a. Yes, IRR = 0.3062

b. No, IRR= 0.1981

c. Yes, IRR = 0.3264

d. No, IRR 0.1865

22. Determine the ERR value of this project, is it acceptable?

a. No, ERR = 0.1810

b. No, ERR= 0.1053 c. Yes, ERR = 0.2380 d. Yes, ERR = 0.2103

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- What is the AVC and MC?arrow_forwardWhy Do We Need to Use Cash Flows in Economic Analysis?arrow_forwardPrepare a flow chart for a typical family of 4 (3 drivers), taking a two-week (Monday is 1st-14th is a Sunday) vacation driving from New York to Orlando in August. Your return to workday is 15th of the month which is a Monday. Discuss areas of concerned revealed by the flow chart.arrow_forward

- How do economic engineers make typical personal decisions?arrow_forwardSo what really happens if we don't raise the debit limit? Hmmmm? Good question we have never not done that before... Verbatum question formulated by Eric Kortenhoven. Comment on the question then reply to a fellow student this will be an extra credit and points can be used wherever you would like just let me know where to apply themarrow_forwardcan you do part b, c, d and e i can hse 4 questions for itarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education