FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

For

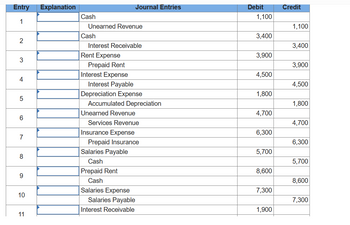

- To record receipt of unearned revenue.

- To record this period's earning of prior unearned revenue.

- To record payment of an accrued expense.

- To record receipt of an accrued revenue.

- To record an accrued expense.

- To record an accrued revenue.

- To record this period's use of a prepaid expense.

- To record payment of a prepaid expense.

- To record this period's

depreciation expense.

Transcribed Image Text:Entry

1

2

3

4

5

co

6

7

8

9

10

11

Explanation

Cash

Unearned Revenue

Cash

Interest Receivable

Rent Expense

Prepaid Rent

Interest Expense

Journal Entries

Interest Payable

Depreciation Expense

Accumulated Depreciation

Unearned Revenue

Services Revenue

Insurance Expense

Prepaid Insurance

Salaries Payable

Cash

Prepaid Rent

Cash

Salaries Expense

Salaries Payable

Interest Receivable

Debit

1,100

3,400

3,900

4,500

1,800

4,700

6,300

5,700

8,600

7,300

1,900

Credit

1,100

3,400

3,900

4,500

1,800

4,700

6,300

5,700

8,600

7,300

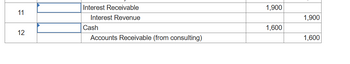

Transcribed Image Text:11

12

Interest Receivable

Interest Revenue

Cash

Accounts Receivable (from consulting)

1,900

1,600

1,900

1,600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Rent paid in advance can be categorized as a. Deferred expense (Prepaid expense) b. Accrued revenue c. Deferred revenue (Unearned revenue) d. Accrued expensearrow_forwardtransactions that require an adjusting entry (debit) to unearned revenue?arrow_forwardExplain an example to record the adjusting entry for accrued revenue.arrow_forward

- Sweet Company provides the following information about its defined benefit pension plan for the year 2020. Service cost $91,000 Contribution to the plan 106,400 Prior service cost amortization 10,800 Actual and expected return on plan assets 65,200 Benefits paid 40,500 Plan assets at January 1, 2020 633,900 Projected benefit obligation at January 1, 2020 701,600 Accumulated OCI (PSC) at January 1, 2020 149,900 Interest/discount (settlement) rate 9 %arrow_forwardWhich of the following accounts could be part of a regular journal entry, an adjusting entry, a closing entry, and a reversing entry? interest revenue account receivable depreciation expense unearned revenue prepaid insurancearrow_forwardQuestion: 1. Under the allowance method, Accounts recorded Uncollectible Expense is a. for an estimated amount. b. when an individual account is written off. c. for a known amount. d. several times during the accounting period.arrow_forward

- Match the statements below with the accounting assumption, characteristic, or principle to which the statement relates. Assumptions/characteristics/principles may be used once, more than once, or not at all. Recorded when the performance obligation is satisfied. a. Revenue recognition principle V The reason for recording accruals and deferrals in adjusting entries. b. Matching principle Valuing assets at amounts originally paid for them. C. Historical cost principle Entity assumed to have a long life d. Going concern assumption Description of significant accounting policies and unusual events. e. Full disclosure principle v Information has predictive and confirmatory value. T. Relevance characteristic 8. Consistency characteristicarrow_forwardAccrual accounting requires adjusting entries. Provide an example of an adjusting entry.arrow_forwardThe purchase of supplies on account is debited to supplies and credited to account receivable. Is this statement correctarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education