ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

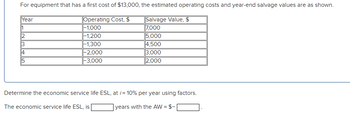

Transcribed Image Text:For equipment that has a first cost of $13,000, the estimated operating costs and year-end salvage values are as shown.

Year

Operating Cost, $

Salvage Value, $

1

-1,000

7,000

2

-1,200

5,000

3

-1,300

4,500

4

-2,000

3,000

5

|-3,000

2,000

Determine the economic service life ESL, at /= 10% per year using factors.

The economic service life ESL, is [

years with the AW = $-|

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- A delivery car had a first cost of $34,000, an annual operating cost of $15,000, and an estimated $5000 salvage value after its 6-year life. Due to an economic slowdown, the car will be retained for only 4 years and must be sold now as a used vehicle. At an interest rate of 12% per year, what must the market value of the used vehicle be in order for its AW value to be the same as the AW if it had been kept for its full life cycle? The market value of the used vehicle is determined to be $ 26423arrow_forwardDexcon Technologies, Inc., is evaluating two alternatives to produce its new plastic filament with tribological (ie.. low friction) properties for creating custom bearings for 3-D printers. The estimates associated with each alternative are shown below. Using a MARR of 10% per year, which alternative has the lower present worth? Method First Cost M&O Cost, per Year Salvage Value Life DDM $-190,000 $-55,000 $4,000 2 years The present worth for the DDM method is $ The present worth for the LS method is $ The LS method is selected. LS $-430,000 $-25,000 $39,000 4 yearsarrow_forwardCalculate the annual worth of a machine that has an initial cost of $35,000, a life of 10 years, and an annual operating cost of $10,000 for the first 4 years, increasing by 1000 per year hereafter. Use an interest rate of 15% per year.arrow_forward

- Please answer as quickly as possible and zoom in for better viewarrow_forwardPlease answer as quickly as possible and zoom in for clear viewarrow_forwardRequired information For equipment that has a first cost of $17,000, the estimated operating costs and year-end salvage values are as shown. Year Operating Cost, $ Salvage Value, $ 1 -1,000 7,000 2 -1,200 5,000 3 -1,300 4,500 4 -2,000 3,000 5 -3,000 2,000 Write the PMT function to determine AW for year 4, if net operating costs are entered into cells B2 through B6. (Please upload your response/solution using the controls below.)arrow_forward

- Ee 353.arrow_forwardAn oil company plans to purchase a piece of vacant land on the corner of two busy streets for $50,000. On properties of this type, the company installs businesses of three different types. Each has an estimated useful life of 15 years. The salvage land for each is estimated to be the $50,000 land cost. Cost* $ 83,000 Type of Business Conventional gas station Add automatic carwash Add quick carwash 195,000 115,000 *Improvements cost does not include $50,000 for the land. Plan A B с Net Annual Income $26,500 39,750 31,200 (a) Construct a choice table for interest rates from 0% to 100%. (b) If the oil company expects a 10% rate of return on its investments, which plan (if any) should be selected?arrow_forwardNote: the answer should be typed.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education