FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Do not answer in image format.

Maintain accuracy and quality in your answer.

Answer completely.

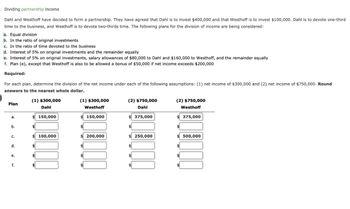

Transcribed Image Text:Dividing partnership income

Dahl and Westhoff have decided to form a partnership. They have agreed that Dahl is to invest $400,000 and that Westhoff is to invest $100,000. Dahl is to devote one-third

time to the business, and Westhoff is to devote two-thirds time. The following plans for the division of income are being considered:

a. Equal division

b. In the ratio of original investments

c. In the ratio of time devoted to the business

d. Interest of 5% on original investments and the remainder equally

e. Interest of 5% on original investments, salary allowances of $80,000 to Dahl and $160,000 to Westhoff, and the remainder equally

f. Plan (e), except that Westhoff is also to be allowed a bonus of $50,000 if net income exceeds $200,000

Required:

For each plan, determine the division of the net income under each of the following assumptions: (1) net income of $300,000 and (2) net income of $750,000. Round

answers to the nearest whole dollar.

Plan

a.

b.

C.

d.

e.

f.

(1) $300,000

Dahl

150,000

100,000

(1) $300,000

Westhoff

150,000

200,000

(2) $750,000

Dahl

375,000

$ 250,000

$

$

(2) $750,000

Westhoff

375,000

500,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Search Google images for bad data visualizations. Post a link to the image.Describe what is inaccurate or misleading about the visualization. Replace the inaccurate and misleading information with what you think makes the image a good visualization.arrow_forwardInspector expenses and other expenses that are designed to ensure quality or uncover defects are examples of prevention costs. ture or falsearrow_forwardMatch each of the components of faithful representation with its definition.Faithful Representation Definition1 . Freedom from error a. All information necessary to describe an item is reported. 2. Neutrality b. Information that does not bias the decision maker. 3. Completeness c. Reported amounts reflect the best available information.arrow_forward

- What is a MIS report, why is it prepared?arrow_forwardWhat is underpricing? Why is it used? What evidence do we have to support the belief that underpricing is a regular problem?arrow_forwardwhat exactly is a cookie jar reserve? Does using a cookie jar reserve follow GAAP? Does using a cookie jar reserve appear to be an ethical practice? Support your opinion. Your post should be more than a single sentence.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education