Economics:

10th Edition

ISBN: 9781285859460

Author: BOYES, William

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

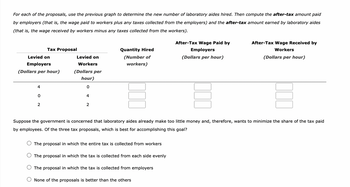

Transcribed Image Text:For each of the proposals, use the previous graph to determine the new number of laboratory aides hired. Then compute the after-tax amount paid

by employers (that is, the wage paid to workers plus any taxes collected from the employers) and the after-tax amount earned by laboratory aides

(that is, the wage received by workers minus any taxes collected from the workers).

Levied on

Employers

(Dollars per hour)

4

0

Tax Proposal

2

Levied on

Workers

(Dollars per

hour)

0

4

2

Quantity Hired

(Number of

workers)

The proposal in which the entire tax is collected from workers

The proposal in which the tax is collected from each side evenly

After-Tax Wage Paid by

Employers

(Dollars per hour)

Suppose the government is concerned that laboratory aides already make too little money and, therefore, wants to minimize the share of the tax paid

by employees. Of the three tax proposals, which is best for accomplishing this goal?

The proposal in which the tax is collected from employers

O None of the proposals is better than the others

After-Tax Wage Received by

Workers

(Dollars per hour)

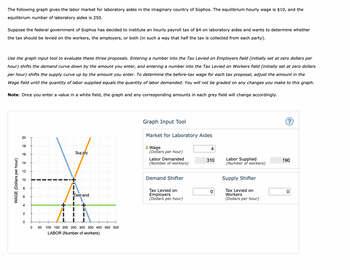

Transcribed Image Text:The following graph gives the labor market for laboratory aides in the imaginary country of Sophos. The equilibrium hourly wage is $10, and the

equilibrium number of laboratory aides is 250.

Suppose the federal government of Sophos has decided to institute an hourly payroll tax of $4 on laboratory aides and wants to determine whether

the tax should be levied on the workers, the employers, or both (in such a way that half the tax is collected from each party).

Use the graph input tool to evaluate these three proposals. Entering a number into the Tax Levied on Employers field (initially set at zero dollars per

hour) shifts the demand curve down by the amount you enter, and entering a number into the Tax Levied on Workers field (initially set at zero dollars

per hour) shifts the supply curve up by the amount you enter. To determine the before-tax wage for each tax proposal, adjust the amount in the

Wage field until the quantity of labor supplied equals the quantity of labor demanded. You will not be graded on any changes you make to this graph.

Note: Once you enter a value in a white field, the graph and any corresponding amounts in each grey field will change accordingly.

WAGE (Dollars per hour)

20

18

16

14

12

10

8

4

2

0

0

Supply

Demand

1

I

I

50 100 150 200 250 300 350 400 450 500

LABOR (Number of workers)

Graph Input Tool

Market for Laboratory Aides

Wage

(Dollars per hour)

Labor Demanded

(Number of workers)

Demand Shifter

Tax Levied on

Employers

(Dollars per hour)

4

310

0

Labor Supplied

(Number of workers)

Supply Shifter

Tax Levied on

Workers

(Dollars per hour)

?

190

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Name some factors that can cause a shift in the demand curve in labor markets.arrow_forwardWhy are the factors that shift the demand for a product different from the factors that shift the demand for labor? Why are the factors that shift the supply of a product different from those that shift the supply of labor?arrow_forwardTable 14.11 shows levels of employment (Labor), the marginal product at each of those levels, and a monopolys marginal revenue. What is the monopolys marginal revenue product at each level of employment? If the monopoly operates in a perfectly competitive labor market where the going market wage is 20, what is the films profit maximizing level of employment?arrow_forward

- The United States government subsidizes many so-called green companies. For instance, it has given millions of dollars to solar panel companies. In the market for solar power, illustrate what the government subsidies mean.arrow_forwardWhether the product market or the labor market, what happens to line equilibrium price and quantity for each of the four possibilities: increase in demand, decrease in demand, increase in supply; and decrease in supply.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:9781337617383

Author:Roger A. Arnold

Publisher:Cengage Learning