FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

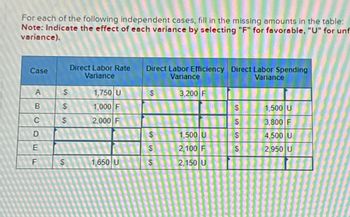

Transcribed Image Text:For each of the following independent cases, fill in the missing amounts in the table:

Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unf

variance).

Case

A

B

C

D

E

F

$

$

$

$

Direct Labor Rate

Variance

1,750 U

1,000 F

2,000 F

1,650 U

Direct Labor Efficiency Direct Labor Spending

Variance

Variance

$

$

$

SA

$

3,200 F

1,500 U

2,100 F

2,150 U

shining

$

$

S

S

1,500 U

3,800 F

4,500 U

2,950 U

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: Introduce to direct labor variance

VIEW Step 2: Working for direct labor spending variance for case A

VIEW Step 3: Working for direct labor efficiency variance for case B

VIEW Step 4: Working for direct labor efficiency variance for case C

VIEW Step 5: Working for direct labor rate variance for Case D

VIEW Step 6: Working for direct labor rate variance for Case E

VIEW Step 7: Working for direct labor spending variance for case F

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 8 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please do not give solution in image format thankuarrow_forward$6.00 per hour. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. Variance Amount Favorable/Unfavorable Controllable variance Volume variance Total factory overhead cost variance %24 %24 %24arrow_forwardNeed help with the following question,arrow_forward

- 4. Prepare a detailed overhead variance report that shows the variances for individual items of overhead. (Indicate the effect of each variance by selecting favorable, unfavorable, or no variance.) The drop down options for the box next to "expected production volume" and the box next to"production level achieved" are: 65%, 70%, 75%, 80%, 85%, 90%, 95%, 100% of capacity the drop down options for the box next to "volume variance" are: favorable, unfavorable, no variance. The drop down option for the boxes under "variable overhead costs" are: depreciation-building, depreciation-machinery, direct labor, direct materials, indirect labor, indirect materials, maintenance, power, supervisory salaries, taxes&insurance. For the last row in variable overhead costs (the column above) "fixed over head costs" the drop down options are: contribution margin, gross profit, income from operations, total fixed overhead costs, total variable overhead costs. The drop down options for the boxes…arrow_forwardverify whether variances favorable of unfavorable: budgeted cost at actual volue would be 25344 (21.12*1200) and total variance to be explained is 2536 (unfavorable 27880-25344). what is the amount of variance that is attributed to the diffence between the budgeted and actual wage rate per hour. what is the amount of variance that is attributed to the change in labor productivity? what is the amount of variance that can be attributed tothe diffence between budgeted and actual volume budget actual wage rate per hour 16 17 fixed hours 320 320 variable hours per relative value unit (RVU) 1 1.1 Relative Value unite (RVUs) 1000 1200 total labor hours 1320 1640 labor cost 21120 27880 cost per RVU 21.12 23.23arrow_forwardFavorable or Unfavorable? Please assist.arrow_forward

- Trini Company set the following standard costs per unit for its single product Direct materials (30 pounds @ $4.40 per pound) Direct labor (6 hours @ $14 per hour) Variable overhead (6 hours @ $8 per hour) Fixed overhead (6 hours @ $11 per hour) $ 132.00 84.00 48.00 66.00 $ 330.00 Standard cost per unit Overhead is applied using direct labor hours. The standard overhead rate is based on a predicted activity level of 80% of the company's capacity of 50,000 units per quarter. The following additional information is available. Production (in units) Standard direct labor hours (6 DLH per unit) Budgeted overhead (flexible budget) Fixed overhead Variable overhead Operating Levels 70% 80% 90% 35,000 210,000 40,000 240,000 45,000 270,000 $ 2,640,000 $ 1,680,000 $ 2,640,000 $ 2,640,000 $ 1,920,000 $ 2,160,000 During the current quarter, the company operated at 90% of capacity and produced 45,000 units; actual direct labor totaled 266,000 hours. Units produced were assigned the following…arrow_forwardThe management of Cleancut Lawnmowers has calculated the following variances: Direct materials cost variance Direct materials efficiency variance Direct labor cost variance Direct labor efficiency variance Variable overhead cost variance Variable overhead efficiency variance Fixed overhead cost variance $10,000 U 37,000 F 15,000 F 14,000 U 3,000 F 6,500 F 3,000 F When determining the total product cost flexible budget variance, what is the total manufacturing overhead variance of the company? OA. $3,000 F OB. $12,500 F OC. $6,500 F OD. $9,500 Farrow_forward3. Compute the direct labor variance, including its rate and efficiency variances. (Indicate the effect of each variance by selecting favorable, unfavorable, or no variance. Round "Rate per hour" answers to two decimal places.) The drop down options under "actual cost" "standard cost" and the middle box for the first row are: actual rate, standard rate The drop down options for the left bottom 3 rows are: total variable overhead cost variance, variable overhead efficiency variance, variable overhead spending variance, volume variance, direct material variance, Direct labor efficiency variance, direct labor rate variance, direct materials price variance, direct materials quantity variance. the drop down options for the right yellow 3 columns are: favorable, unfavorable, no variance please use the exact format as shown in photos. Thank you !arrow_forward

- Which method of closing out the fixed MOH volume variance will have no effect on the financial statements, no matter the capacity used? Question options: a) Prorating the fixed MOH volume variance to FG inventory and COGS. b) Allocating the fixed MOH volume variance equally among WIP Inventory, FG inventory and COGS. c) Prorating the fixed MOH volume variance to WIP Inventory, FG inventory and COGS. d) Allocating the fixed MOH volume variance to COGS.arrow_forwardPlease do not give solution in image format thankuarrow_forwardplease do not Give image formatarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education