FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

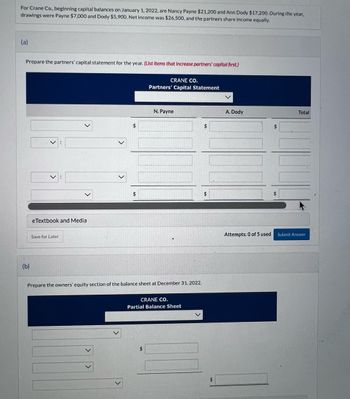

Transcribed Image Text:For Crane Co., beginning capital balances on January 1, 2022, are Nancy Payne $21,200 and Ann Dody $17,200. During the year,

drawings were Payne $7,000 and Dody $5,900. Net income was $26,500, and the partners share income equally.

(a)

Prepare the partners' capital statement for the year. (List Items that increase partners' capital first.)

(b)

:

eTextbook and Medial

Save for Later

$

$

CRANE CO.

Partners' Capital Statement

N. Payne

Prepare the owners' equity section of the balance sheet at December 31, 2022.

CRANE CO.

Partial Balance Sheet

$

$

A. Dody

Attempts: 0 of 5 used

Total

Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Rex and Kelsey are partners who share income in the ratio of 3:2. Their capital balances are $95,000 and $140,000 respectively, on January 1. The partnership generated net income of $40,000 for the year. What is Rex’s capital balance after closing the revenue and expense accounts to the capital accounts? $71,000 $119,000 $146,000 $111,000 None of the above.arrow_forwardCoburn (beginning capital, $56,000) and Webb (beginning capital $92,000) are partners. During 2022, the partnership earned net income of $69,000, and Coburn made drawings of $17,000 while Webb made drawings of $26,000. Assume the partnership income-sharing agreement calls for income to be divided with a salary of $37,000 to Coburn and $32,000 to Webb, interest of 12% on beginning capital, and the remainder divided 50%-50%. Prepare the journal entry to res the allocation of net income. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit Income Summary 69000 Coburn, Capital 34840 34160 Webb, Capital Compute the partners' ending capital balances under the assumption in part (c) above. Ending capital Coburn Webb 34840arrow_forwardPartners A and B formed a partnership on January 1, 2020 where Partner A invested P500,000 while Partner B invested P300,000. Profit and loss as agreed upon by partners is to be shared in the ratio of the original capital. The drawing accounts of Partners A and B have debit balances of P24,000 and P12,000 respectively. Net income for the period ending December 31, 2020 amounted to P180,200. What is capital balance of Partner B for the year ending December 31, 2020?arrow_forward

- The following information applies to the questions displayed below.]Ries, Bax, and Thomas invested $56,000, $72,000, and $80,000, respectively, in a partnership. During its first calendar year, the firm earned $431,100.Required:Prepare the entry to close the firm’s Income Summary account as of its December 31 year-end and to allocate the $431,100 net income under each of the following separate assumptions. 2. The partners agreed to share income and loss in the ratio of their beginning capital investments.arrow_forwardA B and C are partners with capital balances of $90,000, $70,000, and $50,000, respectively. The partners agreed to share profits and losses as follows: Salary allowances of $7,000 to A, $8,000 to B and $14,000 to C. Interest allowances of 1096 on beginning of year capital balances Balance to be divided in the ratio of 2:11. If profit for the year 15 $250,000, calculate each partner's share and prepare the appropriate journal entry close the income Summary to the capital accounts Next Page Support | PowerSchool Communit Time left for thisarrow_forwardGoodman, Pinkman, and White formed a partnership on January 1, 2020, and made capital contributions of $125,000 (Goodman), $175,000 (Pinkman), and $250,000 (White), respectively. With respect to the division of income, they agreed to the following: (1) interest of an amount equal to 10% of the that partner’s beginning capital balance for the year; (2) annual compensation of $15,000 to Pinkman; and (3) the remainder of the income or loss to be split among the partners in the following percentages: (a) 20% for Goodman; (b) 40% for Pinkman; and (c) 40% for White. Net income was $200,000 in 2020 and $240,000 in 2021. Each partner withdrew $1,500 for personal use every month during 2020 and 2021. What was Goodman’s total share of net income for 2020?arrow_forward

- The condensed statement of financial position of Ricablanca, Tac-an and Dimalanta partnership as of March 31, 2019 follows: Assets Cash P 28,000 Non-cash Assets 265,000 Total P293,000 Liabilities P 48,000 Ricablanca, Capital 95,000 Tac-an, Capital 80,000 Dimalanta, Capital 70,000 Total P293,000 Profit and loss ratio is 50:25:25, respectively. The partners voted to dissolve the partnership and liquidate by selling assets in installments. P70,000 was realized on the first cash sale of other non-cash assets which has a book value of P150,000.…arrow_forwardCoburn (beginning capital, $60,000) and Webb (beginning capital $90,000) are partners. During 2020, the partnership earned net income of $80,000, and Coburn made drawings of $18,000 while Webb made drawings of $24,000. (Assume the partnership income-sharing agreement calls for income to be divided 45% to Coburn and 55% to Webb. Prepare the journal entry to record the allocation of net income) What are the account titles and explanations? What is debit? What is credit?arrow_forwardEbanks, Brown, and Thomas are partners. They carry on a business jointly as EBT surveyors and share profits and losses in the ratio 25:45: 30. The trading account profit as at 31 December 2021 was $6,500,000 after charging a nominal tax of $750,000. Notes: The partners receive interest on their capital accounts at 9.5 % on the balance of their partner capital at the end of the budget year. The interest on the capital account was not included in the income statement. Include in the income statement is $80,000 salary per month for each partner. The partnership paid motor vehicle expenses for vehicles owned by the partners as follows: Ebanks -$ 50,000 Brown - $80,000 Thomas - $130,000 The partners did not use the vehicles for the partnership business. Profit on disposal was $180,000. Depreciation on plant and machinery for the year was $900,000. In recognition of the new IFRS 9 standard, a provision for bad…arrow_forward

- After the tangible assets have been adjusted to current market prices, the capital accounts of Grayson Jackson and Harry Barge have balances of $64,900 and $86,500, respectively. Lewan Gorman is to be admitted to the partnership, contributing $43,300 cash to the partnership, for which he is to receive an ownership equity of $50,500. All partners share equally in income. a. Journalize the entry to record the admission of Gorman, who is to receive a bonus of $7,200. If an amount box does not require an entry, leave it blank. Cash Grayson Jackson, Capital Harry Barge, Capital Lewan Gorman, Capital b. What are the capital balances of each partner after the admission of the new partner? Partner Balance Grayson Jackson $ Harry Barge $ Lewan Gorman $arrow_forwardCoburn (beginning capital, $56,000) and Webb (beginning capital $92,000) are partners. During 2022, the partnership earned net income of $69,000, and Coburn made drawings of $17,000 while Webb made drawings of $26,000. Assume the partnership income-sharing agreement calls for income to be divided with a salary of $37,000 to Coburn and $32,000 to Webb, interest of 12% on beginning capital, and the remainder divided 50%–50%. Prepare the journal entry to record the allocation of net income.arrow_forwardWhat is the answer to the question?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education