FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:2

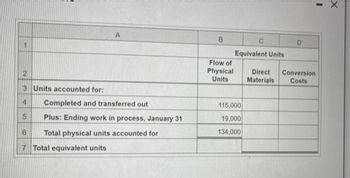

3 Units accounted for:

45

A

Completed and transferred out

Plus: Ending work in process, January 31

6 Total physical units accounted for

7 Total equivalent units

Flow of

Physical

Units

C

Equivalent Units

115,000

19,000

134,000

Direct Conversion

Materials Costs

Transcribed Image Text:Blumhauer's Packaging Department had the following information at January 31, All direct materials are added at the end of the conversion process. The units in ending work in process inventory were only 25%

of the way through the conversion process.

(Click the icon to view the equivalent units)

Complete the schedule by computing the total equivalent units of direct materials and conversion costs for the month

(For accounts with no units in inventory, make sure to enter "0" in the appropriate cell)

Equivalent Units

Flow of Physical Direct

Units

Materials

Units accounted for:

Completed and transferred out

Plus: Ending work in process, January 31

Total physical units accounted for

Total equivalent units

115.000

19.000

134.000

CHID

Conversion

Costs

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Edwina Industrial Products (EIP) manufactures cleaning products. The Grant Street Plant produces a single product in three departments: Mixing, Refining, and Packaging. Additional materials are added in the Refining Process when units are 40 percent complete with respect to conversion. Information for operations in September in the Refining process appear as follows. Work in process on September 1 consisted of 25,000 units with the following costs: Degree of Completion 100% Mixing costs transferred in Costs added in Refining Direct materials Conversion costs Work in process September 1 Amount $ 12,000 Direct materials Conversion costs $ 310,200 396,800 Total costs added $ 707,000 $ 27,800 29,320 $ 57,120 $ 69,120 100% 80% During September, 275,000 units were transferred in from Mixing at a cost of $165,000. The following costs were added in Refining in September. Refining finished 260,000 units in September and transferred them to Packaging. At the end of September, there were 40,000…arrow_forwardPart B: Compute the cost per equivalent unit fir direct materials and conversion costs Please avoid solutions image based solutions thankuarrow_forwardBeverly Plastics produces a part used in precision machining. The part is produced in two departments: Mixing and Refining. The raw material is introduced into the process in the Mixing Department. The cost of the material fluctuates significantly month to month based on market conditions. Information on costs and operations in the Refining Department for September follow: WIP inventory-Refining Beginning inventory (17,500 units, 10% complete with respect to Refining costs) Transferred-in costs (from Mixing) Refining conversion costs Current work (55,300 units started) Mixing costs Refining costs $ 242,055 9,676 Required: a. Complete the production cost report using the FIFO method. Note: Round "Cost per equivalent unit" to 2 decimal places. $ 903,625 103,140 The ending inventory has 14,500 units, which are 90 percent complete with respect to Refining Department costs.arrow_forward

- takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress3Dfalse Calculator A company started the month with 8,333 units in work in process inventory. It started 23,146 units and had an ending inventory of 9,322. The units were 100% complete to materials and 67% complete with conversion. How many units were transferred out during the period? Units transferred out Previous Next Email Instructor Submit Test for Grading All work saved. 5:18 PM 10/2/2020 arch Oarrow_forwardUnits in beginning WIP Inventory completed this period Units Started and completed this period Units in ending WIP Inventory Total units accounted for Total equivalent units of work done this period Costs in beginning WIP Inventory (from last period) Costs added to WIP Inventory this period Total costs to account for Total cost of units completed $ Step 3: Account for costs Total number of units completed Physical Units What is The Skysong Company's total cost units completed? Actual unit cost for units completed $ 1,500 15,100 How many total units did the company complete this period? Total cost per equivalent unit this period $ The actual cost for the units completed this period is 500 17,100 Total Costs The Skysong Company uses the FIFO method of process costing. $1,155 26,895 $28,050 % Added This Period DM 100% 100% $755 0% 8.580 $9,335 DM Equivalent Units Equiv. Units 15,100 500 15,600 Conversion Costs $400 What was the actual per-unit cost for those units completed? (Round answer…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education