FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

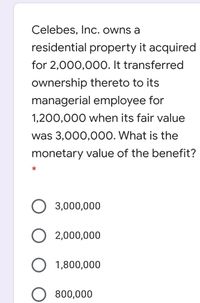

Transcribed Image Text:Celebes, Inc. owns a

residential property it acquired

for 2,000,00O. It transferred

ownership thereto to its

managerial employee for

1,200,000 when its fair value

was 3,000,000. What is the

monetary value of the benefit?

3,000,000

O 2,000,000

O 1,800,000

800,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- it says answer is wrongarrow_forwardActuarial gain or loss - plan assets Fair value of plan assets (1 July 2013) Plus: Return on plan assets (6% x $94 356 000) Contributions Minus: Benefits paid Actuarial Fair value of plan assets (30 June 2014) Required: Select a correct answer for each blank. $94 356 000 5 661 360 8 640 000 (15 552 000) $95 832 000arrow_forwardCarding received the following during the year: 200,000 car as donation; 50,000 income of donated property before donation; 30,000 income from donated property after donation; 100,000 inherited properties. How much is excluded from gross income? P380,000 P350,000 P50,000 P30,000arrow_forward

- An S-Corporation has ownership of a piece of land with an adjusted basis of $10,000 and a FMV of $100,000. It distributes this land to a shareholder, what basis would the shareholder have in this land? a. $0 b. It would depend on the shareholder's inside basis c. $90,000 d. $100,000 e. $10,000arrow_forwardSh4 Please help me. Solution Thankyouarrow_forward______21. The acquisition costs of property, plant, and equipment should include all normal, reasonable and necessary costs to get the asset in place and ready for use. ____ 22. An estimate of the amount which an asset can be sold at the end of its useful life is called residual value. ____ 23. Federal unemployment taxes are paid by the employer and the employee. ____ 24. When minor errors occur in the estimates used in the determination of depreciation, the amounts recorded for depreciation expense in the past should be corrected. ____ 25. Residual value is not relevant when calculating the annual depreciation expense using the double declining-balance method (do not consider the calculation for the final year). True and False questionsarrow_forward

- Kk.192. Vertical, Inc., has a 2022 net § 1231 gain of $67,000 and had a $22,000 net § 1231 loss in 2021. For 2022, Vertical’s net § 1231 gain is treated as: $45,000 long-term capital gain and $22,000 ordinary loss. $67,000 ordinary gain. $45,000 long-term capital gain and $22,000 ordinary gain. $67,000 capital gainarrow_forwardIn a like - kind exchange, Greyland exchanged investment - use real property (FMV $210,000, adjusted basis $190,000) for a smaller piece of investment - use property (FMV $200,000) plus $10,000. They will report a $10,000 gain on the exchange. What is their basis in the replacement property? $170,000 $180,000 $190,000 $200,000arrow_forwardCompany A purchased company B for $50,000,000. Company B had net assets of $30,000,000, therefore $20,000,000 was paid in excess of the fair value of the net assets. What does this $20,000,000 premium paid by company A represent? In other words, what is this called?arrow_forward

- For 2020, Garden Corporation has 800.000 of gross profit from its sales and $410,000 of operating expenses. Garden makes $90,000 of cash charitable contributions during 2020 Inot inchuded in the other amounts). How much of these contributions can it deduct for 2020? (Note that this is for 2020, ie, 25%) O $75.000 O $97.500 $22.500 O $90.000arrow_forwardBoth the managing director and regional manager of Trail Ltd have the benefit of the use of company cars which may also be used for private purposes. The total benefit for the use of the cars are estimated at R350 000 per year, of which 35% is for private use and 65% for business purposes. The total amount that should be disclosed in remuneration as other 7. benefits should be: 1. R122 500 2. R227 500 3. R245 000 4. R455 000arrow_forwardAfter reading Catch Engineering Partnership v. Mai, 2023 ABKB 279, the court assessed Catch's 2021 damages attributable to Mr. Mai in the amount of (Put your answer in as a dollar figure - ex- $25,000): Answerarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education