Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

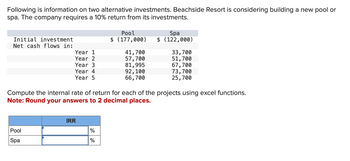

Transcribed Image Text:Following is information on two alternative investments. Beachside Resort is considering building a new pool or

spa. The company requires a 10% return from its investments.

Initial investment

Net cash flows in:

Year 1

Year 2

Year 3

Year 4

Year 5

Pool

Spa

IRR

Pool

$ (177,000)

%

%

41,700

57,700

81,995

92,100

66,700

Compute the internal rate of return for each of the projects using excel functions.

Note: Round your answers to 2 decimal places.

Spa

$ (122,000)

33,700

51,700

67,700

73,700

25,700

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The management of Unter Corporation, an architectural design firm, is considering an investment with the following cash flows: Year Investment Cash Inflow 1 $ 78,000 $ 5,000 2 $ 5,000 $ 10,000 3 $ 12,000 4 $ 15,000 5 $ 18,000 6 $ 16,000 7 $ 14,000 8 $ 12,000 9 $ 11,000 10 $ 11,000 Required: 1. Determine the payback period of the investment. 2. Would the payback period be affected if the cash inflow in the last year were several times as large?arrow_forwardFollowing is information on two alternative investments projects being considered by Tiger Company. The company requires a 15% return from its investments. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Project X1 Initial investment $ (100,000) Net cash flows in: Year 1 37,000 Year 2 Year 3 47,500 72,500 Project X2 $ (150,000) 78,000 68,000 58,000 a. Compute each project's net present value. b. Compute each project's profitability index. If the company can choose only one project, which should it choose on th basis of profitability index? Complete this question by entering your answers in the tabs below. Required A Required B Compute each project's net present value. (Round your answers to the nearest whole dollar.) Net Cash Present Value of Present Value of Flows 1 at 15% Net Cash Flows Project X1 Year 1 Year 2 Year 3 Totals Initial investment Net present value $ 0 $ 0 $ 0 Project X2 Year 1 Year 2 Year 3 Totals $ 0 $ EA Initial…arrow_forwardFollowing is information on two alternative investment projects being considered by Tiger Company. The company requires a 4% return from its investments. (PV of $1, FV of $1, PVA of $1, and FVA of $1) Note: Use appropriate factor(s) from the tables provided. Initial investment Project X1 $ (80,000) Project X2 $ (120,000) Net cash flows in: Year 1 25,000 60,000 Year 2 Year 3 35,500 50,000 60,500 40,000 a. Compute each project's net present value. b. Compute each project's profitability index. c. If the company can choose only one project, which should it choose on the basis of profitability index? Complete this question by entering your answers in the tabs below. Required A Required B Required C Compute each project's net present value. Net Cash Flows Present Value of Present Value of Net 1 at 4% Cash Flows Project X1 Year 1 $ 25,000 Year 2 35,500 Year 3 60,500 0.8890 Totals $ 121,000 $ 0 Initial investment (80,000) Net present value $ (80,000) Project X2 Year 1 Year 2 Year 3 Totals…arrow_forward

- I want to answer the questionarrow_forwardFirst United Bank Inc. is evaluating three capital investment projects using the net present value method. Relevant data related to the projects are summarized as follows: BranchOfficeExpansion ComputerSystemUpgrade ATMKioskExpansion Amount to be invested $686,053 $516,654 $295,458 Annual net cash flows: Year 1 411,000 288,000 177,000 Year 2 382,000 259,000 122,000 Year 3 349,000 230,000 89,000 Present Value of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 0.890 0.826 0.797 0.756 0.694 3 0.840 0.751 0.712 0.658 0.579 4 0.792 0.683 0.636 0.572 0.482 5 0.747 0.621 0.567 0.497 0.402 6 0.705 0.564 0.507 0.432 0.335 7 0.665 0.513 0.452 0.376 0.279 8 0.627 0.467 0.404 0.327 0.233 9 0.592 0.424 0.361 0.284 0.194 10 0.558 0.386 0.322 0.247 0.162 Required: 1. Assuming that the desired rate of return is 20%, prepare a net present value analysis for each project. Use the…arrow_forwardThe HUT is evaluating a 5 year investment projected to yield the following relevant cash flows over its 5 year life: Given that the firm employs a 12% discount rate, what is the value of each of the three criteria: NPV? Profitability Index? Payback Period? Varrow_forward

- Subject :arrow_forwardsanjaarrow_forwardFor each of the investments below, calculate the rate of return earned over the period. Cash Flow During Period - $900 14,000 5,000 70 1,500 (Click on the icon here in order to copy the contents of the data table above into a spreadsheet.) Investment A B C D E Beginning-of-Period End-of-Period Value Value $1,400 140,000 55,000 500 14,000 $400 115,000 49,000 200 12,600arrow_forward

- Compute the payback perlod for an Investment with the following net cash flows. (Round your answer to one decimal place.) Net Cash Flows per Year Cumulative Net Cash Flows $ (101,000) $ (101,000) (90,900) (70,800) Year Initial investment 1. 2. 3. 5. 6. Payback period 10,100 20,100 20,100 26,640 40,100 40,100 years (50,700) (24,060) 16,040 56,140arrow_forwardPlease Need Correct Answer with Explanation with calculationarrow_forwardPlease complete these chartsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education