Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Provide correct answer general Accounting question

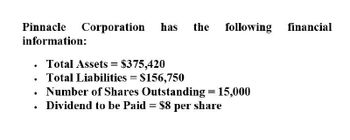

Transcribed Image Text:following financial

Pinnacle Corporation has the

information:

Total Assets = $375,420

•

Total Liabilities = $156,750

.

•

Number of Shares Outstanding = 15,000

Dividend to be Paid = $8 per share

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- XYZ Corporation had the following balance sheet information: Total assets: $500,000Total liabilities: $200,000Shareholders' equity: $300,000If XYZ Corporation has 50,000 shares outstanding, what is the book value per share?arrow_forwardAssume the following data for Cable Corporation and Multi-Media Incorporated. Multi-Media Incorporated Cable Corporation $ 39,800 352,000 409,000 $ 190,000 2,170,000 966,000 234,000 545,000 175,000 421,000 Net income Sales Total assets Total debt Stockholders' equity a. 1. Compute return on stockholders' equity for both firms. Note: Input your answers as a percent rounded to 2 decimal places. Cable Corporation Multi-Media, Incorporated 2. Which firm has the higher return? Return on Stockholders' Equity % %arrow_forwardThe company Flextseel provided the following information: Number of issued common shares 900,000 Net income $1,000,000 Number of authorized common shares 1,000,000 Weightrd average number of outstanding common shares, 800,000 Number of treasury shares, 100,000 How much is earnings per share (EPS)? $1.25 $1.43 $1.00 $1.11arrow_forward

- General accountingarrow_forwardPlease provide answer this financial accountingarrow_forwardThe following information pertains to Sunland Company. Assume that all balance sheet amounts represent average balance figures. Total assets Stockholders' equity-common Total stockholders' equity Sales revenue Net income Number of shares of common stock Common dividends Preferred dividends What is Sunland's payout ratio? O 24.6%. O 9.6%. O 17.9%. O 37.9%. $355000 235000 294000 97000 21100 6000 5200 8500arrow_forward

- A corporation has the following account balances: Common stock, $1 par value, $42000; Paid-in Capital in Excess of Par, $730000. Based on this information, the O number of shares outstanding is 772000. O legal capital is $772000. O number of shares issued is 42000. O average price per share issued is $6.96.arrow_forwardSs.227.arrow_forwardGiven Below is the Balance sheet of ABC Co. Analyze the Balance Sheet and Calculate the Current Ratio. Liabilities Amount Assets Amount Share Capital 50,000 Fixed Asset 1,24,000 Preference Share Capital 30,000 Short Term Capital 10,000 General Reserve 40,000 Debtors 95,000 Debentures 60,000 Stock 50,000 Trade Payable 10,000 Cash and Bank 15,000 Bank Overdraft 20,000 Discount on Share Issue 6,000 Provision for Tax 40,000 Provision for Depreciation 20,000 3,00,000 3,00,000arrow_forward

- The following information pertains to Windsor Company. Assume that all balance sheet amounts represent average balance figures. Total assets $330000 Stockholders' equity-common 210,000 Total stockholders' equity 298,000 Sales revenue 110,000 Net income 20,600 Number of shares of common stock 7,500 Common dividends 4,700 Preferred dividends 8,300 What is Windsor's payout ratio? a. 8%. b. 22.82%. c. 16%. d. 36%.arrow_forwardA corporation has the following account balances: Common Stock, $1 par value, $80,000; Paid-in Capital in Excess of Par Value, $2, 700,000. Based on this information, what is the (A) legal capital (B) number of shares issued (C) number of shares outstanding and (D) average price per share issuedarrow_forwardPlease taru answer general Accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning