FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

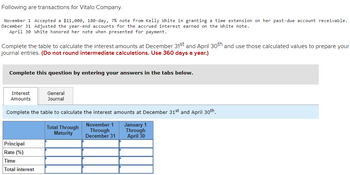

Transcribed Image Text:**Transactions for Vitalo Company:**

- **November 1:** Accepted an $11,000, 180-day, 7% note from Kelly White for a time extension on her past-due account receivable.

- **December 31:** Adjusted the year-end accounts for the accrued interest earned on the White note.

- **April 30:** White honored her note when presented for payment.

**Task:**

Complete the table to calculate the interest amounts at December 31st and April 30th. Use these calculated values to prepare your journal entries. **(Note: Do not round intermediate calculations. Use 360 days a year.)**

**Instructions:**

Complete this question by entering your answers in the tabs below.

---

**Interest Amounts Calculation Table:**

1. **Total Through Maturity**

- **Principal:** $11,000

- **Rate (%):** 7%

- **Time:** 180 days

- **Total Interest:**

2. **November 1 Through December 31**

- **Principal:**

- **Rate (%):**

- **Time:**

- **Total Interest:**

3. **January 1 Through April 30**

- **Principal:**

- **Rate (%):**

- **Time:**

- **Total Interest:**

---

This section of the educational website would guide students through the process of calculating interest amounts over specified periods, journal entries preparation, and understanding the note receivable and interest accrual process.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please help me. Thankyou.arrow_forwardces Required information [The following information applies to the questions displayed below.] Following are transactions of Danica Company. December 13 Accepted a $20,000, 45-day, 4% note in granting Miranda Lee a time extension on her past-due account receivable. December 31 Prepared an adjusting entry to record the accrued interest on the Lee note. Complete the table to calculate the interest amounts at December 31st and use the calculated value to prepare your journal entries. Note: Do not round your intermediate calculations. Use 360 days a year. Complete this question by entering your answers in the tabs below. Interest Amounts General Journal Complete the table to calculate the interest amounts at December 31st, Interest Recognized December 31 20,000 4% 18/360 Principal Rate (%) Time Total interest Total Through Maturity $ 20,000 $ 4% 45/360 Check my workarrow_forwardAnne Taylor comapany borrowed cash on august 1 of year 1, by signing a $46,620(face amount), one year note payable, due on july 31 of year 2. the accounting period of Anne yalor ends December 31. Assume an effective interest rate of 11%. How much cash should Anne Taylor Company receive from the note on August 1 of Year 1, assuming the note is a noninterest-bearing note?arrow_forward

- On May 10, 20X1, Washington Company received a 90-day, 8 percent, $8,400 interest-bearing note from Whitehead Company in settlement of Whitehead's past-due account. On June 30, Washington discounted this note at City Bank and Trust. The bank charged a discount rate of 13 percent. On August 8, Washington received a notice that Whitehead had paid the note and the interest on the due date. Required: Prepare the entries in general journal form to record these transactions. Analyze: If the company prepared a balance sheet on July 31, 20X1, how should Notes Receivable-Discounted be presented on the statement?arrow_forwardK Cheap Inc. borrowed $95,000 on October 1 by signing a note payable to Scotiabank. The interest expense for each month is $554. The loan agreement requires Cheap Inc. to pay interest on December 31. 1. Make Scotiabank's adjusting entry to accrue interest revenue and interest receivable at October 31, at November 30, and at December 31. Date each entry and include its explanation. 2. Post all three entries to the Interest Receivable account. You need not take the balance of the account at the end of each month. 3. Record the receipt of three months' interest at December 31. 1. Make Scotiabank's adjusting entry to accrue interest revenue and interest receivable at October 31, at November 30, and at December 31. Date each entry and include its explanation. (Record debits first, then credits. Enter explanations on the last line.) Start by making the adjusting entry to accrue monthly interest revenue for October. Date Oct Journal Entry Accounts and Explanation Debit Creditarrow_forwardArvan Patel is a customer of Bank's Hardware Store. For Mr. Patel's latest purchase on January 1, 2018, Bank's Hardware issues a note with a principal amount of $560,000, 13% annual interest rate, and a 24-month maturity date on December 31, 2019. Record the journal entries for Bank’s Hardware Store for the following transactions. If an amount box does not require an entry, leave it blank. A. Note issuance. B. Subsequent interest entry on December 31, 2018. C. Honored note entry at maturity on December 31, 2019.arrow_forward

- Following are transactions of Danica Company. Dec. 13 Accepted a $18,000, 45-day, 10% note in granting Miranda Lee a time extension on her past-due account receivable. 31 Prepared an adjusting entry to record the accrued interest on the Lee note.arrow_forwardJournalize the following entries on the books of the borrower and creditor. Label accordingly. (Assume a 360-day year is used for interest calculations.) June 1 James Co. purchased merchandise on account from O’Leary Co., $90,000, terms n/30. The cost of merchandise sold was $54,000. 30 James Co. issued a 60-day, 5% note for $90,000 on account. Aug. 29 James Co. paid the amount due.arrow_forwardPlease Fast answerarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education